MARKET UPDATE

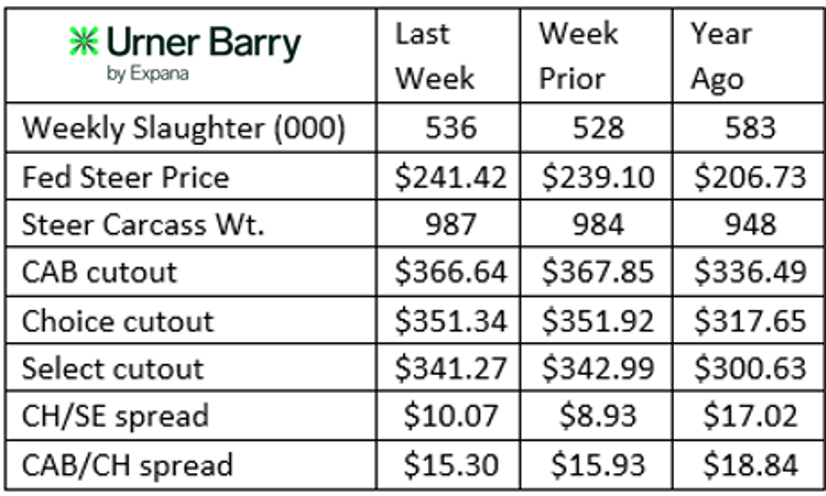

The fed cattle market has been steadily stronger since the first of the year, gaining $10/cwt. from the opening week’s $231/cwt. value through last week’s $241/cwt. average. This closely matches the early 2025 trend but has extended the pattern a week longer than that of a year ago with last week’s continuation higher.

The drastically smaller year-on-year cattle harvest is a significant factor differentiating 2025 and 2026. Since the beginning of the year, fed cattle harvest head counts have run roughly 10% smaller than a year ago. Tightened cattle supply and packer losses deeply in the red both continue to ration the harvest pace. Logic suggests no changes to throughput as long as both cattle and cutout prices work antagonistically against packer profitability.

A counterbalance to lighter harvest runs continues to rear its head in the form of heavy carcass weights. Latest data for the week of January 19 featured a 3 lb. uptick in steer weights to average 987 lb. each, just 2 lb. below the record marked in December. January weights will average near 30 lb. heavier than a year ago.

Weekly average cutout prices turned modestly lower in early February after the Comprehensive cutout value increased 3.6% since the beginning of January. As demand turned to the ends of the carcass, significant discounting on middle meats was a theme last month. History suggests that the most preferred steak items have already posted seasonal low prices, with unseasonably warm weather in some regions coupled with expected early spring buying stimulating prices.

Utilization Key to Prime Success

Fed steer and heifer carcass quality is charting new territory in the first five weeks of the quarter. Record-heavy carcass weights, the longest feeding periods on record and generations of improved genetics continue to press carcass quality grades to new heights. This has generated an average 14.2% Prime carcasses in the fed cattle mix while Select carcasses average an unprecedented low at 9.7% of the total since January 1. This stands in stark contrast to the 10.7% Prime and 13.6% Select grade mix recorded for the same period a year ago.

As the carcass mix continues to press higher with richer quality grades, the expected impact to cutout prices has also come to fruition. The Prime cutout premium to Choice narrowed to $19/cwt. in January versus $59/cwt. a year ago and $37/cwt. in January 2024. This contrast indicates a wide range and directional change in the premium across three years. However, the number of Prime carcasses in the past five weeks has been 21% greater than a year ago while carcass weights have also been 30 lb. heavier for the period.

Recent Prime demand models show 20% and greater year-over-year consumer demand increases for multiple months for the recent two years. Growing Prime supply has been met with growing demand, generally across the last decade. The recent added upswing in the Prime carcass supply suggests that expanded utilization of Prime-specific sales across the entire carcass is warranted. In the past couple of years packers have added a growing list of cuts to their sales sheets specific to their Prime-graded product. This is evident in Certified Angus Beef ® brand sales as we have seen the most recent year’s sales growth in the CAB® Prime category.

