Playing to win: Grid marketing opens door to premiums

by Morgan Boecker

February 10, 2020

Learning to play chess in later life isn’t easy, but it’s not impossible.

Grid marketing finished cattle is similar. It’s not intuitive, but it’s a learnable risk management tool.

“Maintaining ownership through the cattle feeding period and selling on the rail is an opportunity to recapture the input costs and hopefully improve our bottom line,” said Paul Dykstra, Certified Angus Beef ® (CAB®) assistant director of supply management and analysis. “The key is to align genetics, management and performance with the seasonal trends.”

At a January webinar, he said producers can target cow herd genetics toward the factors driving value in the supply chain. Backfat and marbling have differing value implications at the packing plant and can be selected in different directions in the herd.

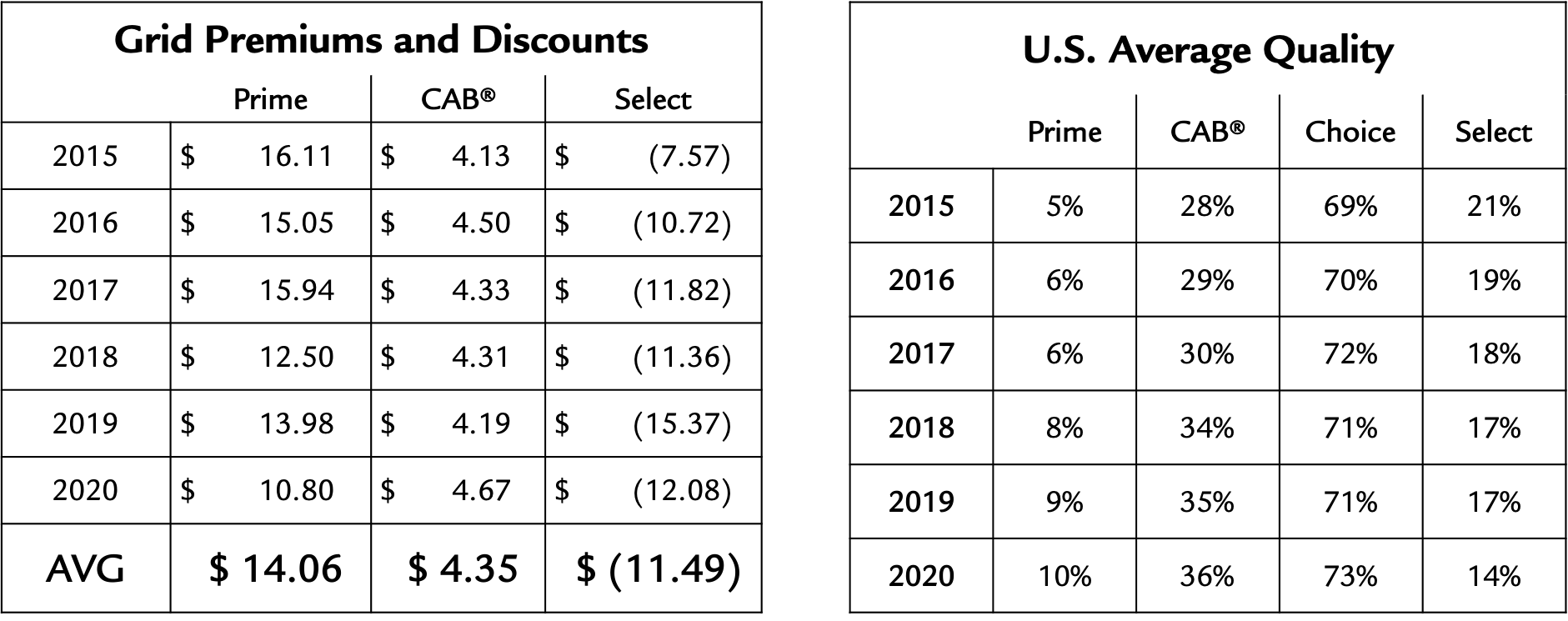

Prime beef production is at record high, while Select beef share is declining (Figure 1)–consumers are paying to keep high-quality beef on the table.

