MARKET UPDATE

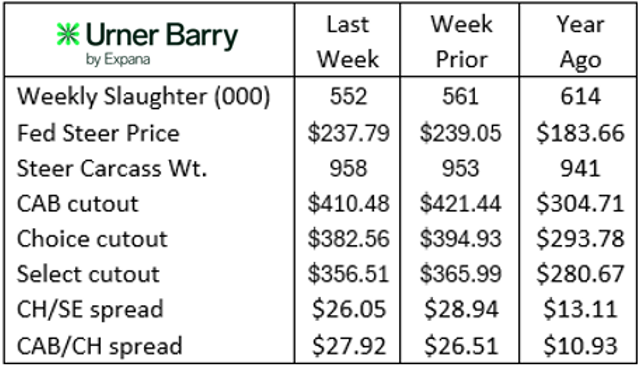

Fed cattle prices have moved incrementally lower in the past two weeks as a handful of factors have accumulated to pressure the market lower. October Live Cattle futures made a significant correction from $235/cwt. down to $230/cwt. on September 9, which has taken days to recover. As well, lower boxed beef cutout values coupled with growing market-ready fed cattle supplies in the northern feeding region add to the downward momentum.

The increasing northern supply situation stands in contrast to Texas feedyard inventories remaining quite devoid of normal supplies in the absence of Mexican feeder cattle. This has inverted the months-long northern price premium, giving the TX/KS market roughly a $2/cwt. premium now compared to the NE/IA trade regions. This reshuffling of price across the regions is a historically expected pattern in the fall, but contrasting cattle inventory conditions across the regions suggest it’s even more appropriate today.

Fed cattle harvest levels remain 8% lower compared to a year ago, an accelerated decline in the past several weeks that began to amplify as far back as July.

Cheapening carcass cutout values were a major theme last week, with the Comprehensive Cutout down $11.31/cwt., accumulating to a two-week decline of $16.14/cwt. This week began with further weakness in boxed beef values as the anticipated September market dip has finally set in despite very tight overall fed cattle harvest. Live Cattle futures have been erratic as of late, reacting to news already accounted for in the fundamentals of the market. Futures are providing no leadership to the cash market, suggesting that seasonal expectations may guide nearby price trends.

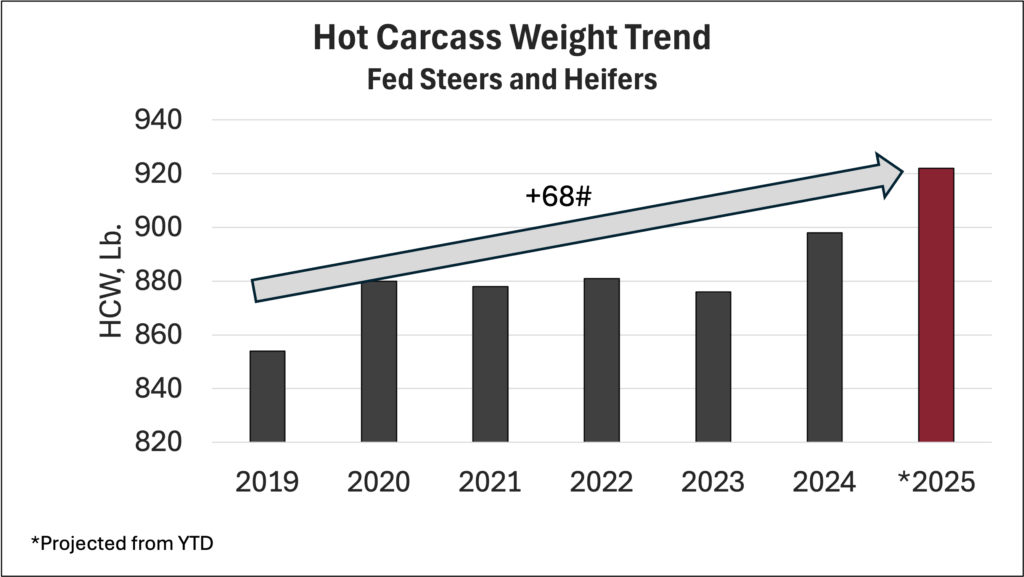

Carcass Weights At It Again

Heavier carcass weights are no headline in 2025, yet this week’s official beginning of fall presents a great time to check in on weight trends. Year to date, average weekly fed cattle carcasses are 24 lb. heavier than a year ago and an astounding 46 lb. heavier than in 2023. These increases are a tremendous leap beyond the historic trend, tracking the annual increase in the range of 5.5 lb. heavier.

The 2020 fed cattle supply backlog, instigated by the pandemic, boosted carcass weights by 26 lb. This unprecedented event was logically expected to undergo a correction with weights returning nearer to the pre-pandemic trendline as fed cattle supplies normalized in 2021. Yet, the correction did not materialize, as annual average weights only declined 2 lb. in 2021 to average 878 lb., still 24 lb. heavier than the pre-pandemic level. A 3 lb. increase in 2022 set a new annual record before the following year’s 5 lb. decline, which would be considered a bit of a normalization. However, winter weather in 2023 was devastating in the feeding sector, removing a month’s worth of gain and dragging weights dramatically lower to start the year. The bottom line is, despite brief weather disruptions, target feedlot out-weights have only increased since the pandemic. The beef industry simply accepted a paradigm shift adding 26 lb. of carcass weight to the trend line in a single year. Little did we know in 2020 that we’d add another 40 lb. to the ledger by 2025.

Early September data shows latest weighted average steer/heifer carcasses just 3 lb. lighter than the single-week record heaviest weights (928 lb.) marked in January of this year. Interestingly, the month of January is never the month the annual heaviest weights are recorded. A strong Live Cattle futures decline last November slowed fed cattle sales as feedlot managers awaited a market recovery. In the five-year average, annual heaviest weights have come during the second week of November. The typical fall pattern tracks weekly weight gain from September 1 through mid-November with an average 15 lb. increase for the period.

If this fall were to follow the five-year average trend, the heaviest annual steer/heifer weight for the year would be 940 lb. in November, surpassing last January’s record by 12 lb. This would also place steer carcasses (averaging 81 lb. heavier than heifers this year) at an annual high of 973 lb. in November.

It may be presumptuous to assume carcass weights will continue to climb at the magnitude of the recent five-year average—given that early September weights were already just short of the record following a strong 14 lb. run-up over four weeks. Packer processing appetite will continue to play a key role through the season, along with cattle basis and weather. Cost of gain remains aligned with some of the best feeding weather of the year to see weights increase to fall highs yet to be determined. Without rationalizing a slowdown in upticks in the fourth quarter, weights are on track to average 922 lb. for the year.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.