MARKET UPDATE

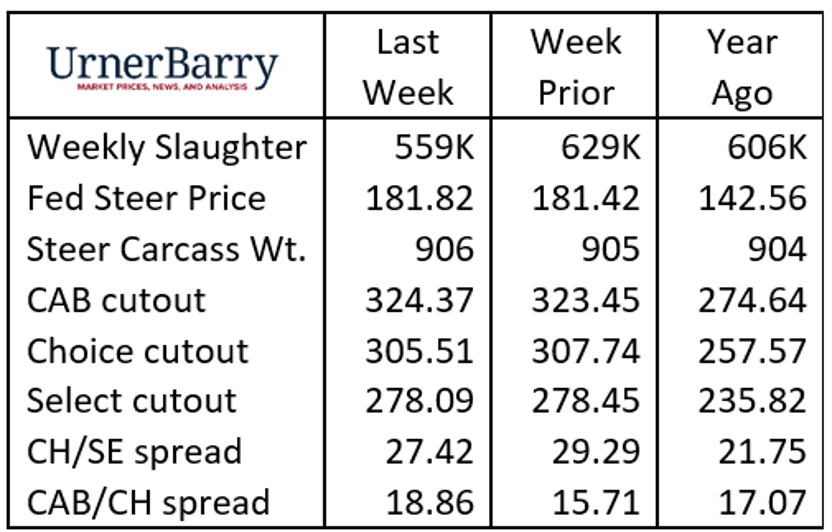

Last week’s fed cattle slaughter was remarkably small even considering that Labor Day shortened the production week for packers. The 559,000 head federally inspected total was 47,000 head smaller than the same week a year ago. On the other hand, fed steer and heifer slaughter Tuesday through Friday averaged 100,000 head per day.

Fed cattle prices remained essentailly unchanged last week at $181.82/cwt. The negotiated head count was quite small and limited packer demand kept a lid on potential for upward price movement.

Live cattle futures, however, have been pricing notably higher with October 2023 moving to a $2/cwt. premium to last week’s cash trade early this week. Monday’s $184.22/cwt. close on the October contract was near the contract high, but it has settled closer to last week’s cash price by mid-week.

The wholesale CAB carcass cutout value showed a weekly increase of $0.92/cwt. higher in last Thursday’s weekly report. However, the Choice cutout was down $2.23/cwt. and Select lost $0.36/cwt. in Friday’s weekly average summary.

Subprimal CAB carcass prices are recently variable depending on the cut. Ribs are generating continued upward price pressure, as are several items from the chuck and round. From the loin complex: strip loins, short loins, top butts and flap meat were all priced weaker while tri-tips, ball tips and tenderloins held to a higher price level.