Grid marketing 101

Profit on the grid depends on beating industry averages for quality and yield grades.

Fed cattle sell by formula, contract or spot-market bids. Live or carcass weight-based pricing formats are often dependent on region.

Grid marketing sets a starting price according to a carcass-value base, then figures premiums and discounts to each carcass. Overall yield, or dressing percentage, converts live to carcass price.

“The average dressing percentage of 63.5% is pretty standard for the industry,” Dykstra said, but grids may vary and the number is affected by mud, gut fill, external fat, muscling, gender and age.

A below average dressing percentage may be overcome by having better-than-average carcass premiums.

Cattle with the most fat usually have the least muscle and red-meat yield. “That combination works against us,” Dyskstra said.

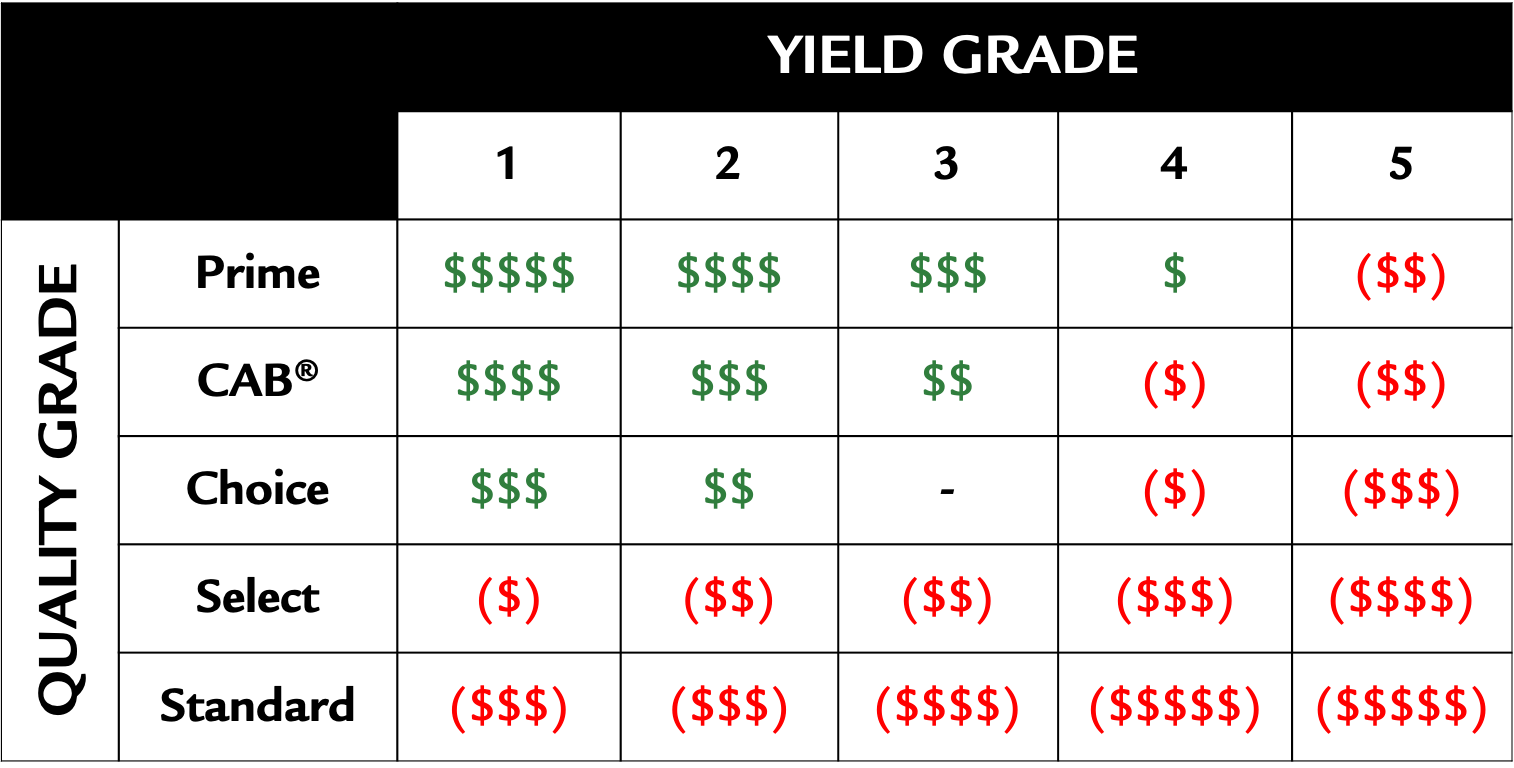

Packers pay the most for the rare combination of Prime quality and YG 1, and they greatly discount carcasses falling at the opposite end of the grading table (Figure 2).

Cattle sold on the grid compete with the average percent Choice at the packing plant. Cattle are graded individually, but packers look at entire load average to determine if any cattle earn a premium.

The current U.S. average of near 70% Choice, with regional differences, means packers only pay the Choice premium for the share of cattle in the whole lot that exceed the plant average, Dykstra explained.

“Whether it’s 40 head or 150 head, the percentage of those cattle grading Choice matters,” he said.

The Choice/Select spread points to supply and demand for high-quality carcasses and determines the premium.

An average of 70% Choice leaves potential premiums on 30% of the load. If the Choice/Select spread is $10 per hundredweight (cwt.), multiply 10 by 30% to get $3/cwt premium for every Choice carcass in the load.

Typically spring and fall are ideal for capturing the most quality premiums, Dykstra said, but CAB carcass trends are impacted by seasonality to a lesser degree.

Even though 36% of all eligible black-hided cattle reached CAB last year, packers have paid higher premiums for the brand lately compared to when supplies were historically low.

“When we can sell more product and still keep a premium up there for cattle, that’s a great thing,” he said.

Yield grade still matters

Yield grade is the other part of the equation.

