MARKET UPDATE

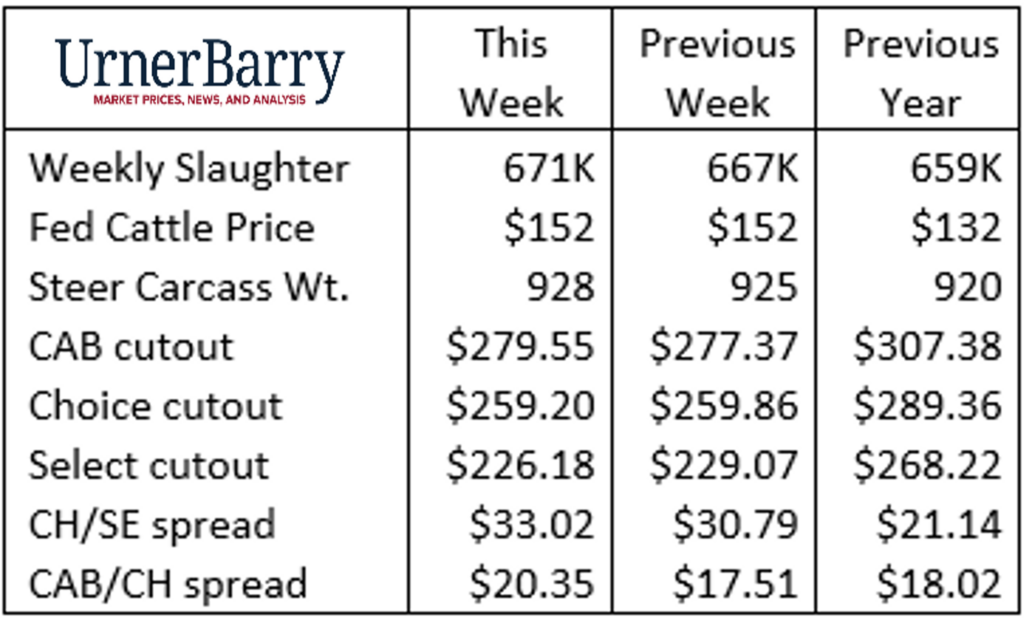

Fed cattle prices were steady last week with a $152.73/cwt. average six-state steer price. The northern end of the feeding region sold some as high as $156/cwt. but a volume at $153/cwt. Very light cash trade volume in Kansas and Texas found an average near $150/cwt.

Live Cattle futures contracts have traded up and down in the past two weeks with the December contract gaining nearly $2/cwt. from the beginning of the month through last week. With volatility in the markets, that increase has since been erased in the past four days with the contract closing yesterday at $151.27/cwt. The February 2023 contract has declined around $3/cwt. since the first of November.

In the same timeframe, corn futures worked to the cattle feeder’s advantage with a 40-cent drop from November 1 through Monday morning’s opening. Reports this Tuesday of Russian aggression in Ukraine spilling over into Poland sent corn prices higher as heightened tensions in that region once again generated volatility in grain prices.

Despite the weekly average data showing the CAB cutout $2.18/cwt. higher last week, the Choice boxed value has declined daily since last Tuesday by $0.07/cwt. With Thanksgiving meal preparations at the focus of many retailers, the beef spot market demand tends to decline in the week prior to the holiday. Emphasis on “spot market” is important since beef purchasing for late fourth quarter needs has been well underway.

Ahead of Thanksgiving, ribeyes and tenderloins are not giving up any ground. These two cuts, in each of the quality grades (including the Certified Angus Beef ® brand,) are reflecting the typical seasonal demand climb. We reported record-high tenderloin prices two weeks ago and the trend has only strengthened in the meantime. This Tuesday’s heavy Choice tenderloin price was $15.24/lb., wholesale, versus $13.73/lb. a year ago. Last week the heavy CAB tenderloin price was $1.20/lb. premium to Choice.

Across the rest of the carcass items, prices are mixed with notably weaker prices on thin meats and round subprimals. Chuck rolls have been difficult for buyers to source in the past few weeks and are consequently 25% pricier at wholesale than a year ago.

Tight Cattle Supplies and Increasing Carcass Weights

The current cattle markets can provide a history lesson for those new to the scene.With last week’s $152/cwt. fed cattle average, feedyards experienced the highest price since June 2015. To give a quick recap of that era: record-high prices, fueled by a supply chain starved for cattle numbers, came to an abrupt end. The November 2014 record steer price of $171/cwt. eroded rapidly and bottomed out 9 months later in September 2015. Following the 31% drop to $117/cwt., the market stabilized and turned higher. This signaled the end of tight cattle supplies, caused by drought liquidation, and beef cattle producers were able to restock the nation’s cow herd.

At the market high in November 2014, weekly steer/heifer slaughter head counts were near 445,000 head, just 13% smaller than the average in the most recent four-week period. At the 2014 market high, carcass weights averaged 874 lb. whereas most recent carcass weights in 2022 have been 18 lb. heavier at 892 lb. The resulting estimated carcass tonnage is 15% larger in recent weeks than in November 2014.

It’s interesting to note that while fed cattle prices declined precipitously in 2015, weekly slaughter head counts continued to trend lower in 2015 as well. As a matter of fact, fed slaughter was 4.8% smaller in 2015 than the prior year even as price declined at three times this pace.

The feedlot sector’s response to tight cattle supplies in late 2015 was to send carcass weights to new record highs. During that October steer carcasses averaged 930 lb., 24 lb. heavier than the fall 2014 high and 51 lb. heavier than that period in 2013. It was a conscious effort by packers and feeders to capture more pounds from fewer head.

As noted, today’s weekly slaughter is much more robust than in 2015 and cattle supplies are at least adequate for the short term. Yet fed cattle numbers will certainly tighten as we move into 2023 due to the shrinking cow herd and a 2022 calf crop at least 1% smaller than last year according to USDA’s July report . The latest steer carcass weight average of 928 lb. is just two pounds lighter than the 2015 fall heaviest, a record that, at the time, seemed an excessive departure under extreme circumstances.

As we stare down the road at a scenario similar to what we experienced a decade ago it’s difficult to imagine that we’ll be able to capitalize on more pounds per head in the fed cattle sector. Carcass weights are starting the upcoming supply dip at an already-elevated level. The beef industry has added an average of 5 lb. of carcass weight annually across a very long time span. Another two-year, 50 lb. increase response to tight head counts is a bit unimaginable today. However, odds are great that carcass weights will press upward, within normal seasonal patterns for many months to come.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.