MARKET UPDATE

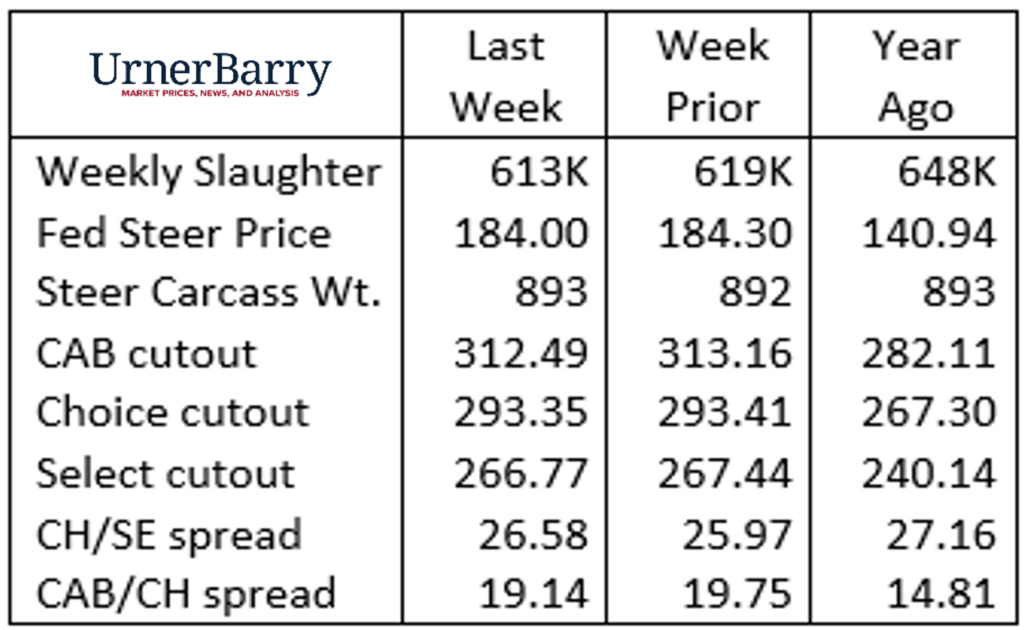

Fed cattle prices continued their relatively strong trading range again last week with late Friday sales closing out the small negotiated cash trade. The Iowa/Minnesota fed steer price was $187/cwt. while Nebraska’s $188/cwt. average topped the major reporting states.

Further south the negotiated price head counts remain very small with Kansas and Texas feedlots selling at $179 to $180/cwt. Given the much larger negotiated headcount in the north, the weighted average price favored the upper end of the price range with a $187.60/cwt. weekly average for the five-area report. The extremely small negotiated cash trade volume in the south remains an impediment to fed cattle values in KS/TX region.

In the past three weeks fed cattle slaughter head counts averaged just 483,000 head, down 6.3% (32,700 head per week) from the same period a year ago. Until fed cattle prices abate, or boxed beef values increase, packers won’t be incentivized to increase throughput.

The wholesale boxed beef trade may have posted the summer low prices last week with incrementally lower cutout values from Prime through Select grades. With Labor Day four weeks away the historic tendency is for beef prices to modestly increase through the next two weeks as retailers fill their short term needs for the holiday.

Christmas Plans in August

Early August in the beef market generally sees lackluster fed cattle prices and the final throes of the summer slump in boxed beef values. However, in the modern retail grocery business, it’s high time that end users make their plans for fourth-quarter holiday beef features.

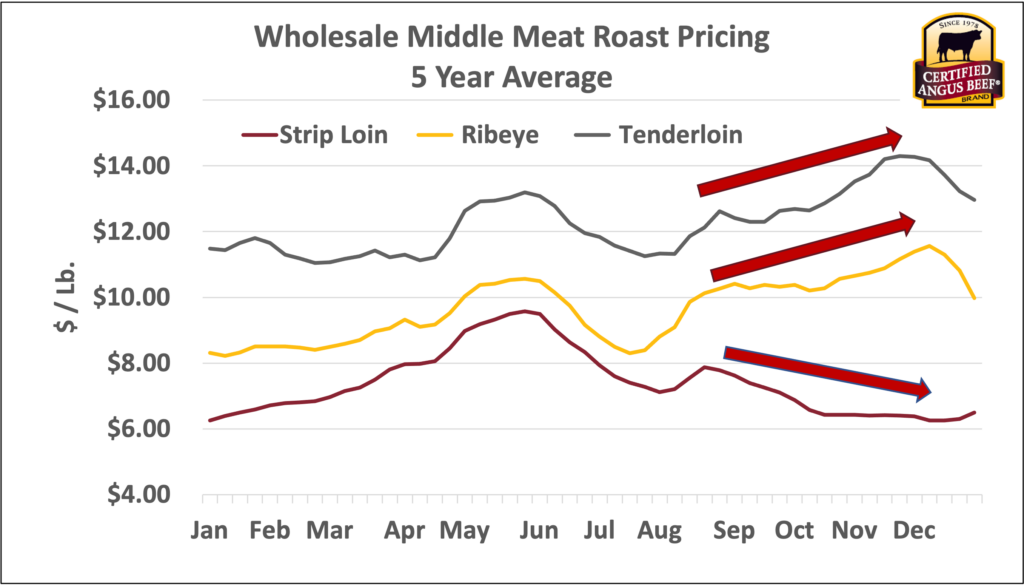

Indeed, the short-term spot market beef trade will immediately be focused on Labor Day needs. Yet diligent grocery operations are looking toward fourth quarter holiday beef sale features and booking product today to fulfill expected volume needs. More and more retailers have turned to locking in their orders as early as August in the past handful of years with two motivations for this trend. First, reserving an allocation of middle meats such as ribeyes and tenderloins for holiday roasts is wise, this assures quantities needed to fulfill ad features. Second, pricing is much more advantageous for these items today, as middle meat demand is weaker during the “dog days” of summer. Businesses willing to store holiday roasts in their almost frozen state can take delivery now and draw on those supplies later for their fresh meat case offering. This practice further restricts spot market supplies in December.

Smaller feeder cattle supplies placed against the fourth quarter marketing timeframe promise to generate spikes in both fed cattle values and boxed beef prices. Since ribeyes and tenderloins are winter holiday favorites, prices for these items are likely to spike acutely beginning in October.

Just as ribeye and tenderloin values drift higher, CAB strip loin prices reliably decline into the fourth quarter. In the past five years strip loin prices dropped, on average, 20.5% from the third week in August to the second week in December. This seasonal trend is quite strong and the resulting opportunity for retailers to feature “strip loin roasts” at a competitive price advantage to Prime rib roasts and tenderloins is a good one.

With wholesale strip loin prices typically $4/lb. cheaper than ribeyes and $7/lb. cheaper than tenderloins, retailers have far more margin opportunity with strip loin roasts than with the pricier middle meat companions. Retail ad designs and marketing plans need to start now, accompanied with forward purchases at cheaper December prices. That’s why Christmas should be on their minds in August.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.