Slow Slaughter Impacts

MARKET UPDATE

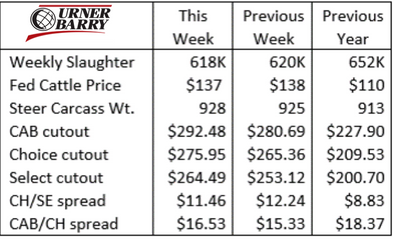

Following a generally positive performance in late December, the fed cattle market has kicked off January with challenges. The Omicron variant is pressuring packing plant efficiency through increased worker absence, resulting in much smaller slaughter totals so far this month.

Potentially surprising to some, the six-state weekly average steer price was $1 to $2/cwt. lower last week to average $136.61/cwt. Given the drastically reduced slaughter totals, intuition suggests that the market could have been even lower. That’s not a recommendation for lower values, but a logical train of thought.

On the other hand, carcass cutout values have moved in the opposite direction, firmly higher since the first of the year. This is a logical outcome of the smaller slaughter numbers, given that restricted boxed beef supplies are certainly prone to move prices higher.

The divergent price relationship between fed cattle price and boxed beef price has driven larger profit margins for packers so far this month. Increasing cutout values have likely played a role in the fed cattle price resiliency, not slipping lower than it did last week. Stronger cutout values continue into this week and a firm fed cattle price may result with some cattle sold at $137/cwt. again early this week.

In the most recent six weeks, carcass quality grades have just held within range of a year ago. A surge in the Choice share was in line with the late Dec. spike observed in the past three years. Even so, Prime carcasses were down a half percentage point in the six-week data, averaging 9.7% of the fed cattle mix, versus 10.2% a year ago.

The Choice category averaged 72.8% for the period, up fractionally over a year ago, but essentially unchanged. Upper 2/3’s Choice carcasses, required for the Certified Angus Beef ® brand, were less plentiful within the total of the Choice grade. The data proves this to be the case, as USDA reports the number of carcasses certified into all premium Choice brands was 28.8% in the past six weeks compared, to 29.8% for that period last year.

Slow Slaughter Impacts

We know that beef demand is very good, and continues to be so, as we roll out of the typically sharper demand of December and into the historically sideways demand in January. Beef demand has seen an increasing trend since the economic woes of 2008 to 2010. CattleFax projects a step back from the 2021 index point of 139 to touch the 2020 mark of 134. We start this year with higher year-over-year wholesale and retail prices.

Currently, smaller packing sector throughput challenges the demand index to start the year on smaller production volume. The table shows the fed steer/heifer slaughter pace to be off a combined 5.8% below a year ago.

Cattle supply is certainly not the issue, rather, it’s a COVID-induced absenteeism issue in many of the country’s packing plants. It’s impossible to project the timeline in which a more efficient slaughter pace will be restored, yet it can’t come soon enough.

The velocity at which boxed beef cutout values are increasing is troubling as we look at demand. The Choice cutout is up 6.9% since it marked the $261/cwt. seasonal dip in late Dec. That compares to a 4.8% increase for the same period a year ago, but the Choice cutout is 29% higher than a year ago as well. It’s another unintended consequence, but one that remains a headwind.

A few production considerations come to mind with the factors outlined above. Carcass weights in the latest data are on the rise again, after pulling slightly lower in late December. Should the pace of slaughter continue to disappoint, we will see seasonally higher carcass weights in a period where lighter weights are the seasonal trend. Even if the trend turns lower with fresh data, weights are 15 lb. heavier than a year ago.

Fed cattle performance has been exceptional this winter and average-daily-gain figures are above average. This condition, coupled with potentially added days on feed resulting from slower processing throughput, may push carcass marbling scores higher, on average. This could be a shot in the arm for supplies of high-grading CAB and Prime carcasses. This potential outcome is a silver lining in a supply-starved market, where product availability is key to continued brand commitment from the important retail sector.

As well, smaller total fed cattle carcass supplies equate to fewer CAB carcasses on a weekly basis, regardless of what proportion of carcasses qualify for the brand. This suggests that end-users will have to pay a premium for higher quality which, in turn, pushes cutout price spreads wider. A net result to cattle feeders is that packers will seek out the pens of brand-eligible cattle with a higher propensity to grade and quality for CAB.

Moving into spring the potential for carcasses surpassing 1,050 lb. as well as higher percentages of yield grade 4 and 5 carcasses tends to seasonally decline. Yet, should this slaughter pace continue at a slower speed, these risks remain a bit higher than in other years. Cattle feeders will need to watch these two metrics as they look to merchandise their higher quality cattle on a carcass value basis, in order that discounts don’t overcome premiums. Yield grade 4s and 5s have continued to creep higher on an annual basis, yet current conditions may pose additional risk in the near term.

Feeder Cattle Swing Higher

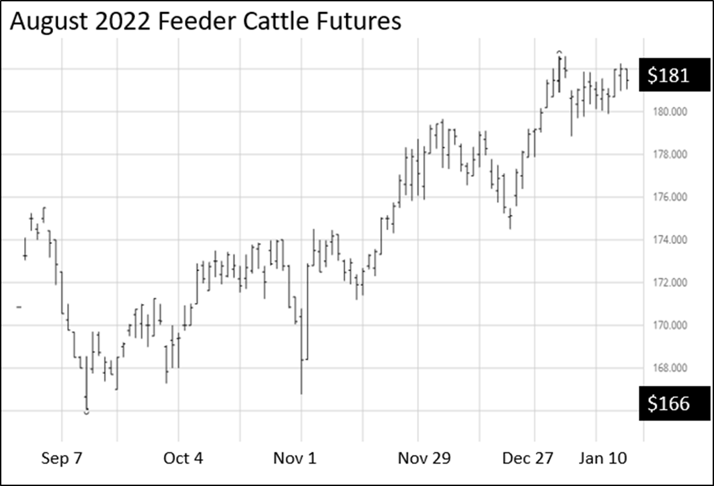

A positive note for cow-calf operators and those backgrounding cattle this winter is the recent trend in feeder cattle prices. Cash feeder cattle sales saw a strong upswing in the fourth quarter, with the 850 lb. steer price up $9.23/cwt. on average. The highest average in December touched $155/cwt., with the previous high of $156/cwt. in the fall of 2017. Since the start of January several video and live auctions have reported values several dollars higher yet. A similar trend exists across other weight classes of feeder cattle.

The outlook all the way out to next fall is even more positive as the calf and feeder cattle head counts are set to be smaller. Feeder cattle futures for the August through November 2022 contracts are trading near their highs in the $181 to $182/cwt. this week.

This optimism has been a long time coming for the ranching sector, as gross values for calves have been on a mostly sideways to slightly lower trend since 2018. The 10-year low came in 2016 after the leverage shift and the deck reshuffled coming off of record highs in 2014-2015.

Risk management has lately captured renewed interest across cattle production sectors, as dramatically higher values in the deferred months of Live Cattle and Feeder Cattle contracts have been posted. Of course, the cash spot market leaves much to be determined in a year that promises to be interesting and unpredictable.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.