MARKET UPDATE

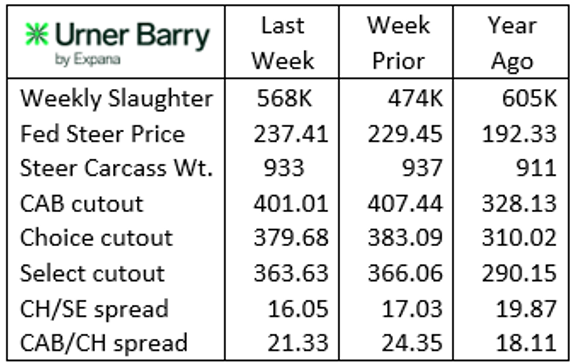

Last week’s federally inspected cattle harvest represented a modest volume of 568,000 head, following the holiday-shortened week prior featuring just 474,000 head.

With large moves in both directions, fed cattle prices have been erratic for the past three weeks. This has left sellers uncertain if the typical weaker July price pattern will develop. Halfway through the month, a nearly $8/cwt. steer price increase argues against directional weakness.

The spot market price spread from north to south has widened again with Iowa and Nebraska live prices averaging $238/cwt. to $240/cwt., while Texas and Kansas feedyards settled for an average of $229/cwt. on small volume.

Carcass cutout prices have been in a downward correction for two weeks now, descending from recent record-highs outside of the COVID slowdown. Cutout prices quoted in the table display a 22% increase in current wholesale cutout values versus a year ago. July price pressure is historically appropriate and it should be of little surprise that prices should retreat from recent lofty levels. Packer margins suffered a big setback last week with cash cattle costs sharply higher and boxes cheaper. This will not stimulate eagerness to harvest cattle faster.

Latest steer carcass weights are averaging 933 lb., 2 lb. heavier than their year-to-date low of 931 lb. logged two weeks ago. The current weight is 22 lb. heavier than a year ago at this time, the same week that marked the annual low at 911 lb. for steers. Heifers just touched the 854 lb. mark, the lightest so far this year.

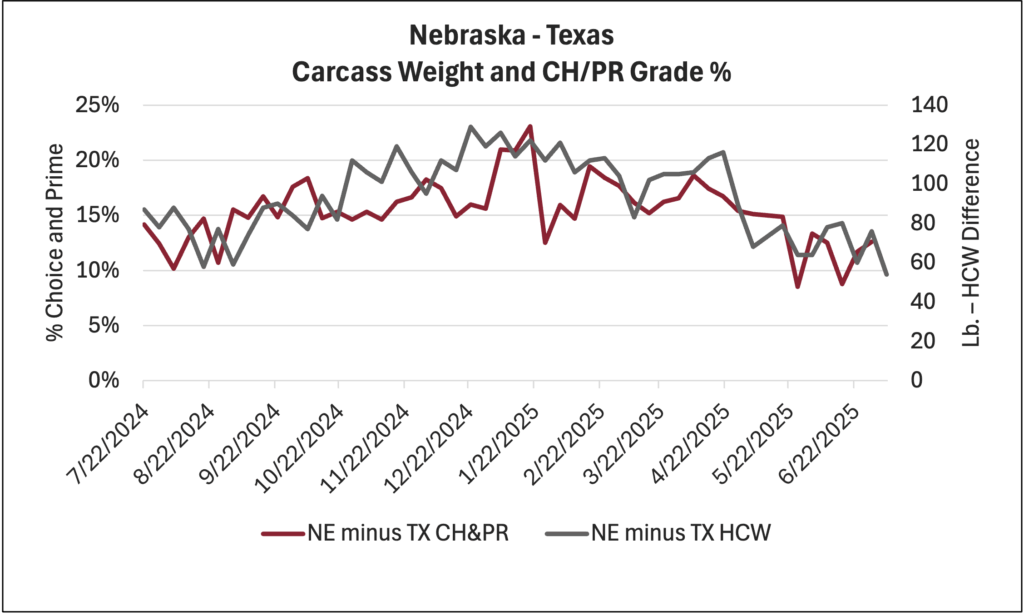

North to South Weights and Grade

From north to south across the three largest volume packing states (NE, KS, TX) Nebraska packers historically harvest, on average, the highest quality set of carcasses. Kansas packers have impressively closed the gap with their northern border state, often running par in tems of combined percent Choice and Prime carcasses. Yet, when USDA Prime is singled out in the comparison, Nebraska plants pull ahead with a 13.2% Prime rate, compared to Kansas at 8.1% and Texas at 6.6% (2025 data.) In fairness, the multi-state USDA western regions (9-10) and eastern regions (1-5) also post exceptional Prime grade percentages equal to or higher than Nebraska on much smaller volume.

Carcass weights historically favor heavier outcomes in the north as data has shown longer feeding periods characteristic of Nebraska, Iowa and nothern neighbors. Those days on feed are often 10 days or more in excess of feeding periods classic to Texas. Breed types logically play a role in carcass compositional end points from one region to the next. This factor has been evolving as the beef x dairy influence has increased more strongly in the south and the lack of Mexican cattle supply has been disrupted (recently halted again) in the region.

For the last 12 months, the average carcass weight for formula-priced steers in Nebraska, versus Texas, peaked in late December. That massive 129 lb. weight gap has since eroded to 54 lb. in early July. While this data is only for formula-priced steers, the contrast is stark.

In a similar trend the difference in the share of Choice and Prime carcasses has narrowed between the two regions. Nebraska packers peaked in January with a 23 ppt. advantage in the combined Choice and Prime share. The grade trend between the two states has erratically narrowed in the past six months, pulling the total to a 10 ppt. difference.

CAB carcass certification rates unsurprisingly mirror the contrast seen in the grading data. While carcasses must meet all 10 specifications, the importance of the marbling specification in brand acceptance lends the trend to follow regional grade tendencies. In the past six months, the CAB acceptance rate in Nebraska packing plants has averaged 5 percentage points higher than their Texas counterparts.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.