MARKET UPDATE

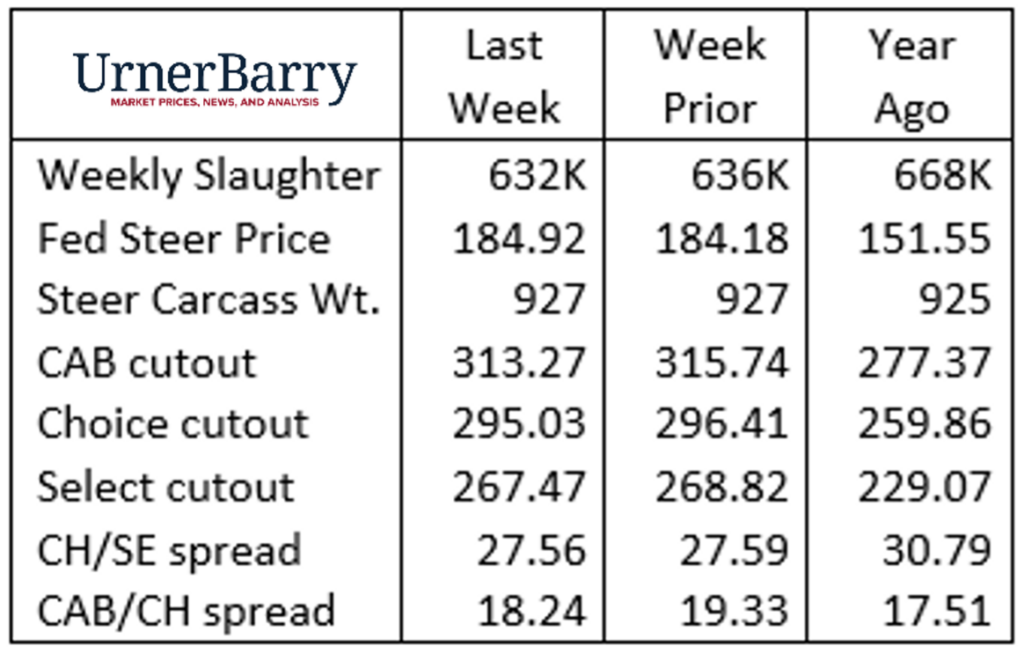

The fed cattle market remained very steady last week with a fractionally higher cash fed steer price at $184.92/cwt. While a positive trend at face value, many in the cattle feeding sector were disappointed that the market did not develop as strong as expected.

Live Cattle futures activity has been excessively volatile in the past 10 days following the suprisingly large feedlot placements number in the October 1 Cattle on Feed report. Nearby contracts had posted some recovery through last Thursday but have since deteriorated in a very large way. The December contract dipped about $6/cwt. since last Friday’s open through this Tuesday’s close.

Seasonally, cash fed cattle prices have increased 4.8% during the month of November in the past five years. Given the relative currentness of fed cattle supplies at this time the quite bearish values in Live Cattle futures defies fundamentals. This is particularly obvious with the December contract last trading at a $7.29/cwt. discount to last week’s cash. Fund trading is having a serious impact on cattle values with a snowball effect remaining strong at the time of this November 8 analysis.

On the other side of the coin, packer margins are thin, or even negative, on a cash basis —a stark contrast to their position during this period in any recent year. Carcass cutout values have started November in a bit of a defensive pattern with an equal share of lower and higher pricing days to start the month. Fundamentals seem fairly strong considering the reduced head counts for cattle harvested, as compared to a year ago at this time.

Middle Meats and Supply Driving Fourth Quarter Spreads

At the retail level, November brings a brief shift in focus, away from beef to turkey and ham, for Thanksgiving meals. Current wholesale prices for each of these protein items are trading at steep discounts compared to the prior two years. Turkeys are the classic “loss leader” item in grocery stores during November as retailers practically give them away to lure a volume of shoppers to spend on the high-margin center of the store goods.

Beef is in the opposing position as the premier protein in the meat case, currently garnering seasonal, record-high cutout values with last week’s comprehensive price at $299.84/cwt. High prices tend to be the cure for high prices but beef demand is historically strong.

Some end meats, such as the inside round, showed declines last week but context reveals a sharp increase preceding this in mid-October. The CAB inside round price last week was record-high and 26% higher than a year ago. An adjustment lower is reasonable considering these factors. Fifty percent lean trim for grinds are, however, $0.10/lb. or 13% cheaper than a year ago as that item seeks winter low price points. This is a noted detriment to total cutout values for steers and heifers.

