Hindsight for the future

Randy Blach’s positive outlook for the industry

by Abbie Burnett

September 17, 2020

The blessing and curse of perspective is not having it until a moment passes. Looking back on the last 40 years shows us more than we can see here and now.

“I think we really have to have an appreciation for where we’ve come from,” said Randy Blach, CattleFax CEO, at this year’s virtual Feeding Quality Forum. “It’s not been a straight line.”

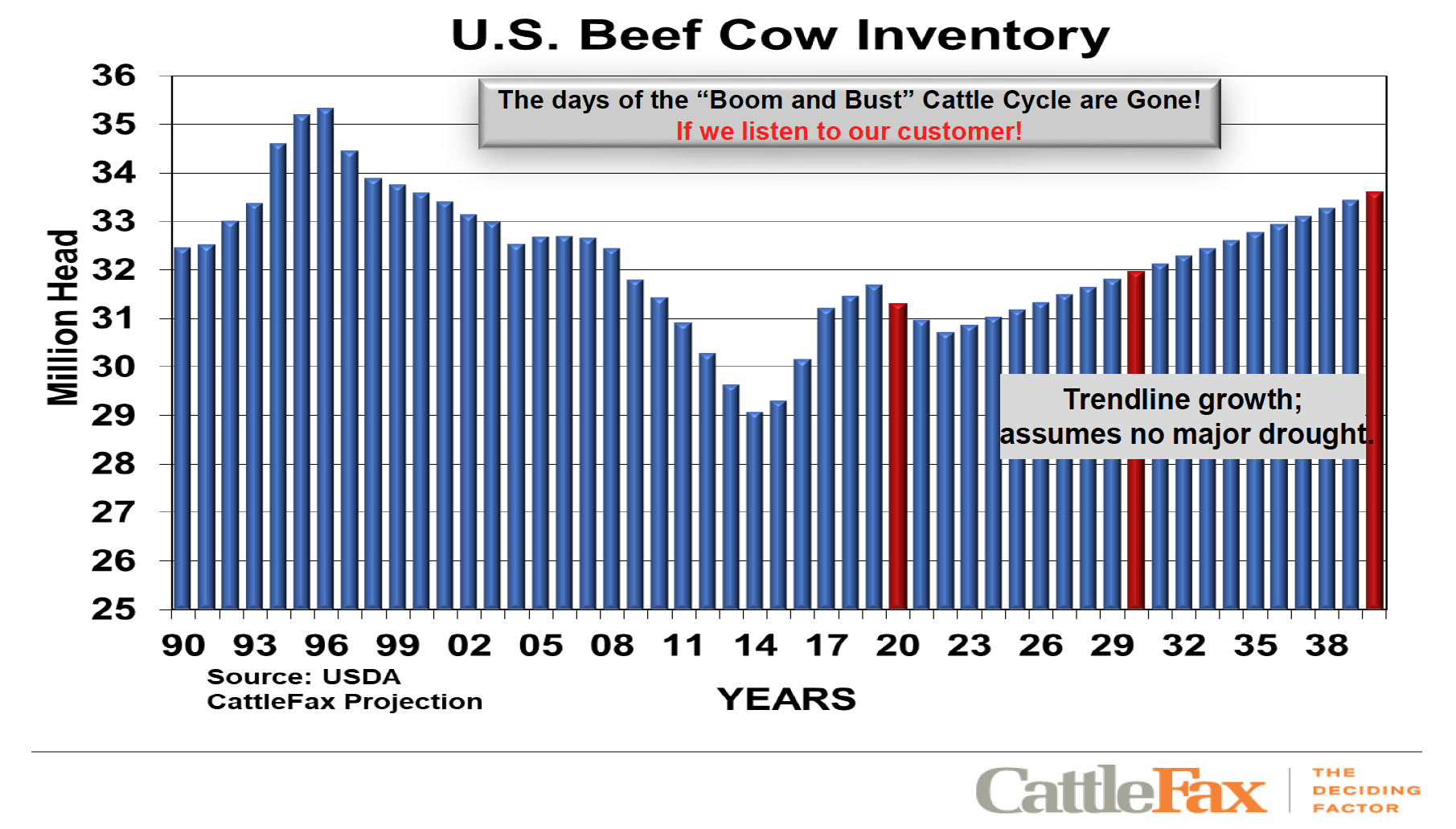

Cattle inventory topped 132 million head in 1975, but it wasn’t until 2000 that the fed-cattle harvest reached its record 30.2 million, and that was with a long decline to 10 million fewer beef cows.

