The grass IS greener for backgrounders

by Miranda Reiman

Cinch up that seatbelt. This cattle market madness is only going to get more dramatic.

You may think you’ve been on a rollercoaster ride, but Derrell Peel, Oklahoma State University (OSU) ag economist, shared data at a recent field day that could wow the most seasoned thrill seeker.

“We have record level prices pretty much anywhere you look in this industry and they’re going to get higher,” Peel said, addressing nearly 75 stocker operators earlier this month.

The “Backgrounding for Quality” seminar at White Brothers Cattle Co., near Chickasha, Okla., was co-sponsored by OSU, Pfizer Animal Health and Certified Angus Beef LLC (CAB).

Peel said being a market analyst used to be much easier. “Beef demand wasn’t changing much, international trade wasn’t all that important and corn was always $2 a bushel, so all you had to do was figure out the cattle inventory and you had a pretty good bet on what was going to happen in cattle markets.”

Not anymore.

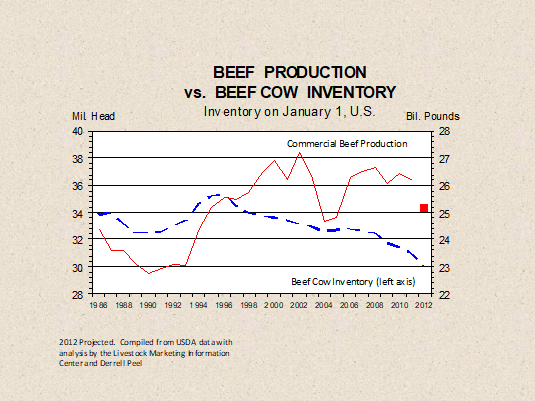

“What’s driving prices today is not something that’s happened overnight,” he said. The industry has liquidated cattle 14 of the last 16 years. In January, USDA numbers showed fewer than 91 million head of U.S. cattle, the lowest inventory since 1952.

That makes supply a key driver, not just in 2012, but for the next four to six years, he said.

Replacement heifer retention has increased since 2009. “But it hasn’t translated into net growth in the herd because we’ve had very large cow slaughter,” he said.

Drought drove that last year and still remains a wild card moving forward.

Perhaps surprisingly, these lower animal numbers have not shown up in the form of significantly smaller beef production, until now. (See chart.)

“You’re eating your way into smaller inventories,” Peel said, noting that liquidation means more harvested animals. “That supports production in the short run, but at some point you simply can’t maintain that. We have reached that point.”

Beef production was already declining during the last quarter of 2011, and the 2012 projection cuts that an additional 3% to 4%.

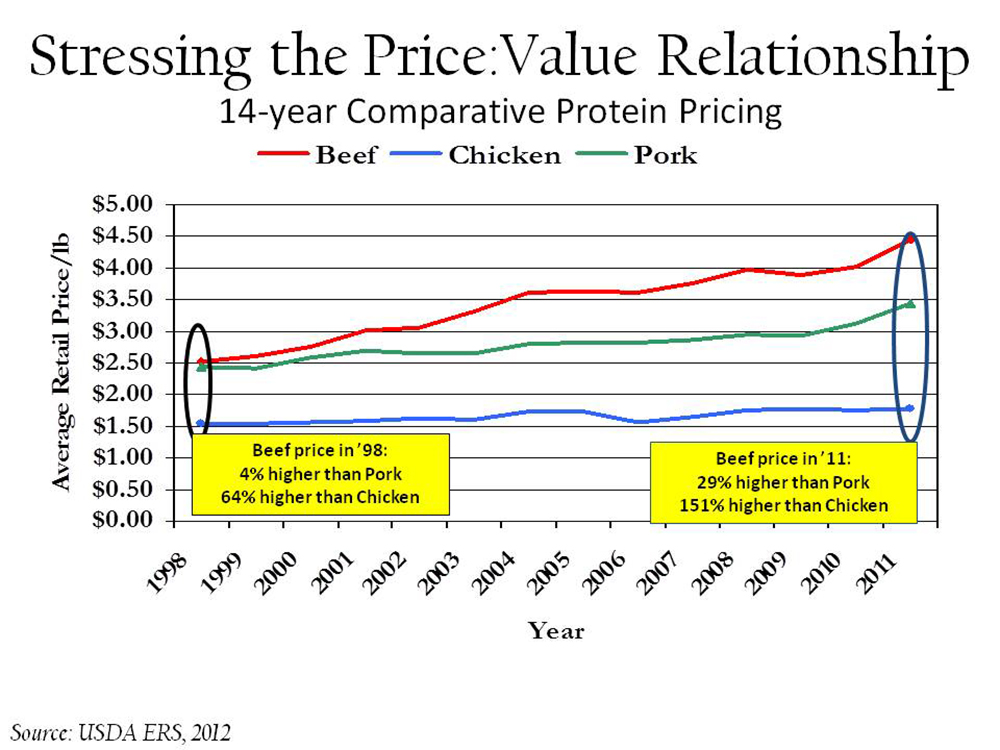

“We certainly have more concerns about what that’s going to do on the demand side,” he said, noting fears about how high prices can go before that turns away consumers.

