Beef industry’s path charted

Demand for higher quality can support more cattle in coordinated supply chains

by Laura Nelson

Prosperity for any industry depends on consumer demand, a Western Kentucky University animal scientist points out. Of course, that includes the beef industry or cattle community.

Nevil Speer, in a new white paper, “Consumers, Business and Breeding Systems: Charting the Beef Industry’s Path,” says the implications are clear.

“All business decisions on the ranch, as everywhere along the beef supply chain, should be made with an eye on consumer demand for beef,” he says.

Following a 2011 work that explored why crossbreeding is not more widely used, the latest paper details shifting market signals and a sometimes-volatile relationship between consumer demand and industry output since 1960. It suggests what emerging dynamics mean for an integrated business environment and outlook for the beef industry’s value chain.

Those expectations and fluctuations have always been tied to the consumer, the animal scientist points out.

“Traditional thinking leads commodity businesses to constantly face the same question: ‘What’s the market going to do?’” Speers says. “That paradigm implies a price-taker mentality and fails to truly connect to the signals consumers send that establish those prices.”

In the face of increased demand for higher quality beef, tight supplies and tighter margins, being a “price taker” risks being left behind.

Within a new mindset, success means delivering “quality, consistency, efficiency and volume across a whole realm of products and attributes,” Speer says. That requires moving from a “commodity-sorting system to growing adoption of more specialized production.”

There are 6 million fewer beef cows in the U.S. compared to 17 years ago, and the feeder cattle supply at 35.6 million head represents less than 2.5 times current feedyard capacity.

“That’s barely sufficient to provide normal turns of cattle, let alone provide opportunities for extended grazing or heifer retention,” Speer says. The shortage brings more focus on the opportunity to capture the “new dollars” derived only from consumers.

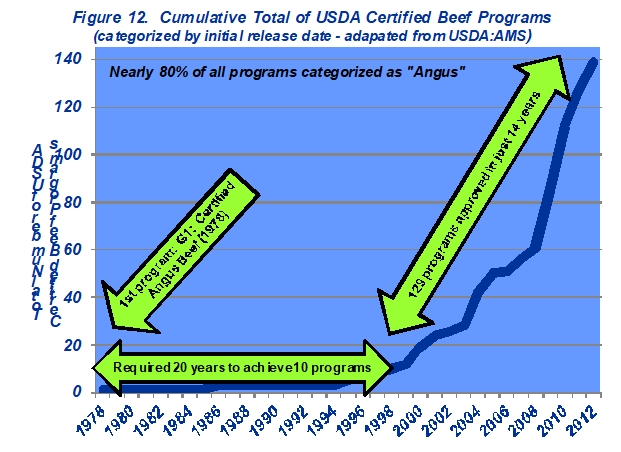

Following the retail grocer example of keeping costs low and profits high by stocking shelves and meat cases only with what’s selling, the beef industry ramped up alliances and certified beef programs. It took 20 years after the Certified Angus Beef ® brand first became USDA-certified in 1978 for 10 more programs to come along. In the 13 years since then, 129 new programs have been introduced, nearly 80% of which are Angus-based (See Fig. 12 from the white paper, below).

“This points to ever-growing market differentiation,” Speers says, noting it has come in the face of a financial crisis.

USDA quality grades are associated with higher levels of marbling, which generally leads to an increased likelihood of a favorable eating experience. In particular, higher degrees of marbling are positively tied to USDA “A-stamp” percentages, with those cattle showing a higher probability of grading Choice or better.

“The effect of establishing positive demand spells prosperity: more consumers buying more beef at higher prices,” Speer notes in the research paper.

Growth in that market speaks for itself: the value of weekly combined sales for USDA Prime and branded products (a function of both volume and price) has increased nearly 400% since 2003 and now represents nearly $4 billion per year.

“Given the outlook for ever-tightening supply, this emphasis and its influence upon the supply chain will likely be amplified,” Speers says. “Whatever the targets that evolve over time, there will be growing pressure to maintain genetics and breeding systems capable of delivering high-quality beef products coupled with synchronized supply chains that facilitate those attributes, including ‘product story.’”

With research and market data proving that consumers identify with brands when shopping for beef, he says, those are the programs best poised to take advantage of integrated supply chains that can sway the industry away from that “price taker” mentality.

The virtuous loop is a kind of self-fulfilling prophesy, he says: “The production of higher quality, more desirable products establishes better consumer demand, and in turn, better consumer demand creates the need for even more high-quality beef.”

That means holding on to theoretical advantages without discipline can eat your lunch in terms of lost profit. To read Speer’s research paper, visit https://cabcattle.com/news/research.

You may also like

$100,000 Up for Grabs with 2024 Colvin Scholarships

Certified Angus Beef is offering $100,000 in scholarships for agricultural college students through the 2024 Colvin Scholarship Fund. Aspiring students passionate about agriculture and innovation, who live in the U.S. or Canada, are encouraged to apply before the April 30 deadline. With the Colvin Scholarship Fund honoring Louis M. “Mick” Colvin’s legacy, Certified Angus Beef continues its commitment to cultivating future leaders in the beef industry.

Raised with Respect™ Cattle Care Campaign Launched This Fall

Raised with Respect™ was developed as part of a strategic cattle care partnership between Sysco and CAB. The collaboration focuses on supporting farmers and ranchers, equipping them with continuing education to stay current on best management practices and helping to increase consumer confidence in beef production.

Drought Impact and Cattle Industry Dynamics

As drought conditions persist across much of cattle country, farmers and ranchers are at a pivotal juncture in the cattle industry’s landscape. What impact does this prolonged dry spell have on the nation’s herd numbers? When will heifer retention begin? How will industry dynamics influence the spring bull sale season?