MARKET UPDATE

The six-state fed cattle average price has traded in a narrow range over the past four weeks, with a slow upward bias from $156 to just over $157/cwt. Last week’s average of $157.07/cwt. was only a few cents below the prior week.

The December market rounded out the fourth quarter in a price pattern modeled nicely after recent years where the fed cattle price followed a firm upward bias, on average.

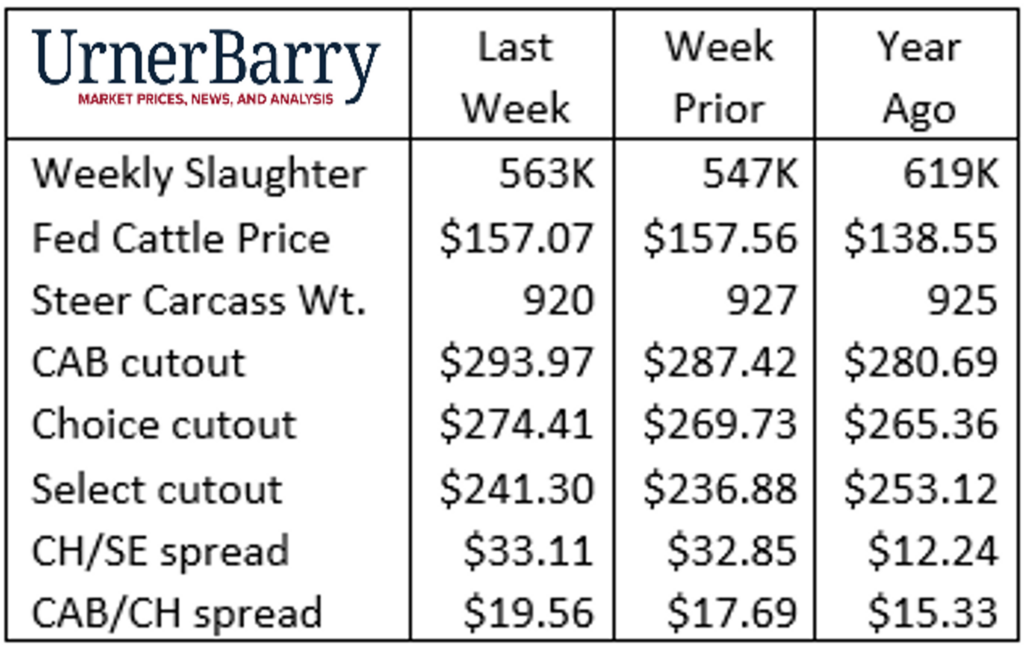

The table shows the slaughter pace from Christmas through January 2 was reduced, as expected, through the first week in January due to the New Year falling on a Sunday. December head counts were also impacted by winter weather production difficulties ahead of the holidays.

These smaller production weeks were beneficial to realigning packer margins to the positive side very quickly, a recovery from the “cash to cash” negative territory seen in mid-December. Shorter boxed beef supplies helped turn cutout values higher, specifically for many end meat and thin meat items, many of which had found 52-week lows—or levels very near that—prior to Christmas.

As the calendar turned to 2023 end users immediately dropped the recent red-hot demand for ribs and tenderloins as attention turned to cheaper end cuts more typical of the January spot market. Prices in late December for delivery 21+ days in the future also showed significant middle meat discounts in contrast to the spot market price spikes for those items.

From early April through the beginning of December 2022, the Certified Angus Beef ® brand cutout value lagged the 2021 market for the period by 12.7% or -$40.30/cwt. However, the 2022 price pulled higher than the year prior in the final three weeks of December. The CAB cutout begins 2022 with a $13.28/cwt. premium over the first week of January a year ago.

Cattlemen Will Continue to Reap Quality Rewards in 2023

Diving into 2023, the much-discussed beef cow herd culling comes home to roost, bringing on a supply challenge for the beef industry. We’ll start to see the projected smaller fed cattle offerings come through in the January weekly data. Keep in mind that last January’s slaughter pace was not impressive due to COVID impacts to their personnel, so weekly head counts for the month should be compared with that knowledge.

Fed cattle carcass quality grade in December was erratic but the USDA Choice grade managed to net a 2 percentage point improvement by the end of the month to finish the year at 74.6% of the carcass mix, just 0.8 percentage points higher than that final week in 2021.

