Bigger, better beef herds

by Hannah Johlman

A bigger beef cattle herd. A younger cow herd. In the face of declining cattle prices, these two facts can bring hope.

Had it not been for the drought early in this decade, Oklahoma State University ag economist Darrell Peel says the expansion would have come sooner.

“We continued to place heifers on feed” – no grass for them to join the herds – “but because of the drought, we were forced to liquidate cows off of the old end of the herd.,” he explains. When expansion finally began in 2015, it was with a large influx of heifers. “As a result, we made the herd very young.”

That gives way to higher quality because of genetic progress.

“The 2015 cow culling rate was very low for as far back as I have data; 2016 is still below average,” says Peel, who suggests 2017 will continue below average. “Eventually as you add more cows, you get back to normal culling for physical reasons, but I would imagine we are still a year away from that at this point.”

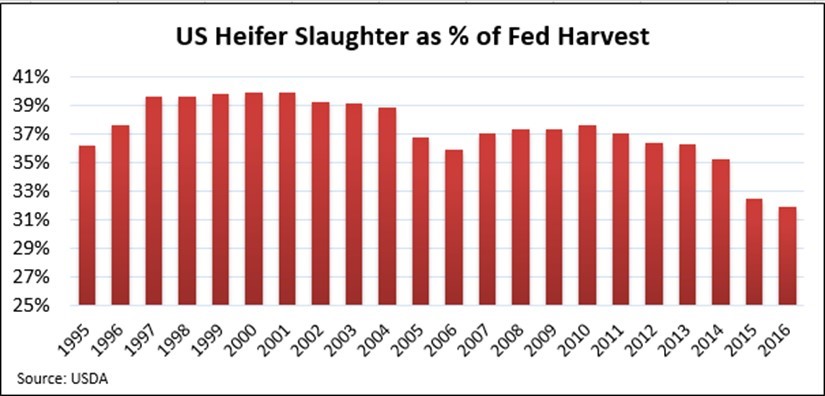

The share of heifers in the USDA reported fed-cattle harvest is a good indicator of expansion trends, says Paul Dykstra, beef cattle specialist for the Certified Angus Beef brand.

“As we retain heifers to expand or replace the cows culled from drought, those heifers never show up in the fed cattle harvest tabulated weekly at USDA-inspected plants,” Dykstra says. Historic data shows the share of heifers in that mix has been more than 36% for 20 years, except for a slight dip in 2006.

“There’s been a dramatic build-up in the past two years as heifers in the fed-cattle mix dipped to 32.5% in 2015 and 31.9% in 2016,” Dykstra notes (see charts).

The most rapid years of expansion are behind us, he says, but Angus producers have made gains.

“Genetics have been upgraded more rapidly with the higher rate of replacements from the drought,” Dykstra says. “And some of those herds destocked in the south are restocking with primarily Angus genetics.”

Simply based on supply and demand, a larger supply of beef means a softening cattle market. But for Angus producers, the steadily higher demand for quality beef despite its increasing supply indicates a strong future.

“More cattle have been accepted into the CAB brand based on meeting the marbling parameter of our 10 specifications,” Dykstra says. “So as a result, we are looking at increased sales volumes.”

The cattle cycle will move ahead as expansion eventually levels off.

“Prices drive decisions to expand or cut back,” he says. “If we are surprised with better-than-expected prices on these increased supplies, that could continue the heifer retention we’ve been seeing at the cow-calf level.”

Dykstra says a heifer percentage of the fed-cattle harvest mix shifting to higher than 35% indicates cow herd expansion is slowing or reaching equilibrium. Read more of Dykstra’s biweekly comments in the CAB Insider at http://www.cabpartners.com/news/cabinsider/

You may also like

Drought Impact and Cattle Industry Dynamics

As drought conditions persist across much of cattle country, farmers and ranchers are at a pivotal juncture in the cattle industry’s landscape. What impact does this prolonged dry spell have on the nation’s herd numbers? When will heifer retention begin? How will industry dynamics influence the spring bull sale season?

Feeding Quality Forum Shares Market Outlook, Path to Meeting Demand

The beef demand success story of the past is also the industry’s roadmap for the future, said speakers at this year’s Feeding Quality Forum. The program covered everything from current market conditions and technology to price forecasts and advancements on the horizon.

Certified Angus Beef Recognizes Beef Quality Research

First-place honors go to Andres Mendizabal, an international student pursuing a Ph.D. in animal science at Texas Tech University. His research is titled, “The Accuracy of USDA Yield Grade and Beef Carcass Components as Predictors of Red Meat Yield.”