“We’re at record-level prices and they’re only going to go higher,” Peel said. As heifers are retained, supplies will get tighter, putting a squeeze on through 2013 and maybe even 2014.

“That’s going to be very important from a beef demand standpoint in terms of how [consumers] will be able to respond with this additional pressure we’ll see on prices,” he said.

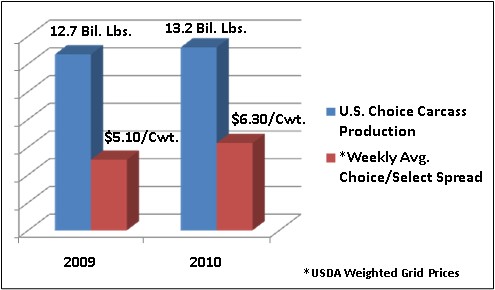

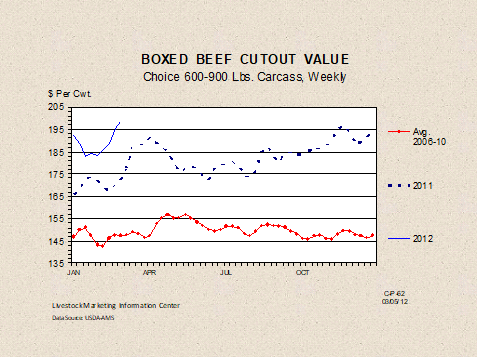

USDA Choice boxed beef has never traded above $2 per pound (lb.), but in recent months it’s gotten close (see chart). What’s a thorn to purchasers is a bright spot for any producers marketing on a value-based grid.

“For the last three years, we’ve had a pretty weak Choice-Select spread,” Peel said. “This year it’s returning to a bit more normal spread.”

Hamburger purchases are partially to blame, as consumers have shifted away from pricier steaks, or middle meats, to end meats.

“For the most part they didn’t stop eating beef,” he said.

Exports are picking up any slack, and setting records. Japan, Mexico, Canada and Korea are the major players, taking nearly equal shares of U.S. beef.

But even record prices can’t prop up profits when input prices are also on the same sky-high track.

“Most of the beef industry we know and think about was built on cheap feed, cheap corn,” Peel said. “We don’t have that right now.”

Or any time soon, he added, thanks to increased competition.

“The beauty of the market is that it never says you can’t have something. It just prices it so you can decide that you can get by without it,” he says.

That’s why the beef industry is better poised to deal with record-high corn prices.

“I don’t see a big future for stocker chickens,” he joked. “There are some folks promoting pasture poultry, and all that does is make the coyotes smile.”

For 40 years, the industry built up the idea of cheap gains on grain.

“Now it’s not the cheapest game in town so we need to think about how to do things differently,” Peel said. That, combined with high demand for forage, equals unparalleled opportunity for backgrounders.

“Pretty much anything you have to sell today sells pretty well,” he said. Marketing has gotten easier. Quality management is now the primary concern.

“You need to spend more of your attention than ever before on managing production,” he said. “Manage health, manage nutrition and manage cost to benefit from this market environment we’re in.”

You may also like

2022 Was as Predicted

If there was a lesson in 2022, it was that the beef market is very sensitive to declines in quality grade, as evidenced through price signals. It’s the first time in recent history where we’ve gone backwards — albeit ever so slightly — and customers are telling us they have unfulfilled demand. That’s reflected in the premiums paid, and that’s saying something after two years of extremely high premiums.

The Cattle Market Teacher

Part intuition, part learned experience and a growing database gave Randy Blach the tools to communicate to producers what the market demands. The bottom line is consistently front and center, his mission is to keep more cattlemen and women on the land, doing what they do best.

Prime Grade Prompts Attention

Prime cutout values and grid premiums have been rich in the third and fourth quarters of the past two years. Yet the spillover into the first quarter this year shows that the market is reacting to the recently smaller availability, retreating back to the 2019 supply pace.