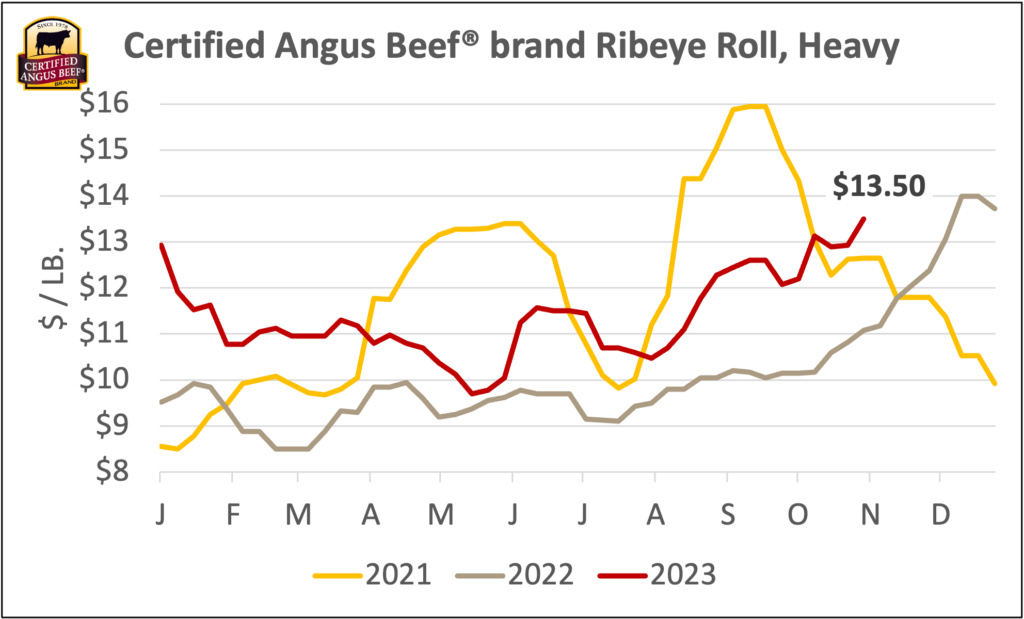

Middle meats tend to pull 4th quarter cutout values higher and latest trends prove this is currently the case. Ribs and tenderloins are the most popular middle meats for the season and both have posted stronger price trends over the past two weeks. CAB ribeyes at $13.50/lb., wholesale, are 8.5% higher than at the start of September. Choice ribeyes are now priced just shy of early September values but we know a volume of buying is done at that time for deep-chill programs to be brought out as fresh holiday offerings.

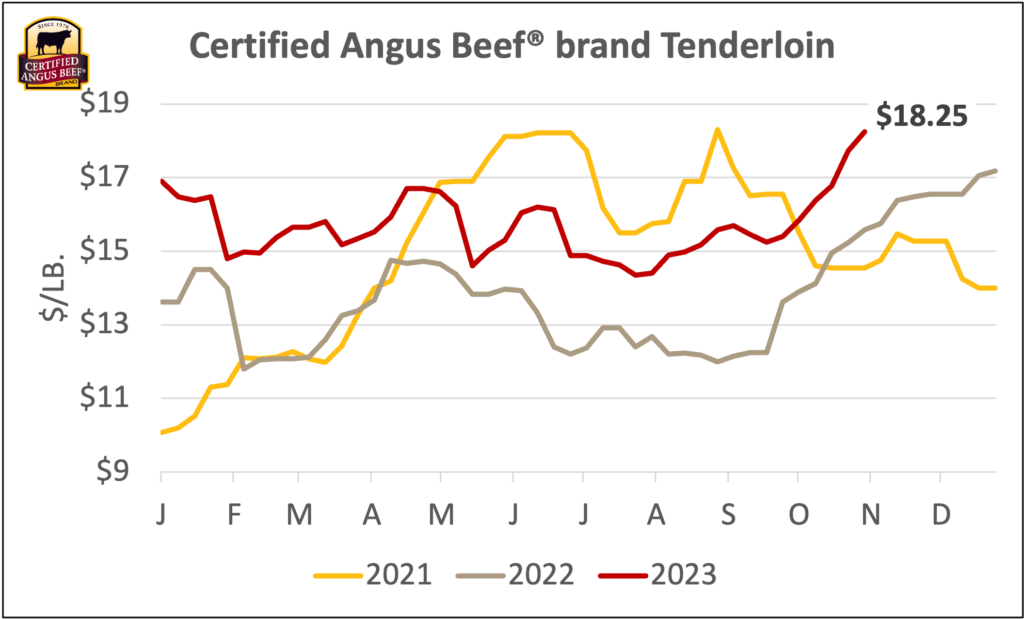

Availability of CAB tenderloins looks to be short since wholesale prices have inflated $3/lb. in four weeks to a recent $18.25/lb. Total supplies of Choice and higher ribs and tenderloins are an issue presently since weekly fed cattle slaughter is much lower than a year ago as packers cut production hours. The recent downturn in total Choice grading percentage has lower 1/3 Choice carcass counts under pressure, further fueling the Choice/Select spread.

Ths has driven the Choice/Select cutout spread to $31.69/cwt. in this Tuesday’s daily report. Last week’s CAB/Choice cutout spread was a bit narrower than the prior week’s at $18.24/cwt. but may have widened in the four days yet to be reported.

Combined Choice and Prime quality grades and CAB carcass acceptance percentages tend to bottom in October/November. This, along with holiday middle meat demand, makes this period an ideal time to market marbling-rich, heavily Angus-influenced cattle on a grid. Using today’s price, CAB carcasses calculate to a $14.50/cwt. premium to cattle feeders on some grids. That’s $130.50 per head premium to the cash market and a $9.20/cwt. premium on a live basis.

Read More CAB Insider

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.

It’s Beef Month

Wholesale and retail beef buyers have been preparing for weeks ahead of the spike in consumer beef buying associated with warmer weather and holiday grilling demand.