MARKET UPDATE

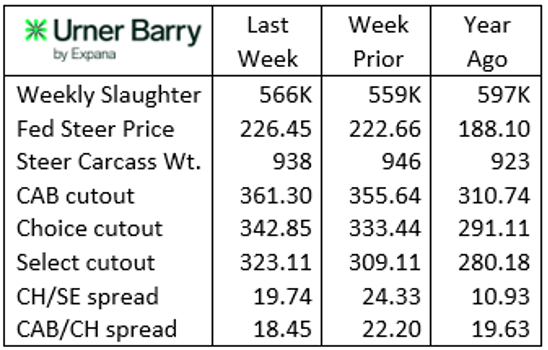

Federally inspected cattle harvest totaled 566,000, an increase of 7,000 head on the prior week but 31,000 head smaller than a year ago. Steer carcass weights pulled back 8 lb. in a week to average 938 lb. Comparatively, that 15 lb. increase over the same week a year ago remains significantly wide, but this is the smallest margin seen in 2025. The year-to-date average steer carcass increase over 2024 is 29 lb.

Cash fed cattle prices continued higher last week with Iowa and Nebraska leading the charge within the 5-Area trading region. Those northern states constitute most of the negotiated trade volume with packer demand pushing prices up to the high of the report at $231/cwt. but averaging $228/cwt. for the week. Thin volume of negotiated trade in Texas and Kansas set those markets at $219 to $220/cwt.

Live cattle futures continue to ignore the strength in spot cash trade with a sharp downside correction last Wednesday, extending into Thursday, pulling $5/cwt. off of the June contract in a hurry. This, despite the preceding weekend’s news that the U.S. border would close again to Mexican cattle imports due to New World Screw Worm concerns. The June contract traded at a $14/cwt. discount to the cash, a basis level about $3/cwt. wider than is historically typical.

Carcass cutout values advanced strongly last week, adding to the already steep upward pattern that’s been almost unshaken since early March. Urner Barry’s weekly average quote for the Certified Angus Beef ® brand carcass was $361.30/cwt., up 12.7% from early March.

Carcass price spreads across the quality spectrum narrowed last week as net wholesale price levels began to consolidate from USDA Select on up. As well, weakening rib primal valuation pressured quality spreads further.

The loin primal is the source of most recent price inflation as end-users continue to seek premium quality steak items for Memorial Day and spring grilling, while pivoting away from the pricier ribeyes in the small volume spot market trade.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher. The last confirmed steer carcass weights indicate a sharp single-week pullback of 8 lb., pulling the year-over-year increase for that week down to just 15 lb. compared to the 29 lb. averege year-to-date.

The more updated formula, grid and forward contract weight information indicates a quick reversal, back to heavier weights. The historic annual trend of the lightest carcass weights being posted in early May has been replaced with a trend pushing the annual lows out into mid-June.

On a more regional basis, the heaviest weights are in the already high-quality carcass state of Nebraska with the latest steer/heifer carcass weights at a 938 lb. average, followed in a distant second by Iowa cattle at 919 lb. each. This has held the Nebraska Prime grade share up to 15% in the latest data, while the national average surged to 13% Prime. This extends the streak to 9 weeks in a row with USDA Prime outpacing USDA Select in the total carcass count.

CAB-certified carcass counts are underpinned by the grade trend and expansion of the allowable ribeye size up to 17 square inches. Neither factor is solely responsible for the noted uptick in the percentage of Angus-type carcasses certified, as both factors have made measurable impacts since the beginning of March.

Setting aside the detailed analysis, the CAB capture rate for Angus-eligible carcasses has been above 40% for the last 9 weeks. That is quite the contrast to acceptance rates 20 years ago, when the annual average CAB acceptance rate bottomed at 14%.

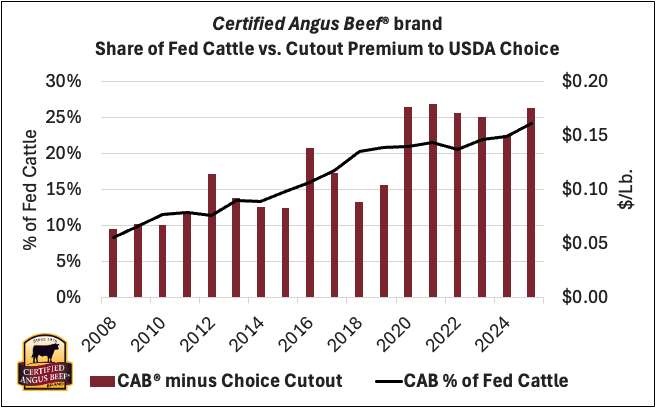

Even though the increasing share of CAB carcasses as a percent of all fed steers and heifers continues forward, premiums remain strong for the brand’s carcasses. Granted, smaller weekly harvest levels have kept net branded carcasses on either side of last year’s weekly supply, but mostly below for most weeks so far this year.

However, the CAB cutout compared to USDA Choice has been wider this year than last. The chart depicts CAB cutout premiums advancing nicely into the modern era with the past 5-plus years posting a premium range averaging near $0.17/lb. These gains have come simultaneously as the brand’s share of the fed steer and heifer supply has grown to 24% in 2025.

USDA reports the CAB grid premium has increased to average $5.21/cwt. in the last two weeks, as pressure from smaller harvest levels pulled certified head counts lower. The top of the CAB grid premium range is posted at $11/cwt., no doubt on a grid structure featuring a minimum threshold CAB percentage.

Read More CAB Insider

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.

Big Shifts in Quality Grades

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages.

Tracking Premiums to the Source

Certified Angus Beef faced the same challenges in the formative years, as the first branded beef label set out to garner specification-based premiums in a market where none existed. Now in its 47th year, the brand has successfully carved out premiums over commodity USDA Choice from end to end of the carcass.