MARKET UPDATE

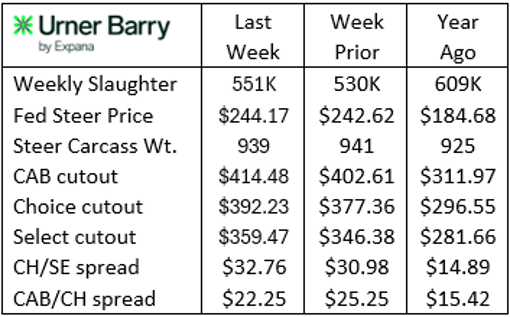

The fed cattle market moved to higher values again last week with a $1.55/cwt. increase in the six-state fed steer price. Negotiated cash trade volume was active in the north, with Iowa and Nebraska prices averaging $245/cwt. live and $386/cwt. dressed. Limited Kansas and Texas negotiated head counts sold for $239 to $240/cwt.

On Monday, USDA adjusted last week’s estimated weekly cattle harvested up from 547,000 head to 551,000 head. This was 15,000 head larger than the prior week’s abysmal 530,000 head and the largest harvest volume since the second week in July. Still, 58,000 head smaller than the same week last year.

Steer carcass weights remain heavier than a year ago by 14 lb. per head and 38 lb. heavier than the same week in 2023. The annual weight increase has narrowed in the third quarter, averaging 18 lb. heavier than last year. This compares to the first quarter jump of 30 lb. per head and the second quarter average of 21 lb. per head. Weights are expected to increase into the fall, but the pace of the increase from the summer low (931 lb.) is slower than it has been in the past two years.

Cutout values have been increasing at blistering speed over the past two weeks. Given that roughly 20% of boxed beef is typically available on the weekly spot market trade, buyers have had to compete for very small volume with fed cattle harvest 10% below a year ago in recent weeks. Cutout values have now surpassed their late-June highs following the July slump that took prices down 6%. Since recovering from the summer low, the comprehensive price is now the second highest price in history, only surpassed by the May 2020 COVID spike.

With retailers through their last-minute Labor Day buying, there is a strong likelihood that prices may relax, as is their tendency, moving into September. Demand tends to wane after the holiday, prior to normal fourth quarter increases.

Holding on for the Ride

The comprehensive cutout value, including all grades and delivery periods for fed steer and heifer beef cuts, has rapidly escalated from the late July summer low of $364.54/cwt. to this Tuesday’s $393.98/cwt. quote. This 8% increase is not much larger than the typical seasonal price hike for the same period, averaging 6.5% in the previous five years.

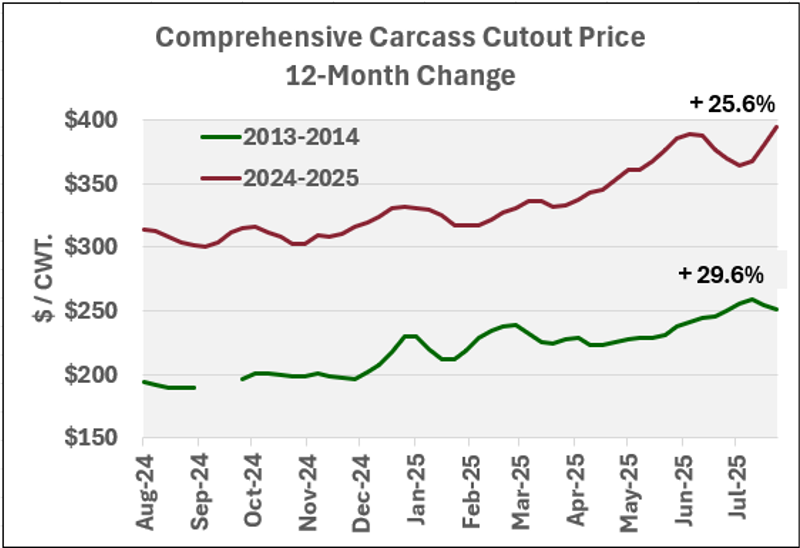

While August boxed beef inflation is more normal than one might think, it is capturing attention this year given the slightly sharper incline and the resulting comprehensive price that is now 24% higher than this time last year. The magnitude of this year over year price advance is a difficult reality for retail and foodservice sectors to digest. Even so, it’s a smaller percentage increase than that of the 2013-2014 period when the comprehensive price jumped 30% in the same August-to-August annual comparison.

Restricted cattle harvest as a result of weather-driven cow herd reductions was also the culprit in the 2013-2014 beef market run-up. Tracing the fed cattle price reaction for these periods provides yet another interesting comparison. From August 2013 to August 2014 the fed steer price increased 24% while the current 12-month price adjustment has, so far, brought on a 33% increase in fed steer value.

Continuing the theme, evaluating similar market dynamics roughly a decade apart, shows dramatic differences in carcass quality price spreads. Starting at the top of the quality grades with the smallest spread difference, the latest price spread between USDA Prime and Choice is just 13% larger than in August 2014. This is logical given that Prime carcass volume and share of fed beef supplies has more than doubled in that period. Next, the CAB® cutout premium over USDA Choice, currently $22.25/cwt., is more than triple that of the August 2014 market. Finally, the Choice/Select price spread last week averaged $23.39/cwt., just over twice the magnitude of that in August 2014. Bear in mind that wholesale boxed beef prices are 60% higher today than they were at that time, tempering the impact of today’s price spreads by comparison.

With fed cattle supplies projected to tighten even further into 2026, we aren’t equipped to mark any peak on the price charts for this phase of the supply cycle. What does appear evident is that, despite total beef market fluctuations, consumer demand for marbling-rich carcasses meeting consumer expectations are generating substantially larger premiums and gross dollars, compared to the average, than they were under similar market circumstances in 2014.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.