MARKET UPDATE

The fed cattle market was sharply higher last week with a $4.29/cwt. upward move. This developed as fundamental supply and demand factors regained traction in the weekly spot trade, shrugging off the downward pressure from the broader economy and equity market bearishness dominating the beef market sentiment for the previous two weeks.

Live Cattle futures prices have traded in a firmly positive direction with increases in seven out of the past eight days, taking the April 2025 contract from $199/cwt to $212/cwt. The strong downward swing that began nearly three weeks ago devalued the April contract by roughly $165/head before surpassing the month’s starting price.

Last week’s harvest volume was 12,000 head larger than the week prior with 70,000 head of fed cattle processed on Good Friday. The most prominent factor in harvest throughput remains in packer margin management. Latest carcass weights show steer carcasses at 30 pounds heavier than a year ago as this factor continues to factor heavily in total weekly production tonnage.

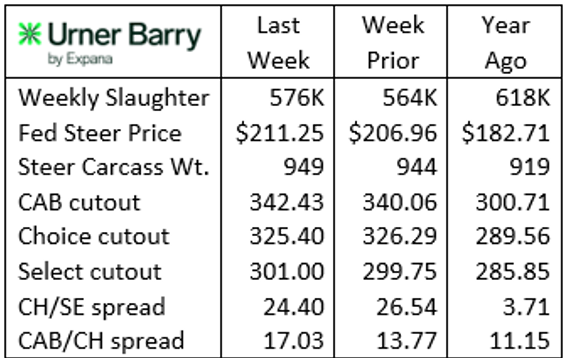

Carcass values were mixed last week with the national comprehensive boxed beef cutout value pulling slightly lower to average $332/cwt. per USDA. The Urner Barry data shows the CAB cutout higher by $2/cwt. even as the USDA Choice value dipped almost $1/cwt. The summary view this spring, however, is that beef demand is very strong with cutout values performing exceptionally well.

As recently noted, demand has turned to focus intently on middle meats with ribeye prices surging early this spring as wholesale CAB ribeyes are priced 40% higher than a year ago. Strip loins advanced to an elevated price earlier in March and remain in a sideways price range 14% higher than a year ago. Sirloins are the featured item this season as meat buyers have shifted to offer customers a relatively cheaper price point. The sirloin’s popularity has sent wholesale values skyward beginning in early March rather than the normal late-April demand push.

End meat prices are trending seasonally lower with several items at levels higher than a year ago and another handful at, or below, 2024 spring values.

USDA Prime Eclipses Select

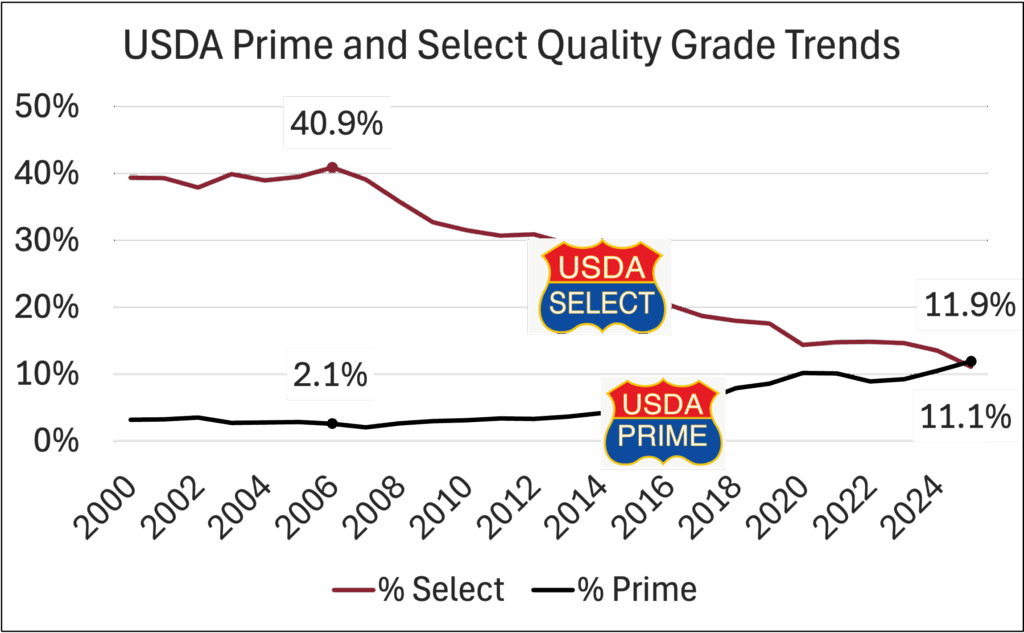

n 2006, the low point in modern beef quality grade performance, the fed cattle carcass distribution, consisted of 41% USDA Select and 2% USDA Prime carcasses. Concerning fed steers and heifers, those were the two practical ends of the quality grade spectrum. That trend had, more or less, been the unwavering standard for many previous years. Since then, a stepwise transformation has brought the industry to a new frontier where USDA Choice is the common denominator, Select carcasses are scarce, and Premium Choice branded (CAB®) and Prime are the progressive targets.

In a twist unthinkable just two decades ago, USDA data reveals that the current percentage of Prime carcasses has averaged 11.9%, surpassing Select carcasses that are averaging 11.1%, in each of the last five weeks. The fractional difference between the two numbers is certainly not the point. Since the turn of the 21st century, just 25 short years, the broad view of the beef product offering is one of monumental change in product quality, specific to marbling and consumer satisfaction.

Thus far in 2025, several factors have contributed to historically strong carcass quality grades, a continuation of a trend years in the making. This includes cheap ration costs, innovations in growth technology and high replacement feeder cattle values, each favoring longer average days on feed and heavier out-weights. However, the bedrock of industry-wide marbling improvement is the long-term selection for improved marbling EPDs by the seedstock sector, in response to commercial market demand. As well, the commercial cow/calf segment has chosen Angus bulls in larger proportions in modern years. A recent CattleFax study found that 82% of operators indicate Angus bulls are a component of their bull batteries.

Carcass-oriented Angus genetics are also important in the beef x dairy production model that’s particularly prominent in Texas feedyards. This is obvious in the Texas qualtiy grade trend featuring a recent spike in the Prime carcass share in Texas packing plants. An aggressive upward Prime trend developed in early February, taking the state’s Prime share up to a recent 7.8% of production versus 5.6% a year ago. While northern states pull the average up with 15% Prime in Nebraska, for instance, the stronger trend in the south is still a significant contributor.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.