MARKET UPDATE

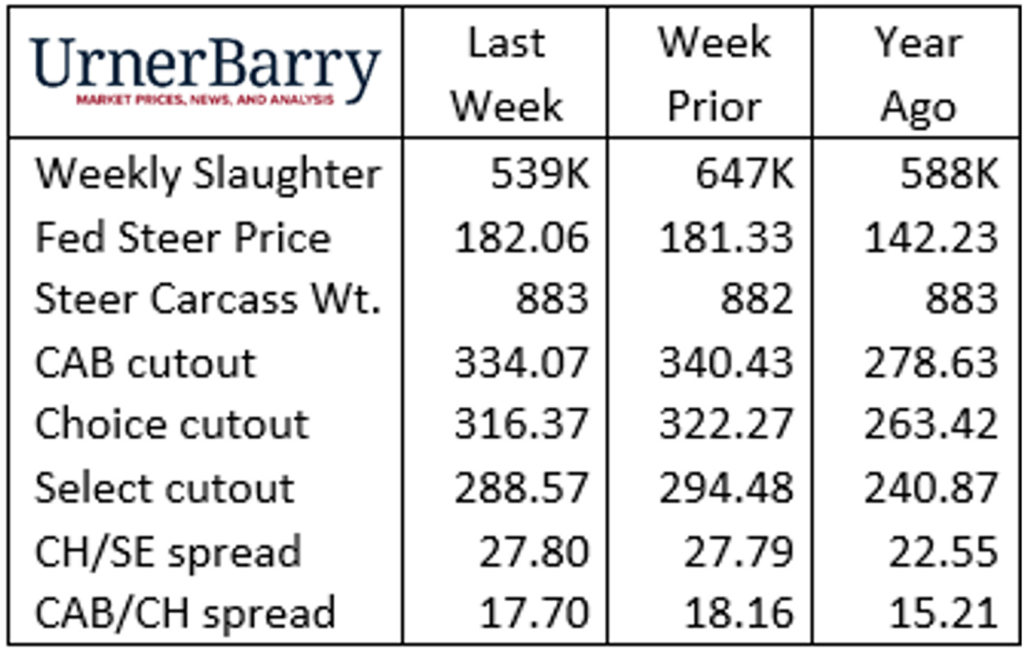

The fed cattle market traded slightly higher last week with the 5-area fed steer average at $182.06/cwt. Nebraska feedlots sold steers as high as $186/cwt. live and $290/cwt. on a dressed basis. The Texas, Oklahoma, New Mexico market averaged $1.78/cwt. on just over 3,000 head sold in the negotiated cash market.

The total federally inspected cattle harvest was especially small last week with packing firms closed for Independence Day. Some of the large packing plants were also closed on Monday, July 3, resulting in just 62,000 head of fed cattle harvested compared to 100,000 head on Wednesday and Thursday.

So far this year only 7 weeks have featured a fed cattle slaughter larger than last year. On average, the weekly steer and heifer slaughter has been 15,000 head smaller in 2023, roughly a 3% change.

In the past three years the July fed cattle slaughter total has averaged 2.6% or 13,300 head-per-week larger than the rest of the year. However, Cattle on Feed estimates remain restricted and packers have been disciplined in keeping slaughter head counts low. Packer margins are estimated to remain positive at this time. But cutout values continue to slip while fed prices are steady to slightly higher. Given this scenario, the smaller slaughter trend should likely continue.

Boxed beef sales tend to dip at the beginning of July with the holiday-shortened business week and a transition from spring holiday-riddled markets to full-fledged summer seasonal weather. Cutout values are in the range of 20% higher than a year ago on lower available supplies. Sales for delivery in the 0-21 day time-frame are generally in line with a year ago considering the smaller slaughter totals. Yet sales for delivery beyond 21 days are noticeably lower in the latest reports. This could be a sign of price fatigue at retail or expectations on buyers’ behalf that prices should continue to seasonally decline in July.

Quality is in demand as is made clear in the cutout price spreads. Urner Barry’s $27.80/cwt. Choice/Select spread based on the simple average is a bit lower than USDA’s weighted average value of $31.32/cwt. last week. This is a record-wide spread for the first week in July but values near this level have been tested in 3 of the last 4 years. The CAB cutout premium to Choice at $17.70/cwt. is healthy but in line with the seasonal expectation after coming off of the early June high of $26.45/cwt.

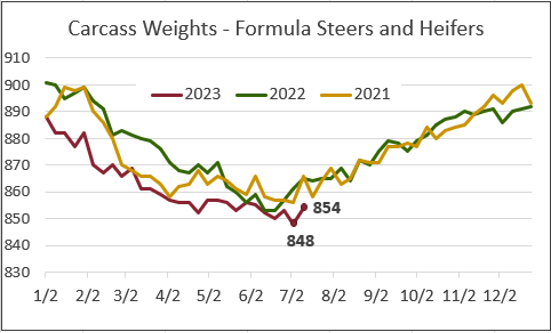

Carcass Weights Find Bottom Late

In a continuation of tracking seasonal transitions we turn attention to carcass weights. Confirmed USDA weight reports lag two weeks behind, but formula-priced steer and heifer carcass weights are current through last week. That represents a large portion of the total head count.

Fed cattle carcass weights traditionally find their annual lightest point in the spring of the year. In the past decade the annual low was realized in May or early June. Yet the latest data indicates that this year’s low was potentially realized two weeks ago, the last week in June, at 848 lb. for combined steers and heifers. This isn’t finalized but last week’s formula cattle weights were 7 lb. higher – the beginning of a seasonal turnaround when weights will build to their annual heaviest in the fall.

The “so what” in this data is the fact that even though the fed cattle slaughter counts are small, we saw lighter cattle harvested well past the early June expectation. Supplies of market-ready cattle are very current and both the market average price and quality price premiums show potential to outperform typical July expectations.

Looking ahead there may be implications for further light carcass weights depending on the basis relationship between cash and futures. However, cattle supplies read as quite tight in the fourth quarter, resulting in the likelihood that weights and finish on harvested cattle could be lower than recent years’ trend lines.

Now is the time for cattlemen to evaluate the potential for exceptionally strong premiums in high quality CAB traditional and Prime carcasses down the road. Feedlot management protocols favoring protection of bred-in marbling potential make financial sense a majority of the time but may become more glaringly true in the fourth quarter this year. When high quality carcasses are in short supply the price spreads tend to explode. Be ready.

Read More CAB Insider

$100,000 Up for Grabs with 2024 Colvin Scholarships

Certified Angus Beef is offering $100,000 in scholarships for agricultural college students through the 2024 Colvin Scholarship Fund. Aspiring students passionate about agriculture and innovation, who live in the U.S. or Canada, are encouraged to apply before the April 30 deadline. With the Colvin Scholarship Fund honoring Louis M. “Mick” Colvin’s legacy, Certified Angus Beef continues its commitment to cultivating future leaders in the beef industry.

Carcass Quality Set to Climb Seasonally

With the arrival of the new year the beef market will rapidly adjust to changes in consumer buying habits. This will remove demand pressure from ribs and tenderloins, realigning the contribution of these most valuable beef cuts to a smaller percentage of carcass value

Misaligned Cattle Markets and Record-high Carcass Weights

Few things in cattle market trends are entirely predictable but the fact that carcass weights peak in November is as close to a sure bet as one could identify. Genetic selection for growth and advancing mature size has fueled the long-term increase in carcass weights.