MARKET UPDATE

The beef sector has been stunned by the velocity of price increases in the fed cattle market. The memory of early April pain in Live Cattle futures seems a distant memory now as fundamental supply and demand have, once again, taken control of spot fed cattle values.

The nearby June Live Cattle contract, deflated by $13/cwt. a month ago, has since posted a $20/cwt. run to the upside, reaching $213/cwt. this Tuesday. The contract has posted just three lightly negative trading sessions of the last 19 days marking the turnaround. Even so, futures have raced to keep up, leaving the June contract $7/cwt. behind last week’s national average cash steer price of $220/cwt.

While the supply side is bullish for cattle feeders, one must be equally aware of the leadership futures prices lend to this market. Although spot cash prices are currently premium to futures, recent strength in futures gains are largely driven by a resurgence of capital into those contracts from managed funds. Psychologically, this is impactful to the cash price direction, along with the obvious active packer demand.

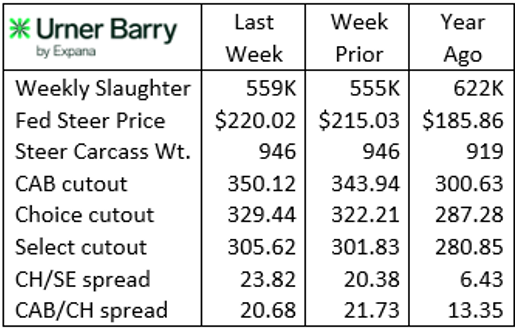

Last week’s total cattle harvest of just 559,000 head marks the fifth week in a trend of firmly smaller harvest volumes averaging 44,000 head fewer per week than a year ago. Negative packer margins remain a headwind to the entire beef sector as rising carcass cutout values fail to regain ground relative to explosive cash cattle prices.

Packers procured 99,000 head in last week’s negotiated trade—a large sum compared to most weeks. The likelihood that this reduces packer negotiated volume needs this week may dampen further advances in cattle prices, although not immediately evident. As well, carcass weights remain 27 lb. heavier than a year ago. The increase in the number of long-fed cattle continues to be a factor to watch as the feedlot sector gauges the currentness of cattle inventories.

Beef Month Begins

May is “Beef Month” for good reason as the spring holidays kick off with Mother’s Day this Sunday, followed up quickly by Memorial Day. Wholesale and retail beef buyers have been preparing for weeks ahead of the spike in consumer beef buying associated with warmer weather and holiday grilling demand.

The 2.6% reduction in year-to-date fed cattle harvest head counts have largely been offset by a 30 lb. increase in carcass weights. Yet, middle meat steak items are the grilling favorites of the season. The availability of steaks cut to an inch and a quarter thickness, for example, is still largely constrained by head count, even if ribeye areas are slightly larger.

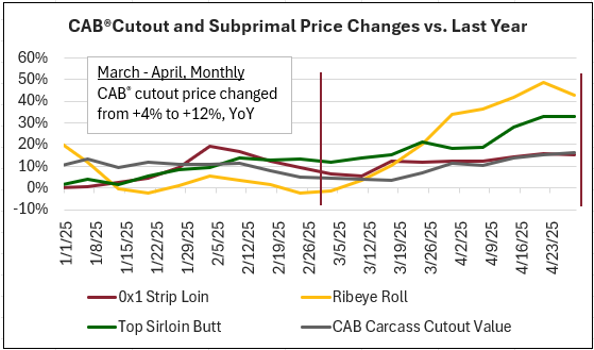

Meat buyers, well aware of the supply trend, accelerated spring steak procurement earlier than normal this spring, sending middle meat values rapidly upward. Wholesale CAB ribeye prices began an unstoppable climb in early March, capturing a 32% price increase by late April as buyers proactively stocked away inventory. Last week’s price decline of a few pennies signaled short term finality to that run-up, but at a value nearly 50% higher than a year ago. Bear in mind that the spot market trade volume represents a relatively small volume of total sales, creating heightened price sensitivity as demand spikes and end-users rush to fill in product inventory on limited unsold supplies.

Earlier seasonal price increases were also noted for CAB strip loins and top sirloin butts with wholesale price increases in the last two months of 13% and 26%, respectively. It’s especially notable that top butts have reached 33% higher than a year ago as their much cheaper price point provides a budget-friendly alternative to ribs and strips. Tenderloins, currently 10% pricier than ribeyes, contrastingly don’t see spring price inflation to the degree that they do ahead of December holidays.

An admittedly narrow focus on just three cuts describes a fraction of the carcass, yet they are a focal point for the season. Briskets have also undertaken their seasonal uptick that will only increase into summer as smokers are brought back into use. Tight supplies of lean grinding material continue to support round cuts such as insides, knuckles and eye of rounds.

Heightened demand for richly-marbled middle meats brings to a cattlemen’s mind the associated quality-based price spreads paid out on packer grids. It’s understandable to assume that record fed cattle and retail beef prices may squash premiums. Yet last week’s Choice-Select spread was quite wide at $23.82/cwt., while the CAB-Choice cutout spread was $20.68/cwt., compared to $13.35/cwt. a year ago.

The weighted average premium for Prime carcasses for this week is $14.92/cwt. over Choice, just $0.06/cwt. below a year ago and $1.49/cwt. lower than this week in the record-setting Prime market of 2022. This is impressive considering that latest data shows Prime carcasses comprised a hefty 12% of national fed steer and heifer production for the past four weeks. This adds to the historic stretch of 7 weeks where the Prime carcass share has surpassed that of USDA Select.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.