MARKET UPDATE

The pace of cattle harvest slowed even more last week with 549,000 head total, down 14,000 head from the week prior. A mechanical issue at one major plant last Monday pulled the head count lower that day, yet abundant harvest capacity did not pick up the slack by Friday, which has been the truncated harvest day in most recent weeks.

After an early July pullback to the $224/cwt. average, fed cattle prices uncharacteristically ratcheted higher for three weeks, culminating in last week’s $238.80/cwt. steer average.

At the beginning of July the nearby August Live Cattle contract started at $212/cwt., apparently favoring seasonal expectations leading to a major cash market break developing through the month. Since quite the opposite has occurred in the cash market, the August contract has had to hustle to catch up to the reality of the fundamentals. Thus, the August contract as of Tuesday this week traded at $229/cwt., still below the market average but in-line with the southern cash trading range of $230/cwt. last week.

Packer leverage has been impossible to find as spot negotiated trade remains unfazed in the wake of handfuls of cutout price cuts throughout the past three weeks. The National Comprehensive Cutout has dropped $0.19/lb. (5%) since the beginning of July while spot fed cattle values increased 6.6%.

Cutout values are expected to continue on a slightly lower trend for a few weeks as the market finalizes a reset coming off of the sharp summer highs. Ground beef demand has been a bit softer lately as buyers watch round primal prices weaken. Rib values were stronger last week but short loin, strip loin and sirloins continued sharply lower retreats from record early July price points.

Trends Entrenched

Last Friday’s USDA Cattle Inventory and Cattle on Feed reports made for a big day in updating cattle supply forecasts for the near future. June 2025 feedlot placements were 8% lower than June 2024, greatly missing the average analyst expecations that predicted just a 2.5% reduction. The production sector is more attuned to the impact of the stoppage of Mexican feeder cattle imports and a domestic feeder and calf supply down -0.4% (CattleFax estimate) from Friday’s report.

Downstream beef buyers (distributors and grocers) must adjust their price expectations to remain on trend at recent levels with an upward bias. Since early July the national Comprehensive Cutout price has declined 5% from $388.64/cwt. to $369.20/cwt. (17% above a year ago). This classic July downturn shouldn’t be mistaken for weakening demand or a shift to a lower trading range for beef. Instead, this normal seasonal dip should be followed by an increase ahead of Labor Day, followed not long after by fourth quarter holiday demand surge. These are historic patterns, subject to unforseen developments impacting the market.

Certified Angus Beef ® brand supply trends will continue to see the push and pull of cattle management responding to tight cattle supplies. Estimates for this year’s corn crop suggest an exceptionally large yield, continuing downward price pressure. This, coupled with freshly printed record replacement feeder cattle prices, will work to entrench the modern feedyard motivation to push days on feed to new heights with carcass weights following along to new records. The latest average fed cattle carcass weights are 23 lb. heavier than a year ago and 46 lb. heavier than two years ago. Feedyard and packer margins are assisted through the increased weight per head. In this scenario, excessive external carcass fat is problematic on many pens of cattle but economics have lately been overriding this downfall.

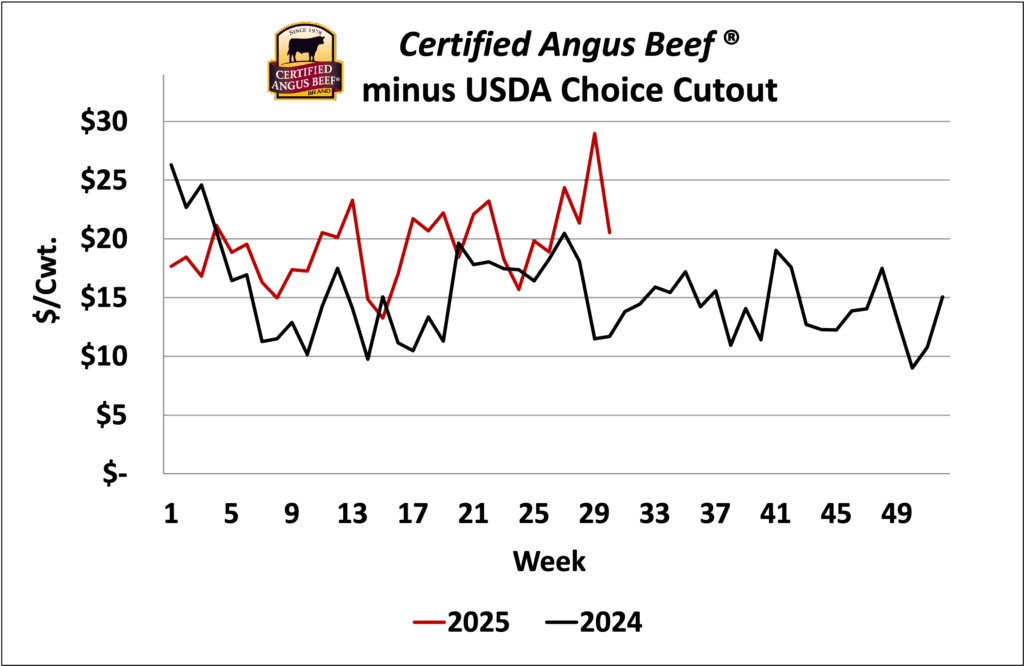

With even tighter cattle supplies ahead in 2026, consumer beef demand remains key to pulling the beef supply chain through the narrowest of the cycle supply lows. So far, higher prices have not diminished traditional CAB cutout premiums. The magnitude of inquiries for the most premium, Certified Angus Beef ® brand Prime product from retail end users has been impressive lately, at even more impressive price levels. Yet with expected further tightening of fed cattle harvest throughput into next year, the proportion of quality carcasses meeting brand standards is keenly important. We cannot grow the pie without the ingredients, and the customer needs every carcass the supply chain can create.

A parting supply chain bright spot from the Cattle Inventory report shows a slight increase in the beef cow herd this year (CattleFax estimates +0.9%) and a relativley even, yet slightly smaller beef replacement heifer number compared to a year ago. With cow/calf economics looking bright near term, the capital investment in replacements (i.e. opportunity cost in retention) is ever-growing. Ranchers have to compete with feeder cattle prices whether buying replacements or opting to retain them. This means that decisions on expansion are very much individualized from producer to producer and likely won’t result in an ”all-in” turnaround in heifer retention.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.