It’s time to pay attention

As the quality spread widens, prepared cattlemen profit

by Laura Nelson

Boxed beef climbed 15% in value to start the year, but with the passing of summer into fall value trends began a dramatic differentiation. “At these prices, buyers wanted better quality,” said Larry Corah, vice president of Certified Angus Beef LLC (CAB).

The spread between USDA Choice beef and lower quality Select, moderate since 2008, shot up $15 per hundredweight in a matter of weeks. It was partly attributed to a major retailer switching to higher quality beef, but others had set the stage.

“Two of the largest retailers in the United States had added a premium-Choice program to their marketing plans in the past couple of years,” Corah noted. They were winning more satisfied customers, and the competition was quietly building demand at the high end.

The latest retail shift signaled a sudden need for more Choice and better beef, he said, but more importantly an excess of the low-Select product formerly in those cases.

“Combine the retail factors with an improving middle-meat market in our upscale, fine dining restaurants and a whole new demand profile for high-quality beef has been created,” Corah explained.

What does it mean at the feedlot and ranch? More money for informed marketers.

“There’s no reason not to sell high-quality cattle on a grid,” said Paul Dykstra, beef cattle specialist for the Certified Angus Beef ® brand, commenting on prices for CAB Prime. “When you’re looking at nearly $250 per head in premiums, that makes a guy pay attention.”

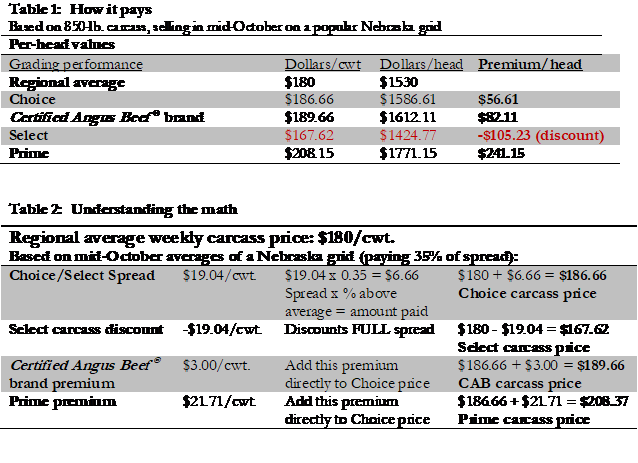

Those figures are based on mid-October calculations of an 850-pound (lb.) carcass, sold on a popular Nebraska grid (Table 1). The difference is much larger when compared to Select, which brought $187-per-head less than CAB on the grid. The premiums for quality represent a significant jump from recent annual averages.

Before anybody tallies potential premiums, Dykstra warned that it’s important to understand how area-weighted averages work (Table 2).

“Many people believe they’ll get the full Choice/Select spread over and above the carcass price for Choice,” he said. “Not true. It all depends on the plant location and grid structure.”

If a plant averages 65% Choice, the packer will likely pay 35% of that Choice/Select spread on every Choice carcass. Southern plants with historically lower grading may pay up to 50% of the spread, Dykstra noted.

Even in Nebraska, where quality competition is fierce, there’s plenty of reward for those who have focused on carcass quality.

“Select is always a discount by the full Choice/Select spread below the base, and Choice is that area-average premium over the base,” Dykstra said. “The spread covers the up- and the down-direction from the base.”

Regardless of whether you think about quality, it affects your price, he added: “Cattle with a track record for quality are the ones now bringing higher bids as calves and feeders.”

You may also like

Healthier Soils and Stronger Herds

Effective land stewardship requires an understanding of how each decision affects forage growth, cattle performance and long-term stocking rates. When land is the foundation of the business, producers are more likely to invest time and resources into managing it intentionally.

Smitty’s Service on CAB Board

Lamb continues to find himself struck by just how far-reaching the Angus breed has become. The brand’s growing demand and rising prime carcasses left a strong impression. He hopes everyone recognizes the vital connection built between consumers and Angus producers. Humbled by the opportunity to serve, Lamb reflects on his time as chairman with gratitude.

Zybach Angus Receives Certified Angus Beef Progressive Partner Award

Steve Zybach’s vision for smaller Angus producers to get more value for their calves through feeder calf sales with value-added programs led him to be recognized as the 2025 CAB Progressive Partner.