In the 1980s, 12% of U.S. farmers and ranchers went out of business, and the “war on fat” in the ’90s nearly eradicated a poorly informed cattle industry, Blach said. Between 1998 and 2000, almost 40% of carcasses graded Select.

“If you go back to the quality audits at that time period, one out of four steaks was a disappointment,” he said. “No wonder consumers were walking away from our product. They didn’t like it.”

While a new focus on quality emerged in the early 2000s, genetics, growing drought and mistakes of the past kept up pressure to liquidate. From 2000 to 2015, annual fed harvest numbers declined by 7 million head to close some packing plants and limit harvest capacity going forward.

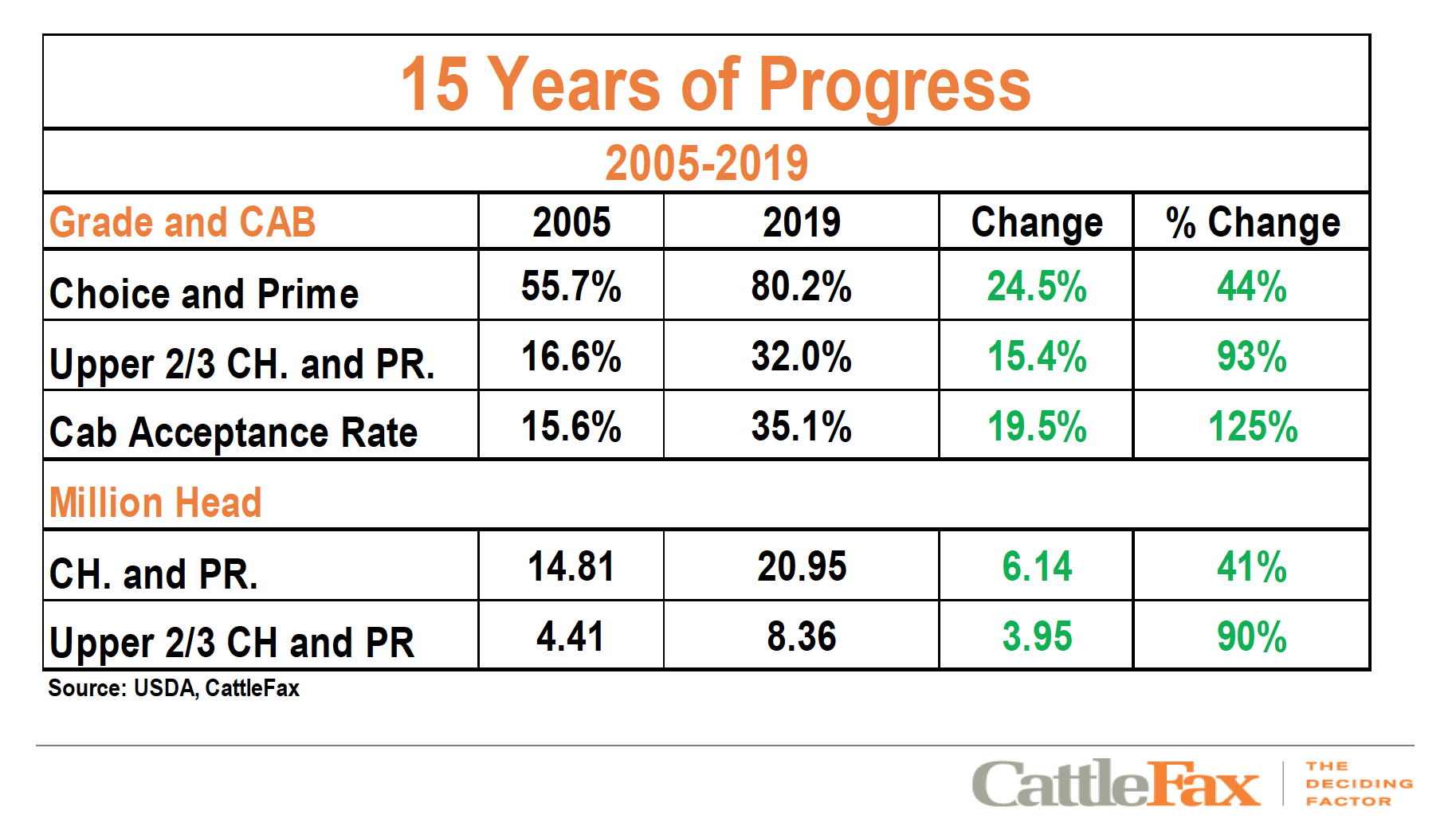

The seeds of that early move to boost quality finally sprouted after the drought, blooming with record-high Choice and Prime grades.

“We’ve just taken out the long-term downtrend in numbers,” Blach said. “I believe the reason we’ve done that is because we’re an industry that is now focused on doing the right thing, producing the highest quality product that we can, and meeting the changing demands of our consumers.”

As the U.S. herd decreased, productivity per head greatly increased and finally added premium quality. The market analyst looks for some liquidation due to drought in the near term but overall numbers should only ebb and flow instead of crash and rise. Stabilization has come to the industry.

The retail sector provides a case study, Blach said. From 1980 to 1998, beef demand was cut by more than half, but since then it’s risen by 14 points to 61 on 1980’s baseline of 100. There’s room for more, but much value has already been added.

“That growth from the demand low has been worth anywhere from $225 t about $280 a head,” he said.

Demand is well established for today’s higher quality beef, but without an increase in the bottleneck of harvest capacity, Blach sees herd numbers flattening.

With the current balance in supply and demand, “we increase harvest capacity or we decrease the number of animals that are moving through the system,” he said. “This will be a situation that ebbs and flows and will start to balance back over the course of the next several years.”

On the global stage, the U.S. is the top beef and poultry producer, and third in pork, dominating meat trade overall. The reason?

“Because the lion’s share is a high-quality fed-beef product so we have more yield per animal,” he shared.

