MARKET UPDATE

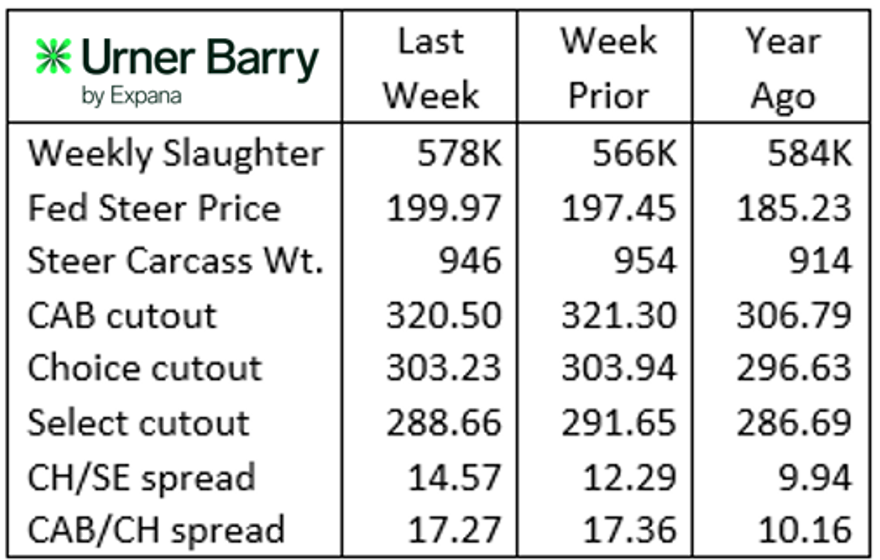

Total beef cattle harvest last week was up 12,000 head from the prior week at 578,000 head, 6,000 head fewer than the same week last year. In the past three years, federally inspected cattle harvest has increased from March 1 through the middle of June. This corresponds with increasing beef demand as grilling season develops. As we’re just ahead of St. Patrick’s Day, there are a number of weeks ahead before spring demand begins in earnest.

Spot fed cattle prices remained unchanged through most of the week but Friday’s trade sparked values higher. The summary for the week featured live prices in the north at $200 to $202/cwt. and $315/cwt. dressed. The southern market traded primarily at $197/cwt., culminating in a 5-area weighted average of $199.97/cwt.

Carcass weights made a significant turnaround in latest confirmed data for the week of February 17. Steer carcasses averaged 949 lb., a 9 lb. decline on the week, while heifers dropped 10 lb. to average 866 lb. Extreme cold and precipitation were likely the primary contributors to the decline. Combined steer and heifer carcass weights are down 37 lb. year to date.

Urner Barry cutout values indicate lower prices last week. But, USDA weighted average prices noted slightly higher prices, up just over $1/cwt. on average. Earlier this week prices continued to drift higher, confirming the short term turnaround.

Carcass quality trends are on the uptick, with historical expectations to see marbling trends top out for the year this month. The latest USDA Choice percentage is 73%, just half a point below a year ago, while USDA Prime is fractionally higher than a year ago at 10.9% of fed steers and heifers.

The proportion of Angus-type carcasses qualifying for the brand has been up and down in 2025. Yet as expected, CAB qualification has been trending higher within seasonal patterns. Similar to annual quality grade trends, the brand’s acceptance rate tends to find the annual high in March each year. With the brand’s 43% acceptance rate marking a new all-time record, the latest highlight in production trends rounds out February.

