MARKET UPDATE

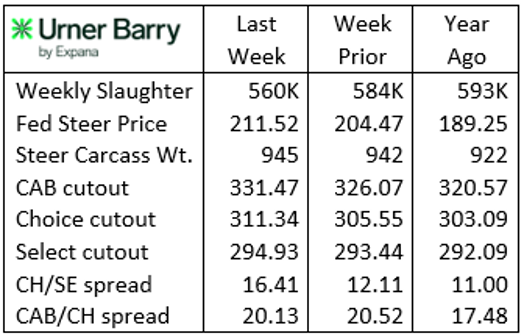

Last week’s fed cattle trade was highlighted by sales late Friday that featured substantially higher prices as packer demand for spot market cattle pressed prices higher in all regions. The five-area weighted average for the week summarized strong market support with a $212.76/cwt. live steer price and $335.15/cwt. dressed price in the north.

The north-south price spread remains a factor in the market, although smaller at this time than the record-wide spread in the $10/cwt. range last summer. Nebraska and Iowa prices were reported from $212/cwt. to $215/cwt. live, while Texas and Kansas prices were between $209/cwt. and $210/cwt.

The March price pattern has been exceptionally bullish, with this latest development bringing the month’s fed cattle price increase to just over $14/cwt.

Carcass cutout values have also reflected a very strong price trend through March as healthy demand has been met with lower weekly fed cattle harvest head counts to culminate in higher values. Even so, increasing cattle costs for the packer have outpaced boxed beef price increases. As such, packer margins remain well below breakeven in spot market calculations.

Price increases across several cuts were noted last week, but most notable is demand and higher values focused on middle meats. Ribeyes and strip loins were the highlight attractions in last week’s CAB pricing report with the week-over-week price change spiking nearly straight upward for each. Wholesale ribeye rolls were up $0.80/lb., or 7% on the week prior, while 0x1 strip loins were up $0.85/lb., or 8% on the week. Top sirloins were up next with a $0.20/lb. single-week increase to bring that wholesale price change to 4% for the week.

Carcass Quality Spreads Pop

In the last edition of the Insider we focused on the total carcass value contribution between the four major beef carcass primals. A summary of that discussion revealed the chuck and round primals contributed a slightly larger share of total carcass value in the past two years. This is due to increasing demand for cuts from end meats that could be easily substituted as lean grinding material in the face of limited cull cow harvest.

An adjustment of focus this week swings attention back to the pricing power that middle meats exert in the beef market. In particular, high quality steak and roast items such as ribeyes, strip loins, tenderloins and sirloins carry an outsized share of the load when it comes to generating pricing separation up and down the carcass quality spectrum.

Beginning in January, typical seasonal trends pressured quality price spreads rapidly lower as beef demand shifted away from middle meats. The premium between USDA Choice and Select dropped from December’s record $38/cwt. to the season’s low $12.20/cwt. in early March. A similar, less pronounced narrowing between CAB and Choice cutout values narrowed that gap to $16/cwt. for the period.

The latest market highlights show middle meats surging to higher prices as spring demand sets in early and smaller recent harvest totals create urgency for buyers. As carcass cutout prices have shifted swiftly upward, the spread between CAB, Choice and Select have widened. Last weeks’ Urner Barry report pegged the CAB-Choice spread at $20/cwt. and Choice-Select spread at $16/cwt. Today’s daily USDA weighted report indicates the Choice-Select spread has widened to $20/cwt.

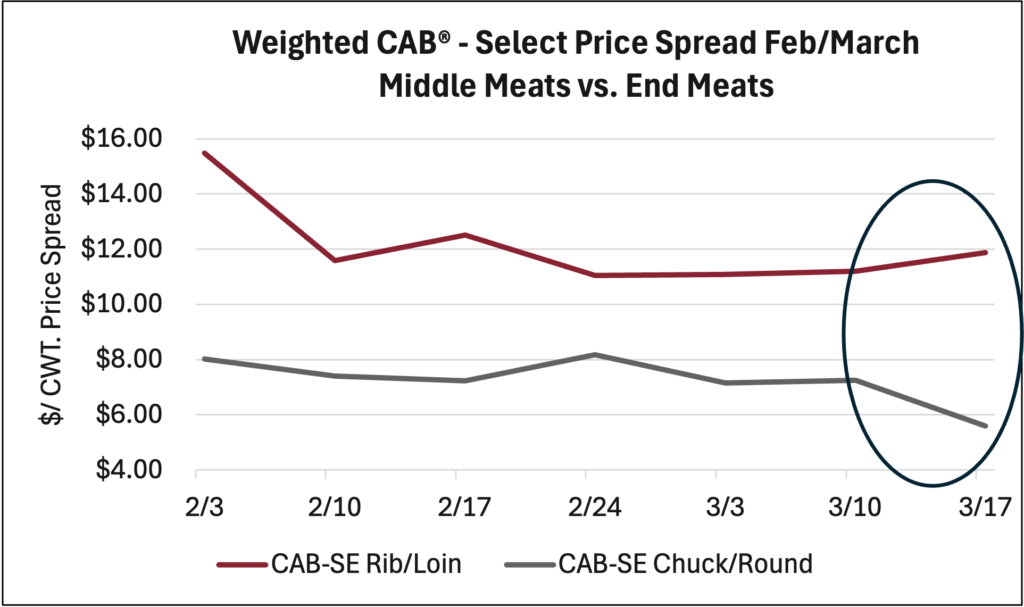

The pattern depicted in the chart’s timeline, beginning in February, shows the trends for the combined rib and loin primals compared to the combined chuck and round primals. The price spreads for the cutout values are weighted for the share of total carcass value contributed by each. Note the divergence in price spread direction between CAB and USDA Select. The rib and loin primals are shown with widening price spreads for quality recently while the chuck and round spreads are narrowing.

Summarizing total carcass value, the CAB-Select carcass price spread in the first quarter was narrowest in mid-February at $29.65/cwt. and has quickly widened to $36.54/cwt. It’s yet to be seen if spring demand, and the price spreads that come with it, are here to stay through the spring season. Price spreads narrowed last year from late March into early April, but remained rather strong in the two previous years.

Carcass quality, including CAB carcass certification rates and combined Choice and Prime quality grades, are running at peak historic levels. The latest CAB acceptance rates touched 43% of Angus-type carcasses and have since pulled back to a still-stellar 41%. Demand ahead of spring holidays, plus the pace of packer harvest schedules, will be the key factors in the equation.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.