MARKET UPDATE

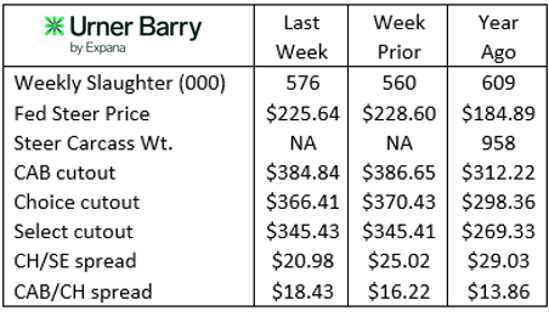

The fed cattle market continued the downtrend last week as pressure from Live Cattle futures and lower boxed beef values weighed on the total beef complex. The larger volume of cash cattle traded in the north with Nebraska and Iowa prices averaging $224/cwt. for the week. Much smaller negotiated head counts in the south were led by Kansas feedyards receiving an average of $230/cwt. with Texas right behind at $228/cwt.

Total harvest volume increased on the week by 16,000 head to reach 576,000 head total. Just 10,000 head of the increase came from fed steers and heifers, putting that weekly total at 459,000 head.

Carcass weight data remains unavailable despite the government reopening but estimates are that average steer/heifer weights should now be near or above 950 lb. Excellent feedlot pen conditions and moderate October-November temperatures have likely added to the year-over-year weight increases which have averaged +24 pounds over last year.

Carcass cutout values have been weaker in November, a pattern which is not atypical for the month. The comprehensive cutout has averaged a 3% decline from the beginning to the end of November in the past three years. With the Thanksgiving holiday coming up next week it’s unlikely that spot market beef business will be sharp enough to support upward wholesale beef prices this week or next.

Tracking Premiums to the Source

Merchandising carcasses is not an easy task. If you ask any ranch-to-table producer what their largest pain points are, you are likely to hear that finding a customer for all of the end meats can be a challenge. That producer likely has excess ground beef supplies just waiting for a customer with a similarly large need. The middle meats are typically easier to move and undersupplied in comparison.

This issue has plagued startup branded beef programs for a few decades. A solid cattle supply plan coupled with a promising marketing niche has been undercut time and time again by the inability to sell the end meats at the necessary premium to make the business model profitable.

Certified Angus Beef (CAB) faced the same challenges in the formative years, as the first branded beef label set out to garner specification-based premiums in a market where none existed. Now in its 47th year, the brand has successfully carved out premiums over commodity USDA Choice from end to end of the carcass.

On a dollars per primal basis, the loin is untouchable when it comes to the CAB markup with a heavy-hitting combination. Constituting 21.3% of total carcass weight, the loin’s key premium-grabbing cuts, such as the tenderloin, strip loin and top butt, push the loin primal to the top of the carcass without fail. In the brand’s 2025 fiscal year, the loin premium added $51.06 per head to CAB carcasses over Choice.

Many are surprised to learn that the chuck primal is the second largest premium contributor to the CAB carcass, calculating a $38.84 per head premium. The chuck edges out the rib’s total return simply because of its distinct weight advantage at 2.6 times that of the rib. Interestingly, the chuck’s average CAB premium per pound over Choice has advanced such that the chuck moved up to second in the premium hierarchy as recently as 2023. The CAB rib, unsurprisingly, captures just over double the premium per pound when compared to the chuck. The rib added $30.39 per head over Choice in the fiscal 2025 data, contributing just 11.4% of total carcass weight but 18% of the total premium contribution to the carcass.

The round is the last of the four major carcass primals when it comes to the brand’s premium contribution. At 22.3% of carcass weight, the round has traditionally offered less premium opportunity, as these cuts are often less tender than others, often utilized for roasts and ground beef. These factors tend to limit the CAB round premium, landing at $17.68 per head value-add for the year.

Total CAB premiums per head quickly diminish as weight rapidly declines across the brisket, plate and flank. Premiums per pound are quite attractive for briskets and plates, nearing $0.13/lb. for the year. Yet those two combined are just 12% of total carcass weight, limiting their impact as compared to the much heavier primals that carry even larger premiums per pound.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.