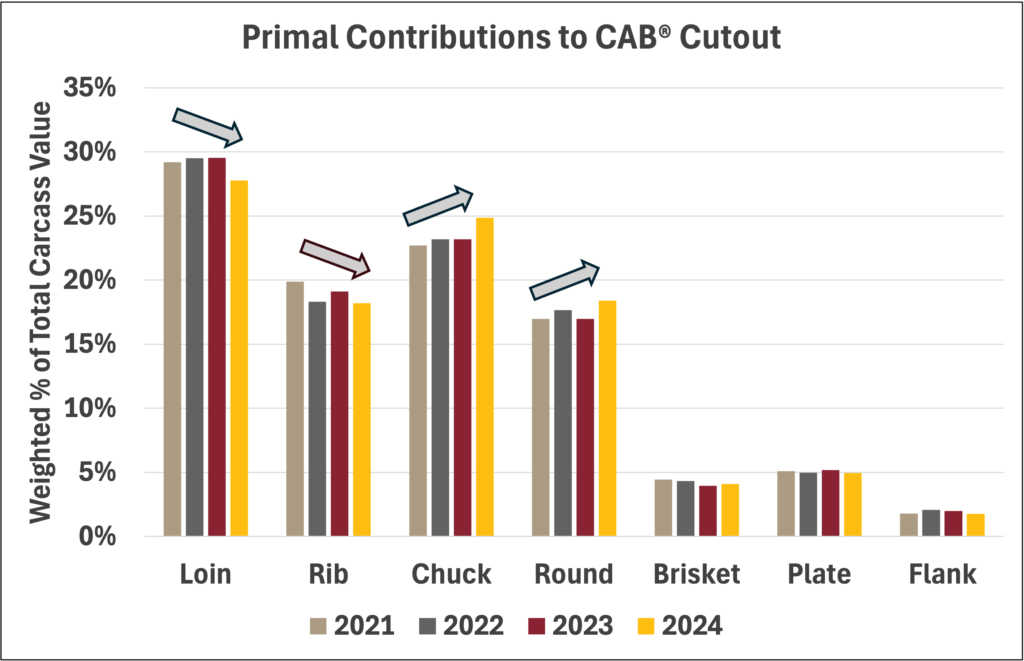

Chuck and Round Cutout Contribution

When we talk about highly marbled Certified Angus Beef ® brand beef cuts, we typically think ribeyes, tenderloins and strip steaks. These are among a class of beef cuts that enjoy the limelight and capture tremendous consumer demand. As well, these cuts enjoy the largest premium markups of any subprimal from USDA Select up through USDA Choice, Premium Choice CAB and CAB Prime.

In the past two years the chuck and round carcass primals have edged their way upward relative to their contribution to total carcass value. One of the primary reasons for this is the decline in domestic supply of lean grinding beef from cull cows. In 2022, U.S. cow harvest reached a peak for the cycle as drought pushed producers to send cows to town in volume. The culling trend continued and the declining cow inventory pulled total weekly cow slaughter 21% smaller in 2024 than that of 2022. This was one major factor pushing 90% lean grinding beef prices up 26.5% over the two-year period.

In 2024, average wholesale and retail beef prices saw net increases across all quality grade and brand classes. Yet the contribution to total carcass value from each of the primals shifted around the carcass in response to tighter lean ground beef supplies. That condition remains a factor in the current market as chuck shoulder clods and round knuckles, for instance, show continued price strength.

In the fed cattle supply this is not just a phenomenon reserved for the leaner, USDA Select grade carcasses. The 2024 CAB cutout trend featured the loin primal contributing 27.8% of the total carcass value, slightly less than the 29.5% contribution in 2023. The rib primal similarly pulled back from 19.1% in 2023 to 18.2% of value contribution last year. Picking up the slack in 2024, the CAB chuck primal contribution increased to 24.9% of total value, a 1.7 point increase. The CAB round primal increased nearly the same as the chuck, up 1.4 points to average 18.4% of total carcass value last year.

This trend is not necessarily an indication of poor middle meat demand, rather it’s a reflection of a slight uptick in demand for end meats that are lean enough to be used as substitutions for grinders. These shifts aren’t expected to be permanent but are more likely to remain in place as long as domestic cow harvest remains historically low.

Carcass premiums garnered through the brand continue to extend their reach across the entire carcass. The premium derived from the CAB chuck moved up to $13.52/cwt. above USDA Choice in 2024, a $3.86/cwt. increase in two years. The CAB round premium was $9.01/cwt. over Choice last year, $1.46/cwt. higher than the prior year but similar to the spread observed in 2022. Comparatively, the Choice-Select price spread for the chuck was $2.44/cwt in 2024. with the price spread for the round primal at $2.57/cwt.

Read More CAB Insider

North to South Weights and Grade

CAB carcass certification rates unsurprisingly mirror the contrast seen in the grading data. While carcasses must meet all 10 specifications, the importance of the marbling specification in brand acceptance lends the trend to follow regional grade tendencies.

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.