MARKET UPDATE

A robust Saturday slaughter of 53,000 head brought last week’s fed cattle total up to 520,000 head, the largest total since the week beginning November 28. Slaughter cow totals continue to run quite large, with cull beef cows holding the total cow number well above a year ago, despite dairy cow culling slipping seasonally lower by the week.

Fed cattle values finally showed some life last week just in time, given that April is about to close. Northern packer buyers are having to work to find the market-ready pens with enough days on feed to hit their quality grade and CAB percentage targets.

Nebraska and Iowa saw prices advance to a range of $144 to $147/cwt., while the Texas average improved to a range of $140 to $143/cwt. More ample supplies of market-ready cattle in the south generated the wide disparity and more notable advances in the north.

Last Friday’s Cattle on Feed report delivered a surprise placements number. Cattle placed in March were projected by analysts near 92% of a year ago, but the reported number came in at 1.99 million head or 100% of the March 2021 placements. This sent Live Cattle futures contracts sharply lower Monday, including the April and June contracts, even though the nearby contract delivery periods are unaffected by March placements. The bearish sentiment permeated both Live Cattle and Feeder Cattle contracts and this week’s cash fed cattle trade will likely not advance much given the futures direction.

Boxed beef values have cheapened early this week with the latest Choice cutout value at $267/cwt., down $6 from the April high of $273/cwt. touched 10 days ago. In the middle meat category, ribeyes and tenderloins have been holding a strong seasonal price pattern thus far this spring. However, ribeyes have shown some price weakness with last week’s quote down 33-cents to average $8.88/lb. wholesale. There’s still plenty of time through the heavy demand period in May to see price appreciation for ribs.

Tenderloins remain on pace with the record-high 2021 pricing on a strong upward trajectory with the CAB heavy tenderloin priced 55-cents above Choice at $14.67/lb. wholesale. Strip loins tend to price higher in the spring but are currently $2/lb. cheaper than the mid-May high touched a year ago. Two weeks may prove to be the difference as we move ahead through May.

Several round items have proven to be a harder sell for packers and prices are indicative. Prices are weak on chuck rolls as well, offering an opportunity for buyers during seasonal demand downturn for these items.

FED CATTLE MARKET CHASING GRADE

In the past couple of weeks, the spread between fed cattle prices in the north has advanced to generate a sizeable advantage over the south. Last week cattle in Nebraska traded in a wide range from $141 to $147/cwt. The bulk of the trade took place at $143 and higher with the weekly average calculated at $145/cwt.

Kansas and Texas markets were consolidated around the $140/cwt. average, with the top-end of reported sales at $141/cwt. The $5/cwt. average price spread from north to south is indicative of a lack of quality grade achievement in the north. Currently, the northern cattle are “green” as far as fat content is concerned, falling short of the marbling and quality grade benchmarks that packers need to fulfill customer demand.

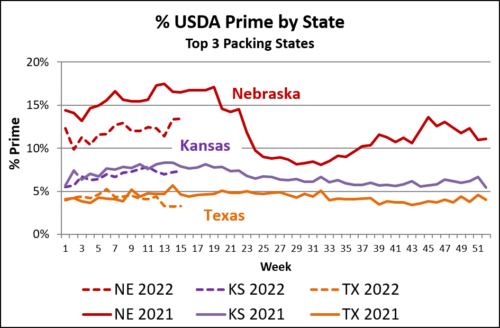

As a rule of thumb, northern feedlots in states such as NE, IA, IL, SD, and MN have been the volume producers of richer marbling cattle. While this trend stands up in the data, it is not to the exclusion of other states nor negating impressive advances made by states more southern.

Looking just days ahead at May, customer demand for CAB traditional and CAB Prime products is heating up along with the weather. A good share of beef items have been booked ahead by end-users expecting their quality specs to be met in large quantities very soon. As such, packers need to compete to procure the fewer pens of “optimally finished cattle” available in feedlots.

A deeper analysis of the grading data shows that the void in quality carcasses lies within Premium Choice and Prime. Looking specifically at the Nebraska trend, the Choice grade in total is exceptionally high at 73.6%, 1.6 percentage points above a year ago. The Prime grade is where the deficit is seen, 13.4% in recent data versus the record-high 16.5% a year ago. It’s important to keep in context that we are suggesting a “void” in Nebraska Prime carcass production for a period with the second-largest share of Prime carcasses in history.

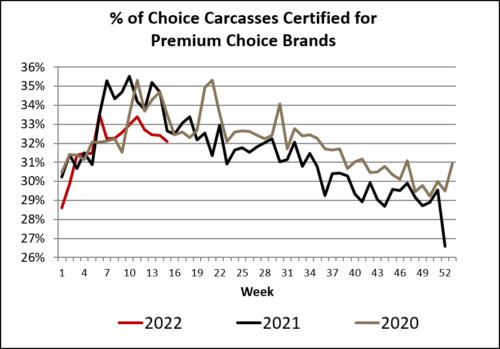

Sharpening focus to the Premium Choice category, the heart of CAB, the void is also evident. Fewer carcasses in the Prime grade have not resulted in a larger share in Premium Choice. USDA data shows the percentage of Choice carcasses certified for Premium Choice branded beef programs is currently lower than in any of the past four years, albeit fractionally so.

These factors are building a reiteration of the spring seasonal supply/demand imbalance in the premium beef category. Although carcass cutout values have started this week in a slight downtrend, the overarching seasonal theme is for a widening Choice/Select price spread, setting the foundation for CAB and Prime carcass premiums.

Southern cattle feeders with high grading cattle typically benefit from lower packing plant grade thresholds for the upper-quality grades and CAB. Currently, the cash spot market has provided plenty of premium opportunities in the north as buyers have had to pay up to secure the cattle fitting customer needs

SPRING DEMAND RALLY?

As noted in the Market Update, carcass cutout prices were slightly softer in the latest weekly averages, with similar downward pressure noted early this week. It’s likely that grocery and retail businesses are weighing the potential consumer beef consumption pattern during this period of inflationary cost increases for goods.

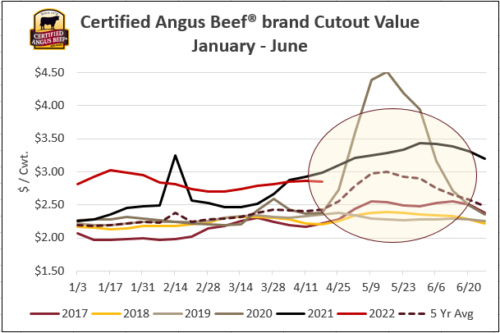

The CAB carcass cutout increased on average $0.58/lb. the last five years from mid-April through mid-May, a 24% increase. Processing disruptions heavily skewed the 2020 data with a 90% jump in carcass price. Therefore, it’s instructive to ignore that year’s data to gauge recent historical price patterns.

While spring 2021 fed cattle slaughter didn’t feature plant shutdowns, slower chain speeds held production below optimum levels during the high beef demand period. The carcass cutout advance from mid-April to mid-May last year increased just 10%. However, the starting April price was already 25% higher before the advance, bringing the annual price increase for that time to 35%. A 10% increase would have been a logical expectation for the time period moving ahead toward the middle of May. But the lower trend over the past 10 days has nullified that for the time being/

Moving into May the question around boxed beef sales is whether or not the small percentage of wholesale trade conducted in the spot market will see a significant price move. Current price points for tenderloins, ribeyes, strip loins and briskets suggest that these items could develop their normal seasonal trajectory higher into the period. These key items hold much of the potential influence for higher prices.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.