In 1990, beef exports were a very small percentage of U.S. production, whereas today it’s 19 billion pounds or 18% of total meat exports.

Blach sees that growing to as much as 150 billion pounds of beef exported by 2040, or 50 billion more than this year.

That sunny projection comes with challenging considerations.

“Are we prepared to continue to make the strides, some of the same hard decisions we made 15 to 20 years ago, focused on quality? Are we going to be willing to do that as we move forward where we can increase our global market share and presence? To have a traceable product? Be source-verified?” he asked.

Instead of $350 per head, Blach said beef exports could be worth close to $500 per head by 2030.

“We’ve seen these premiums stay strong all the way through here because more and more consumers, once they taste the good stuff, they want to stay with it, don’t they? So this has been a quality movement,” he said. “Now the opportunity is to layer some of those other attributes onto this to move the value equation moving forward as we move forward into this next decade.”

Real-time perspective isn’t really a thing, but the progress in the latter half of the last 40 years says a lot about where the beef business is headed.

Find recordings from the event here.

You may also like

CAB Sets Sales Records, Sees Historically High Brand Acceptance Rates

In an otherwise tough time in the beef business, sales and supply records have been a bright spot. The positive numbers mean that quality beef production has not let up, and beef demand is holding. Consumers have proven the value proposition: the good stuff is worth a little more money, for a better eating experience.

Feeding Quality Forum Dates Set Earlier in August

When you’re feeding cattle, it counts to keep track of every calf, pound and dollar. Beyond the event’s educational sessions, networking between segments of the beef supply chain is invaluable—from feeders and cow-calf operators to allied industry and university researchers.

Making Sense of Supply, Pricing and Navigating the Market

Amid anticipated shifts in cattle supply and evolving market dynamics, CAB remains well-positioned to navigate the beef sales road ahead. Clint Walenciak addressed how producer profitability, strategic specification adjustments, and resilient demand will help stabilize the brand’s beef supply chain through herd size and pricing shifts in 2025 and beyond.