MARKET UPDATE

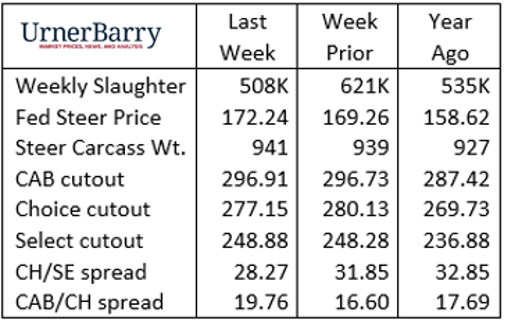

Last week’s holiday-disrupted cattle harvest schedule proved to yield a very small total for the week with an estimated 508,000 head, down 5.6% on the same week a year ago. That suggests packers will need to fill their inventory due to this week’s shortened slaughter from Monday’s holiday.

Further evidence of spotmarket, fed cattle demand came through in a sharp uptick in fed cattle values. Last week’s fed steer price average of $172.24/cwt. was $2.98/cwt. higher than the week prior. The last week of the year often culminates in a brief, bullish fed cattle market and last week’s action adds confirmation to the trend.

Live cattle futures this Tuesday were also much higher as February becomes the front month on the CME board. The February contract was higher by more than $3.25/cwt. by mid-afternoon with April more than $2.00/cwt. higher. Given the recent depression in spot market fed cattle prices it appears to many market observers that a short-term bottom has been marked after a seven-week spiral dropping spot market values $16/cwt.

Carcass cutout values were mixed in last week’s report in what could be summarized as a sideways market. CAB tenderloin prices are rapidly retreating from their lofty record-highs with last week’s $17.40/lb. wholesale price down 7% from the high in late November. Ribeye prices were also a bit lower last week but have only adjusted 2% from their December highs.

Many of the end meat cuts pulled to dramatically lower prices in December as is the seasonal tendency. Last week’s summary showed price stabilizing or slightly higher with the expectation for modestly firmer values in January. Consumer demand following the holidays tends to favor roasts as winter weather develops just as holiday spending hits home for many households with additional buildup of consumer credit card debt.

Carcass Quality Set to Climb Seasonally

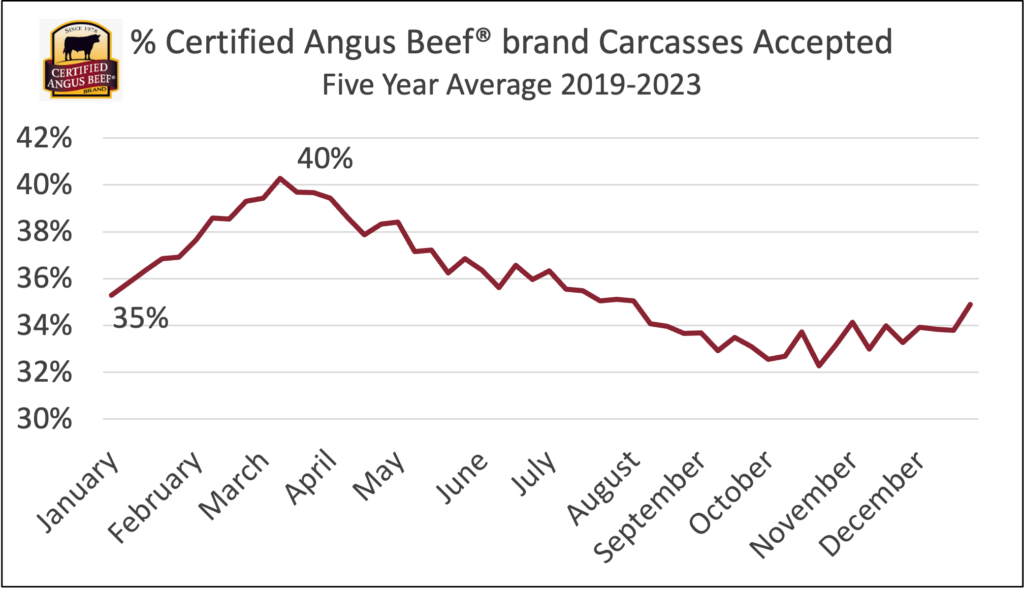

With the arrival of the new year the beef market will rapidly adjust to changes in consumer buying habits. This will remove demand pressure from ribs and tenderloins, realigning the contribution of these most valuable beef cuts to a smaller percentage of carcass value. This expected shift seasonally tends to combine with rising carcass quality grade trends through March, narrowing price spreads between USDA quality grades and CAB branded product.

In the past 5 years the Choice/Select spread has peaked at an average of $22/cwt. in early November, remaining in a range between $20 and $25/cwt. through the first week in December. This November/December timeline has defined the annual widest Choice/Select spread in the average 5-year data, although brief departures to even wider spreads can be noted in other months in given years. The largest CAB cutout premium over USDA Choice followed a similar fourth quarter high in 2022 but has been more common in the low supply/high demand period of early June in other recent years.

The first quarter of 2024 promises to deliver higher average carcass quality grades, particularly as carcass weights remain record-large. The latest confirmed data places steer carcasses at 941 lb. for the week of December 11th, the record so far. The slowed pace of slaughter has yet to show any sustained increases as well. Unless this changes front-end cattle supplies will continue to be elevated along with average days on feed.

These factors should couple with the typical seasonal pattern in the first quarter to track carcass quality to their highest annual levels by March. In March of 2023 CAB carcass certification topped out at 41% of eligible cattle, very near the record of 41.5% set in the same month of 2021. While we won’t predict another record-high this year, the above trends are, so far, aligned to position the share of quality carcasses near the top of the historical range by the end of Q1.

Read More CAB Insider

$100,000 Up for Grabs with 2024 Colvin Scholarships

Certified Angus Beef is offering $100,000 in scholarships for agricultural college students through the 2024 Colvin Scholarship Fund. Aspiring students passionate about agriculture and innovation, who live in the U.S. or Canada, are encouraged to apply before the April 30 deadline. With the Colvin Scholarship Fund honoring Louis M. “Mick” Colvin’s legacy, Certified Angus Beef continues its commitment to cultivating future leaders in the beef industry.

Misaligned Cattle Markets and Record-high Carcass Weights

Few things in cattle market trends are entirely predictable but the fact that carcass weights peak in November is as close to a sure bet as one could identify. Genetic selection for growth and advancing mature size has fueled the long-term increase in carcass weights.

Credit End Meats With CAB Value-Add

We focused on fourth-quarter middle meat demand as a beef price driver in the last edition of the Insider. This is certainly the case in the current data as rib and tenderloins are pricing near their annual highs. However, a look at annual price trends across the beef carcass shows increasing contributions to CAB premiums from both ends of the carcass.