Certified Angus Beef Premiums Record High in 2021

MARKET UPDATE

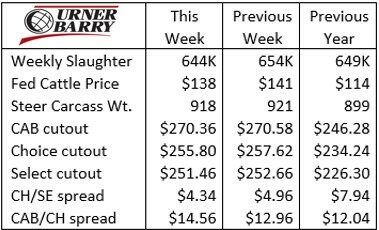

Daily fed cattle slaughter numbers continued to post 95,000 to 97,000 head totals last week Monday through Thursday. Throughput at this level has been fairly steady for the past two weeks, the strongest so far this year. Last Friday featured a much smaller total than the preceding four days with just an 84,000 head total. While we don’t know precisely the issue causing that departure from the trend, we can only chalk it up to a one-day anomaly. We like the improved pace of slaughter in recent weeks.

On the other hand, fed cattle prices have suffered lately from a general bearish undertone to the market. Over a ten-year period, prices have tended to increase from mid-February through early March. Instead, we’ve seen a $6.50/cwt. retreat since the week of February 7 in the live fed steer price.

While unwelcome, the softer market in the past month is understandable, with a good handful of influences to blame. Chief concerns on the list are related to U.S. inflation and uncertainty surrounding the Russian/Ukrainian conflict.

Markets do not like uncertainty, and as a result cattle and all classes of commodities have experienced more volatile futures and cash prices. Cost of production is impacted on the cattle production side while consumer behavior and beef prices are questioned on the end product side of the equation. In the past four trading days, live cattle futures have recovered from a $136/cwt. session low last Thursday/Friday to this Wednesday morning’s $141/cwt. range.

The boxed beef market has also been a bit tenuous, as of late. The onset of daylight savings time brings on thoughts of spring demand with the official start of the season just ahead on March 20. End users have been a bit gun-shy, waiting to see if the first quarter market bottom has been put in. The Choice cutout was roughly $2/cwt. lower in the week-to-week comparison, but in a daily trend up through mid-week has been stagnant at $255/cwt.

Looking at those spring grilling demand items, the current CAB ribeye price has sat at $8.50/lb. for three weeks now. That’s $1.23/lb. cheaper than a year ago. Given the timing and seasonal change it’s unlikely to be much lower in coming weeks, with a historical bias for an upturn very soon. Wholesale CAB strip loins at $7.80/lb. were 5-cents higher last week, with a historical trend line suggesting sharp increases through April and May before turning lower again in June.