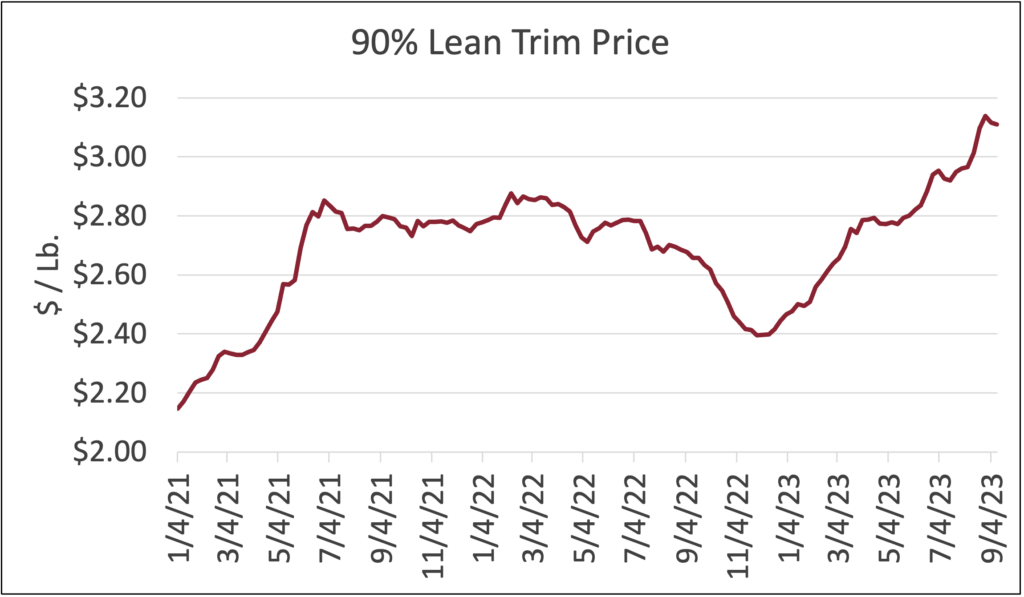

90% Lean Trim Drives Round Primal Value

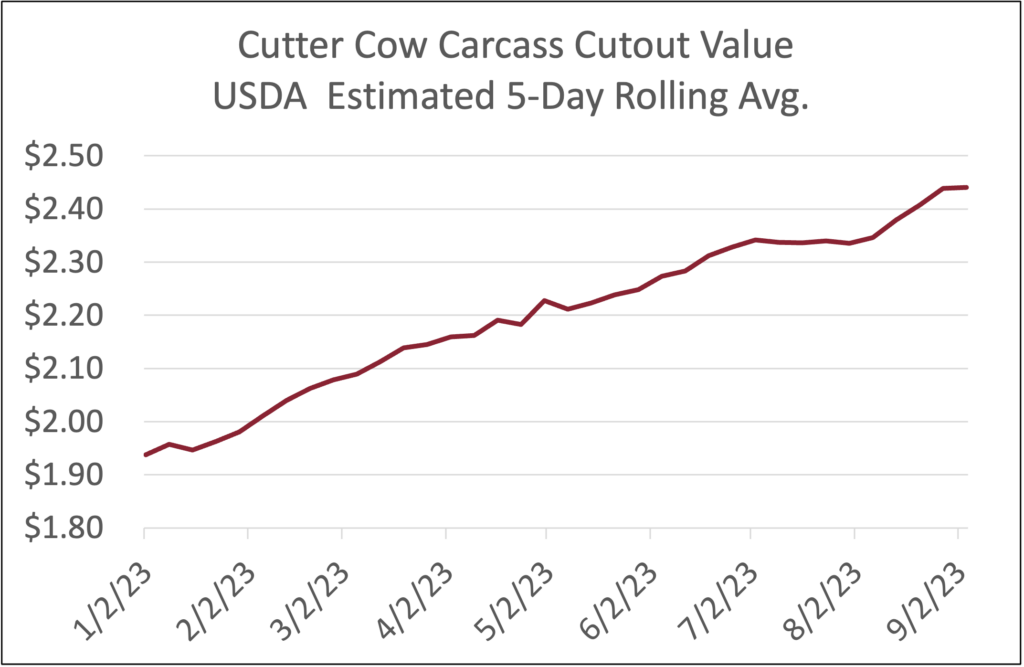

Weekly U.S. beef cow slaughter this year has averaged 65,531 head, down 10,467 head per week or 13.7% lower than 2022. Dairy cow slaughter is running 6% higher than a year ago with a weekly average of 61,754 head. All told the beef cow reduction is tipping the balance to a net result of all cull cow slaughter at 5.2% lower year to date.

U.S. beef cow herd contraction, now its fourth year, has accelerated in the past two years driven by drought in much of the western half of the U.S. This has generated sharp packer competition for a shrinking pool of cull cows already aggressively culled in affected regions.

AT $244.03/cwt., cutter cow carcass values are now record-high, surpassing the 2014 and 2021 price levels at this time of the year by roughly $0.10/cwt. Cutter cows are the primary source of 90% lean grinding trim, normally blended with fed steer and heifer fatty trim to create ground beef.

Record-high cutter cow values create record-high 90% lean trim prices, which have recently touched $3.11/lb. This price spike has sent ground beef processors seeking alternatives, as high prices often do. Fed steer and heifer cuts from the round primal are a logical substitution in this scenario and prices for round cuts are showing positive price moves in the latest reports, lifting the total carcass value contribution attributed to the round. The Choice round primal price, for instance, has lifted 15.6% and the CAB cutout is up 13.7% since August 1. Total carcass cutout prices have tended to increase during August in most recent years, but round cuts are holding the stronger price spike this season longer into September due to the substitution effect noted above.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.