Cattle reach their endpoint faster today than 20 years ago, increasing the average YG 4s to 12% last year with cases of 20% to 40%. The pandemic added to that as cattle feeders and packers worked through the backlog and cattle spent more time on feed.

While grids may incentivize YG 1 (recent average $5.43/cwt. premium), YG 2 is a reasonable target to maintain high grading carcasses, Dykstra said. YG 3 is par.

Yield Grade 4s and 5s now incur smaller discounts than in the early 2000s, he said, “evidence that packers have become more accustomed to a little extra fat thickness to achieve a desired quality grade.

“The premium for YG 2s averaged $2.42/cwt. last year,” Dykstra added. “We should have as many YG 2s as we can possibly get, keeping in mind that YG 1s with acceptable finish are difficult to achieve.”

Bring the data home

Dykstra posed the questions: How do commercial cattlemen pursue their share? What numbers need to be achieved to perform well and earn more money in grid marketing?

Start by evaluating traits in your cow herd and bull battery.

Backfat thickness indicates days on feed and total body fatness, while marbling affects quality grade–also the primary driver for carcasses qualifying for CAB. Backfat, hot carcass weight and ribeye area are other measures used to determine YG and CAB eligibility, Dykstra said.

The many moving pieces in grid marketing make it a bit of a chess game, but learning to play opens more opportunity for big wins.

You may also like

CAB Sets Sales Records, Sees Historically High Brand Acceptance Rates

In an otherwise tough time in the beef business, sales and supply records have been a bright spot. The positive numbers mean that quality beef production has not let up, and beef demand is holding. Consumers have proven the value proposition: the good stuff is worth a little more money, for a better eating experience.

Feeding Quality Forum Dates Set Earlier in August

When you’re feeding cattle, it counts to keep track of every calf, pound and dollar. Beyond the event’s educational sessions, networking between segments of the beef supply chain is invaluable—from feeders and cow-calf operators to allied industry and university researchers.

Gardiners Highlight Service, Strength at Foodservice Leaders Summit

Mark Gardiner and his son, Cole, of Gardiner Angus Ranch offered a boots-on-the-ground perspective for CAB specialists attending the annual event, designed to deliver resources that help train foodservice teams and serve consumers at a higher level.