CERTIFIED ANGUS BEEF PREMIUMS RECORD HIGH IN 2021

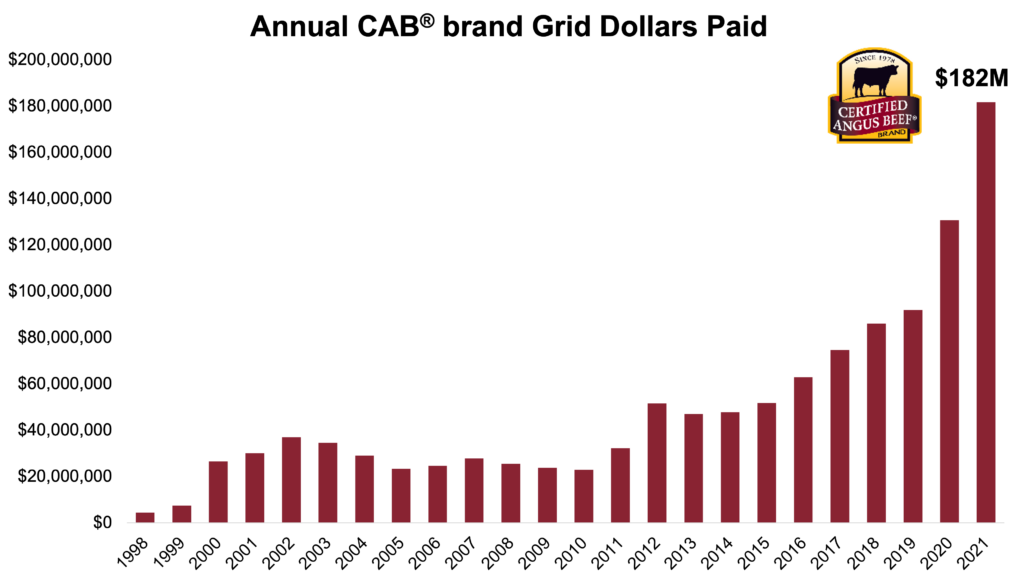

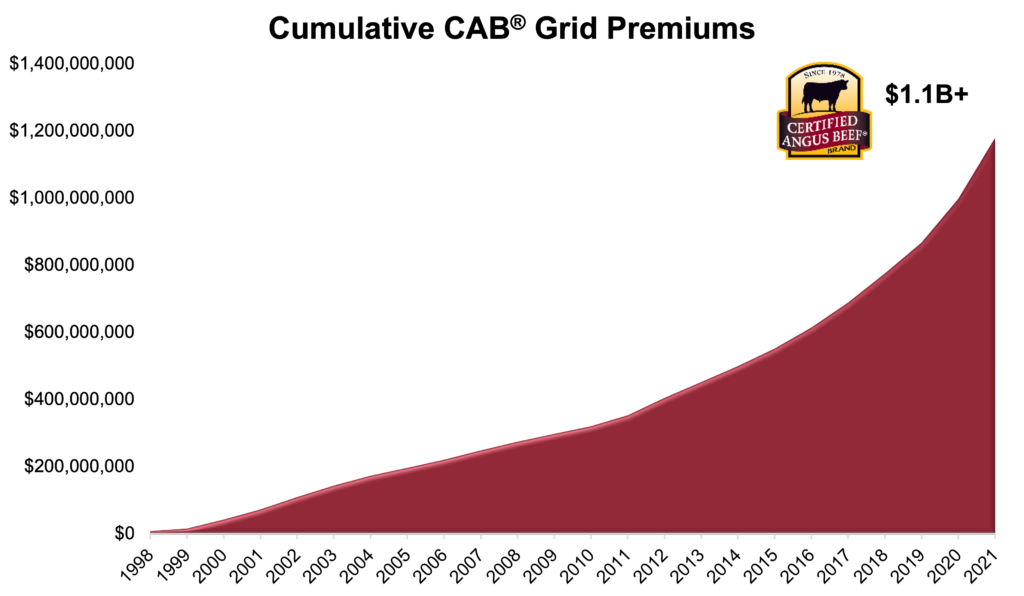

Since 1998 our Supply Development team has surveyed CAB-licensed packers every two years to aggregate total premium dollars paid to suppliers for CAB brand carcasses. It’s been an ever-increasing trend line, with a cumulative $1 billion in grid and formula premiums garnered over the 24 year period.

A major contributor to larger annual total premiums has been the increase in carcasses certified into the brand. While not a linear increase, the brand captured 1.7 million carcasses in 1998 versus 5.9 million in fiscal 2021.

In the past two years, beef cutout values have been anything but normal given the imbalance of packer throughput speed and market-ready fed cattle at any one time. While the base price for fed cattle hasn’t performed in step with cutout values, quality premiums have trended higher.

In relation to the Choice carcass price, CAB brand premiums have increased greatly in recent history. In the five-year period from 2015 to 2019 the CAB carcass cutout value averaged a $10.32/cwt. premium to Choice, according to Urner Barry’s market data. In 2020 the premium jumped to $17.70/cwt., changing little in 2021 with a $17.76/cwt. annual average.

While cutout value price spreads don’t translate directly to grid premiums paid to feeders, the wider premium spread trend is certainly reflected in the packers’ reported premiums last year. In our 2019 report, the aggregate packer CAB premium total came in at $92 million. The 2021 total has seen that total nearly double in only two years, resulting in $182 million in CAB premiums.

Looking at the USDA data, the largest difference in dollars per hundredweight in this period of time has been at the top-end of the premium range. In 2019 the average high of the CAB premium price range was $5.66/cwt. while in 2021 that number increased 80% to $10.18/cwt. The one-week top of the premium range for the year was $18/cwt.

About 12% of CAB brand carcasses qualify for the Certified Angus Beef ® Prime label. Today those premiums are paid to cattle suppliers in the form of Prime premiums, which are not included in the packer premium survey. That being said, in 2021 packers reported to USDA an average Prime grid price of $18.80/cwt. over Choice.

Within the perspective of tumultuous modern cattle markets of the most recent three years, this premium expansion is a silver lining, to be sure. It’s also instructive as to what is driving beef demand since we can readily see the value drivers irrespective of what the underlying commodity base price is doing.

Cattlemen throughout the supply chain benefit from knowledge of the evolution of beef carcass pricing as we continue to adjust our course for the future. At the same time, understanding where the benchmarks are is important.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.