MARKET UPDATE

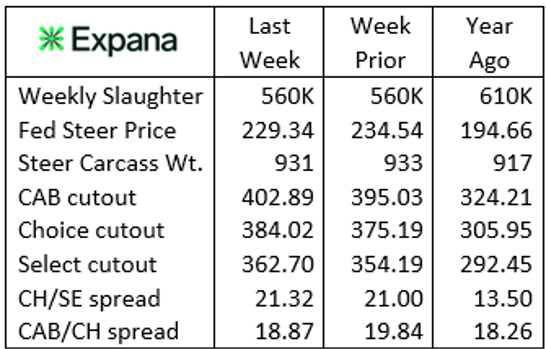

The past two weeks have each featured a federally inspected cattle harvest total of 560,000 head, a 52,000 head per week step back from the same period a year ago.

Focusing on just fed steers and heifers, the weekly average for the two-week period was 462,000 head harvested, 36,500 head fewer than a year ago. The upcoming Independence Day holiday will darken packing plants on Friday, creating yet another weekly pullback in processing volume. This Monday’s harvest was quite large as packers boosted daily totals to make up for the holiday, while Saturday’s harvest volume will provide an opportunity to further cover missed volume.

The past two weeks brought on a significant decline in fed cattle values, unwinding the steep escalation that had taken average fed steer values to $238/cwt. The rapid slippage pulled the market down $9/cwt. for the period with last week’s average value at $229.34/cwt.

The passing of the early summer seasonal high in fed cattle values came two weeks earlier than last year but was aligned with that of 2023.

Carcass cutout values continued to sail higher last week with the Certified Angus Beef ® cutout surpassing the $400/cwt. waypoint to average $402.89/cwt. Commodity USDA Choice carcasses were similarly inflated with a weekly gain of $8.83/cwt. while USDA Select was up $8.51/cwt.

After months of deeply red margins, the magnitude of change—in opposing directions—of fed cattle and boxed beef market prices has landed packers back in a profitable position. Estimates vary, but one source indicated black ink slightly above $100/cwt., based on spot cash market values.

Progress, Not Complacency

Any endeavor with measurable goals provides opportunity for reflection on progress and satisfaction for achievement. Cattlemen and women have many achievements to be proud of, with significant improvements in food safety, animal welfare, production efficiency and consumer satisfaction. There are several metrics within each of these areas, and others not mentioned, that have seen rapid enhancement in the last few decades.

It’s all too evident that progress potentially leads to complacency. For the beef sector to remain relevant and continue to increase sustainability we must not stop to congratulate ourselves for long. We should often recognize tremendous progress, but then reassess and adjust goals to align with the evolving future.

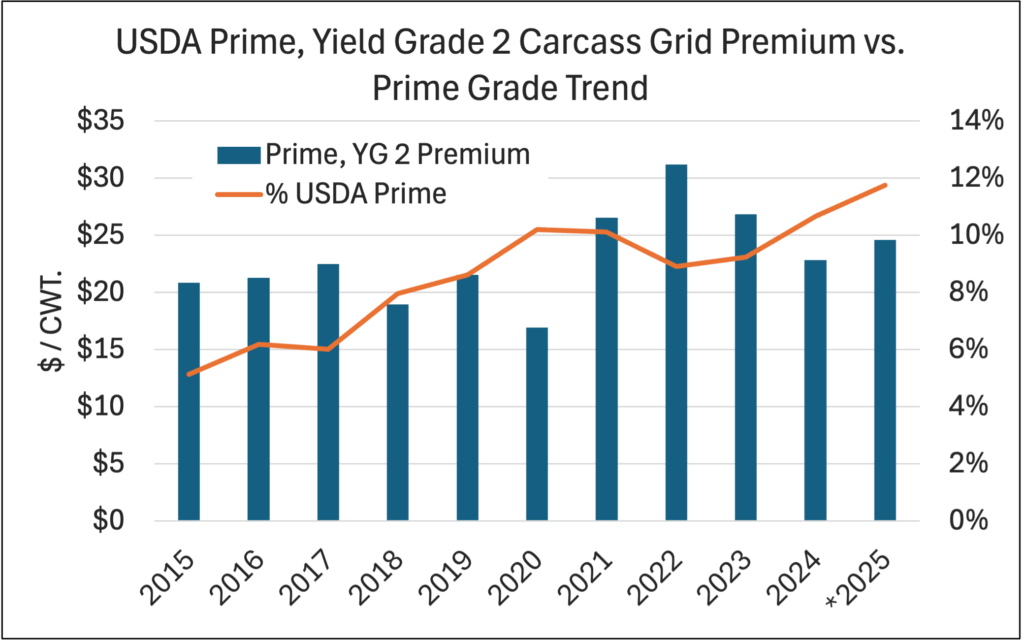

Applying this specifically to the quality and eating satisfaction of our beef products provides a prime example. In the history of modern carcass grading, the USDA quality grade and premium branded beef mix has never been richer in quality. We’ve taken a few opportunities to highlight all-time highs in U.S. average carcass quality in the first six months of this year. If not for record marbling in fed steer and heifer carcasses, our downstream customers would have faced unfulfilled demand for premium quality beef cuts.

Current market values for corn, fed cattle and boxed beef have collaborated to incentivize even greater marbling achievement than genetic advancement alone would have realized under different economic circumstances. The latest national USDA Prime grade percentages have topped 12% and for the past 12 weeks, CAB certification rates have been above 39%. Both are astoundingly good measures.

As far as quality grade is concerned, these measures have led some in the industry to suggest that we’ve arrived at the destination. Perhaps, it could even reaffirm an ideology that carcass quality is just “fed on” rather than “bred on.” While indeed exceptional, there may be a bit of a misleading narrative resulting from recent trends.

The record-wide gap between cost of gain versus fed cattle price is a significant factor in elongating feedyard stays for cattle. The unintended, negative consequences of these conditions are record-large proprotions of yield grade 4 and 5 carcasses. In the likely event that future feed costs or carcass cutout values shift, shrinking incremental cost of gain at heavier weights, potential exists that feeding days shorten and average total carcass fat content declines. This adjustment can’t be predicted, but given that markets are ever-changing, we should guide decisions on the probability that carcass quality will not always be artificially propped up on extremes.

This is where the free will of cattlemen to breed and raise cattle as preferred will continue to present value differentiation. The fact that some choose to apply some (or a lot) of focus on genetics for carcass traits, while others do not, will persist as a significant margin opportunity.

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.” Packers continue to share a decent portion of their cutout premiums upstream to the cattle feeder, despite a growing proportion of higher-quality carcasses. Once the health and feed conversion components are accounted for, what else shall a cattlemen do to add value to their product? Nichè markets and verified production claims are viable margin drivers. But the differences in carcass value between the poorest and the best carcass outcomes are so tremendous, that even a half-hearted try toward excellence provides one of the largest payoff opportunities in the business.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.