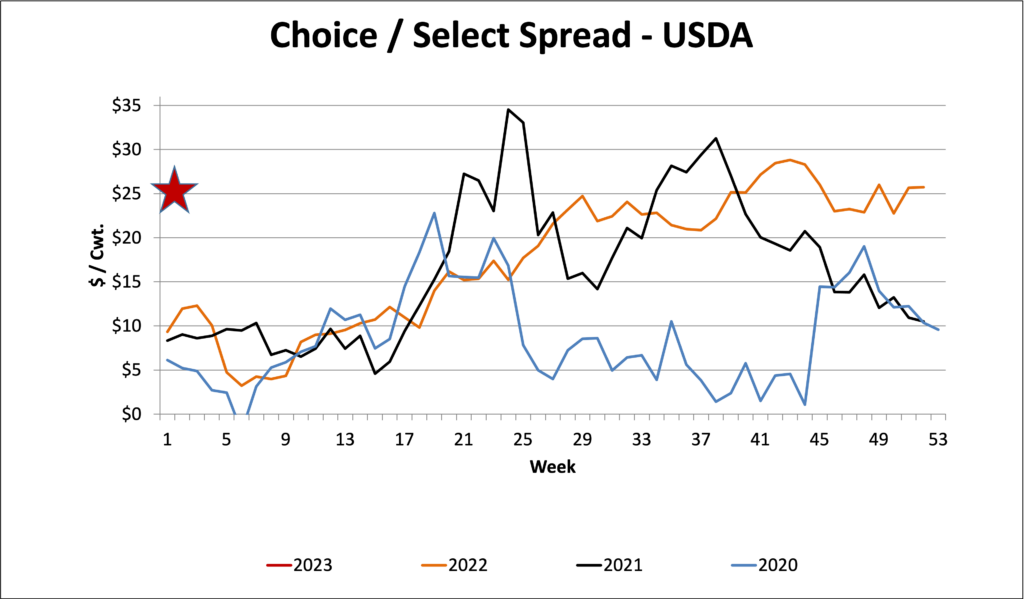

Estimated net Choice carcass tonnage in the latest three weeks’ data shows just a 1.3% smaller volume in December 2022 than the prior year. However, the Choice/Select price spread kicked off the new year on packer grids at $25.20/cwt. on average, 140% higher than a year ago.

Packers may pay a Choice premium for cattle anywhere north of 65% or 75% Choice, depending on region and grid format. This results in a net Choice carcass price of either $8.82 or $6.30/cwt. over the cash market average, respectively. At a carcass weight of 880 lb. that starts a pen of 100% Choice cattle from $55 to $78 per head above the cash carcass price.

The 2021 to 2022 track record for high-quality boxed beef pricing suggests a projection that tighter cattle supplies this year will support a continuation of premiums near the record highs. CAB grid premiums started the year with a $5.02/cwt. average across the packers with this week’s high of $10/cwt. by at least one packer. Added on top of the Choice price, the CAB carcass value then averages in a range from $99 to $122/head, depending on the Choice value. With a $10 premium at the top of the CAB range, the carcass generates a value just over $155/cwt.

In 2022, record Prime and CAB Prime premiums over Choice were all the rage, and appropriately so. The 11% dip in estimated total Prime carcass tonnage last year spurred the October grid premium to average $32/cwt. over Choice. While marbling genetics continue to progress and feedyards may manage cattle carefully to fulfill their quality grade potential this year, a lot would have to change to bring Prime carcass tonnage measurably higher in a smaller pool of fed cattle.

Market prices illustrated above aren’t predictive of every week ahead in 2023. Seasonal demand trends and cattle grading fluctuations tend to rule the ebb and flow of premiums throughout most years. While this is true, different demand levers have elevated premiums in a more prolonged fashion during the second half of the past two years.

Everyone downstream from the packer needs to be prepared to see more frequent, potentially wider price spreads for quality within the shrinking supply setting. That’s a decent bet without factoring in any major socioeconomic changes ahead. From the cattlemen’s perspective, evidence shows that pressing ahead with a quality carcass mindset is the course to pursue.

Read More CAB Insider

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.

It’s Beef Month

Wholesale and retail beef buyers have been preparing for weeks ahead of the spike in consumer beef buying associated with warmer weather and holiday grilling demand.