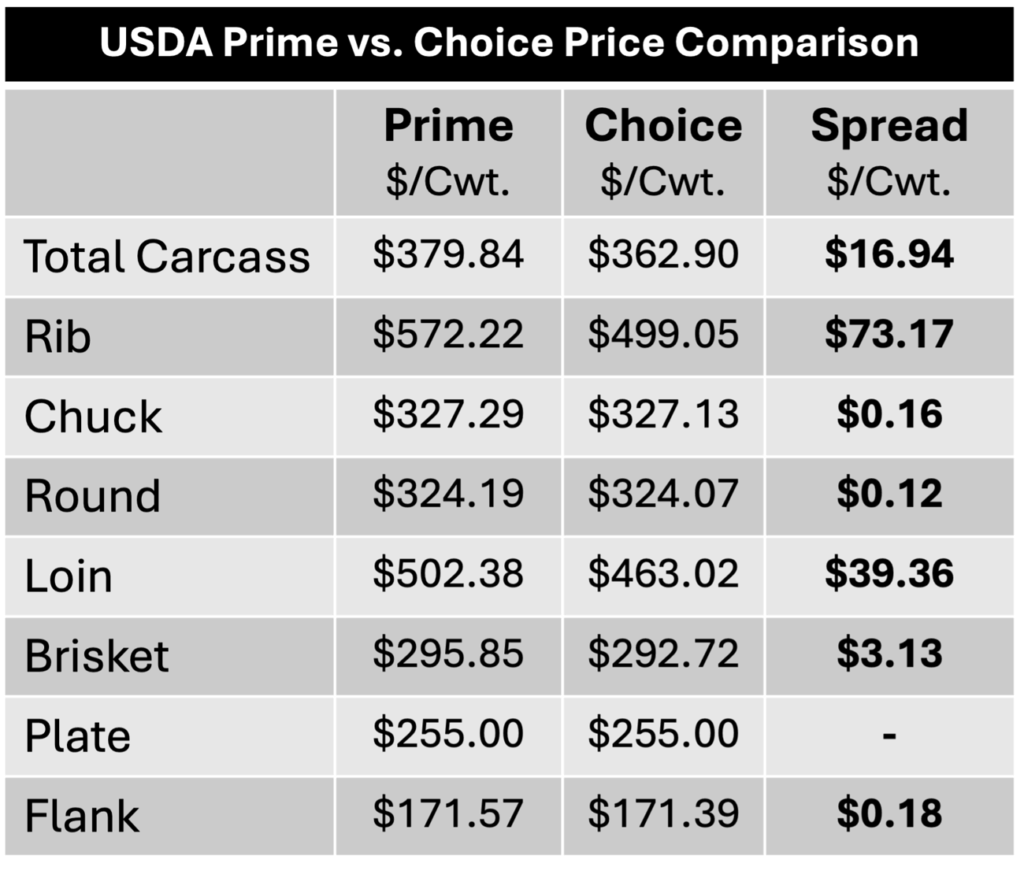

Further opportunity exists to capture consumer demand across the Prime carcass as evidenced by the most recent USDA carcass cutout value report. For the first week in February, USDA lists the Prime cutout premium to Choice at $16.94/cwt. for the entire carcass. Yet, practically all of the premium is found in the rib primal which features a $73.17/cwt. premium, and loin at $39.36/cwt. Briskets have often carried a larger premium than at present, but very adequate supplies have narrowed that premium to $3.13/cwt. While Prime premiums are increasingly being captured on some cuts on both ends of the carcass, chuck and round summary values show relatively small premium contributions, as do the flank and plate.

It’s important to note that more demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand. Emphasis on greater utilization of Prime and CAB ® Prime carcasses is key to recapturing larger Prime cutout premiums that get allocated throughout the supply chain. After all, the economic drivers fueling current carcass weights and extended feedlot stays may shift over time such that carcass quality takes a step back. Even if not, building demand through exceptional quality is the factor that has allowed beef to vastly outpace other protein options in the market.

Read More CAB Insider

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.

Big Shifts in Quality Grades

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages.