MARKET UPDATE

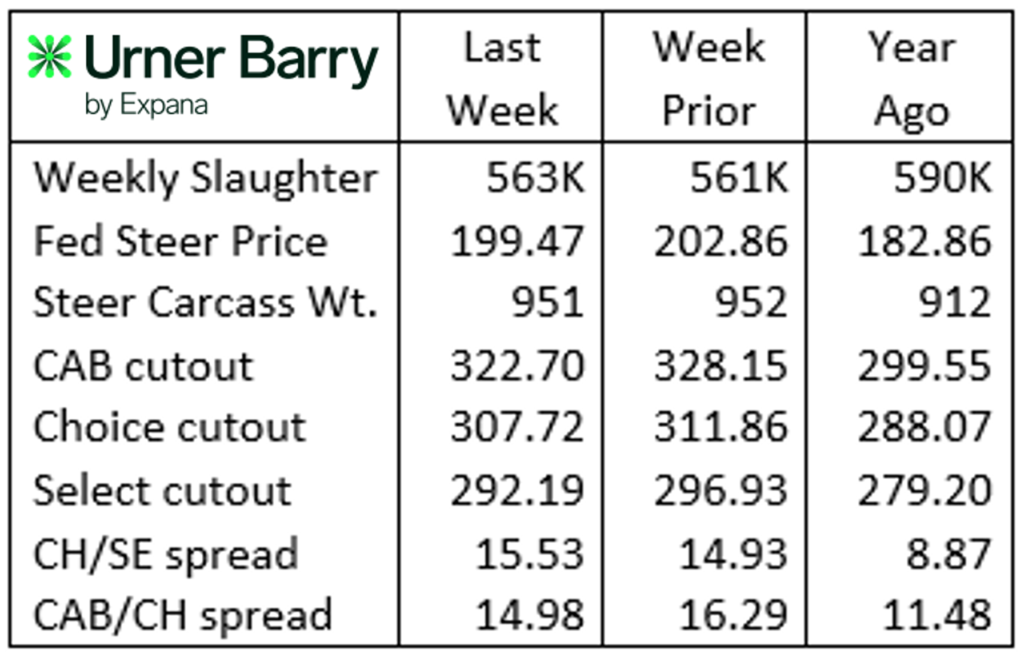

Total beef cattle harvest last week was slightly larger than the prior week at 563,000 head, an increase of 2,000 head. Cull cow processing was the laggard with winter weather impacting movement of cattle, resulting in cow harvest pulling back 8.9% from the week before.

Spot-market prices for fed steers and heifers remained under pressure last week with Live Cattle futures contracts on the Chicago Mercantile Exchange continuing to lead the cash market lower. Further pressure on cattle prices traces to lower boxed beef values that persist despite the smaller harvest volume and tighter supplies. Firming prices in Live Cattle futures early this week brought an end to the multi-day downward correction from recent record highs. The April contract remains a $3.63/cwt. discount to the February contract, signaling weaker fed cattle market expectations by traders near term.

The February 1 Cattle on Feed report, issued last Friday, contained no surprises relative to analysts’ earlier forecasts. The number of cattle in feedyards with 1,000 head or larger capacity was 11.7 million, 99% of a year ago, on February 1. The head count placed in feedyards through January was 102% of the number placed in January 2024, a blizzard-stricken month in cattle feeding regions that resulted in a record-low placement number for that period last year.

Combined Choice and Prime quality grade rates are even with a year ago with a slightly higher USDA Prime grade recently at 10.8% of fed cattle and USDA Choice slightly lower at 72.9% of total. The Certified Angus Beef ® brand acceptance rate has ranged slightly above and below a year ago in recent weeks, averaging near 38% of carcasses from Angus-influenced cattle meeting all 10 of the brand’s quality specifications.

CAB Drives Brand Relevance with Specification Update

Evolution of cattle type, management technology and production economics continue to shape the beef business. As a pioneer in the branded beef space, the Certified Angus Beef ® brand has remained relevant throughout the supply chain via continued innovation.

Effective the first week of March, the brand will modify its ribeye area (REA) specification from the current 10 to 16 square inch acceptable range to include carcasses wth ribeyes measuring up to 17 square inches.

Innovating to drive industry relevance has been a focus of Certified Angus Beef since it’s inception. For instance, in 2007 the brand transitioned from the “yield grade of 3.9 or leaner” standard to specifications for each of the yield grade component traits, including carcass weight, REA and backfat thickness.

Adapting to increasing fed cattle finished weights generated incremental shifts in the brand’s upper hot carcass weight (HCW) limit in 2014 and 2022. While heavier carcasses have inevitably resulted in larger beef cut sizes, we have been purposefully slower in modifying the REA specification until now.

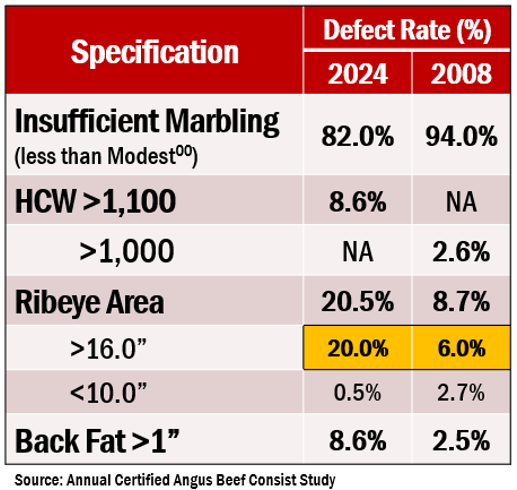

In the past three years, our packing partners have shared data with us on six million carcasses, allowing us to evaluate marbling, fat thickness, REA and HCW—tracking seasonal effects and overall industry trends. The data reveals that, since shifting our maximum HCW 50 lb., up to 1,100 lb. in 2022, the proportion of carcasses excluded from CAB certification due to excessive REA size has increased by 30%. This means that in 2024, ribeye size has been the reason carcasses don’t qualify in 20% of the cases where Angus-eligible carcasses fail to meet brand standards.

Increasing the REA target by an inch represents a subtle shift in the distribution of ribeye sizes across all CAB carcasses. Data on more than two million carcasses in 2024 shows that just 7.4% of the brand’s certified carcasses would have fallen within the range of 16.1 to 17.0 square inches. As well, the shift will have little impact on middle meat steak thickness. The difference from a 12 oz. center-cut strip steak will vary less than one tenth of an inch between carcasses measuring a 16.1 inch ribeye versus a 17.0 inch ribeye. (Schiefelbein et. al., Colorado State University 2024)

It’s this research and examination that have culminated into the decision to further evolve the brand’s standards with this adjustment. As total fed cattle supplies trend lower in the short term, this move will positively impact everyone in the brand’s supply chain, alleviating some downstream supply pressure.

From a cattlemen’s view, the shift embraces current, and most likely future, production trends. It is not a directive toward larger cattle, rather a logical shift to sharpen the brand’s relevance in response to the evolving cattle population.

Increasingly important carcass-based cattle values will reward a few more of the highest quality carcasses previously constrained by ribeye size, especially those near the upper end of the allowable weight limit. It’s also important that producers realize that insufficient marbling is easily the primary reason that Angus-type carcasses are unsuccessful in meeting CAB specifications, with 82% of failures owing to that reason alone in 2024.

Read More CAB Insider

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.

It’s Beef Month

Wholesale and retail beef buyers have been preparing for weeks ahead of the spike in consumer beef buying associated with warmer weather and holiday grilling demand.