MARKET UPDATE

The fed cattle market is showing signs of sands shifting underfoot as weekly cash trade showed signs of fatigue as cattle traded, on average, about $1/cwt. lower last week. This interrupts what has been a steadily firmer price trend building after a short-term pullback in late June.

While cattle in the northern reporting regions of Nebraska and Iowa/Minnesota have long commanded a significant premium over Texas and Kansas cattle, this trend also ended last week. The northern market averaged roughly $2/cwt. lower while Texas and Kansas averages remained steady.

Some indications point toward short-term cattle supplies in the north a bit more adequate at this time than they have in in recent weeks. With the passing of Labor Day beef demand, Live Cattle futures ended last week with a softer tone. This extended to much deeper cuts this Tuesday as the market sold off in a major way. Little news on the fundamental side could have pressured the market, but when it comes to the reaction from speculative traders, President Trump’s recent comments about future lower beef prices can’t be ignored.

Last week’s carcass cutout values were higher, on average, and in the range of $2.30/cwt. The trends were close to even across the quality grades and CAB. Price spreads between each remained quite wide with a tremendous $51/cwt. spread between the Certified Angus Beef ® brand and USDA Select.

Early this week, however, cutout quotes began to trend a bit lower, possibly indicating the expected easing following Labor Day. Perspective is important to the discussion, as packers continued to ration supply last week even accounting for Monday’s holiday. Tight supplies have boosted cutout values to roughly 35% higher than a year ago. As such, a step lower in wholesale beef prices is hardly an indication of weakness in beef demand. Assuming harvest volume remains near recent levels through September, the seasonally expected easing of wholesale cutout values will likely be muted.

Big-time Cutout Performance

In the second and third quarters this year, carcass cutout values have risen at an unprecedented pace. Meanwhile, fed cattle harvest levels fell from just a 0.5% deficit in the first quarter to averaging near 8% below last year beginning in March.

September carcass prices typically decline as Labor Day demand passes and the shift toward fall pulls prices a bit lower. Typical seasonal price weakness is most noted on the loin, the carcass’s leading primal for total value.

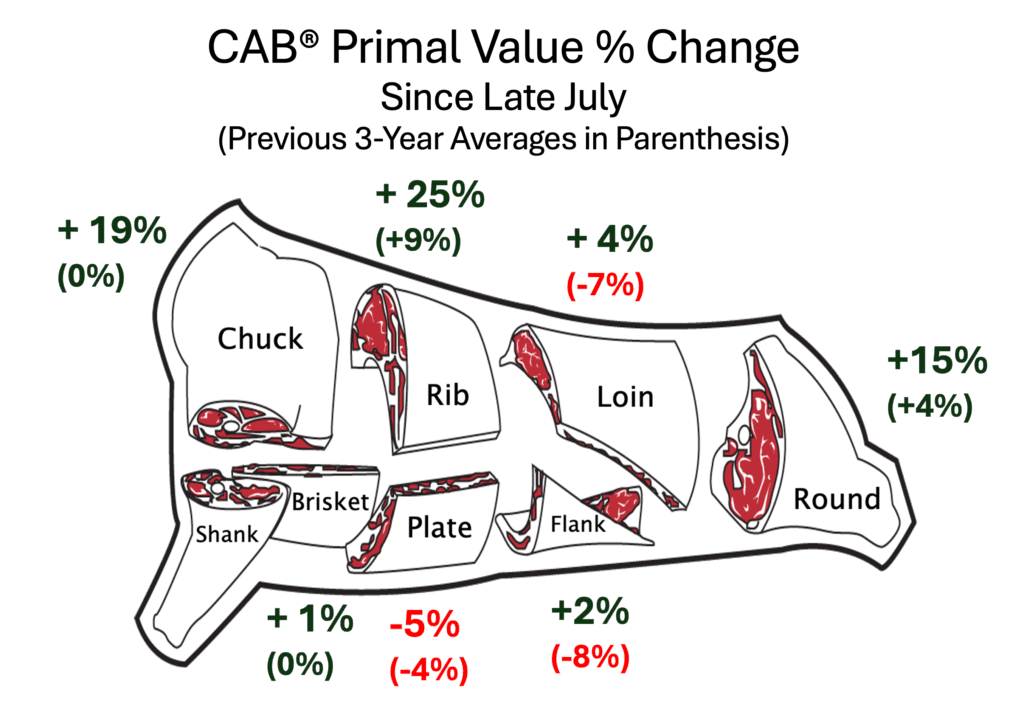

In what’s left of September, current market dynamics appear to be limiting downside risk for boxed beef prices. Tight fed cattle harvest volume has spurred beef retailers to begin securing their fourth-quarter middle meat roast needs a month earlier than normal. This has sent pricing for the two “darlings of December”, ribeyes and tenderloins, to record-highs in the latest wholesale data. Prices for these two cuts typically pick up in September with stronger weekly gains in October/November. Yet proactive buying has CAB ribeyes already pricing 37% above late July values and tenderloins 25% higher for the period. These compare to 10% and 4% average increases from the July lows through August in the prior three years.

Carcass weights averaging 25 lb. heavier this year will do little to offset the deficit in ribeyes and tenderloins. Depending on cooking method, these cuts remain sensitive to steak thickness for desired doneness, leaving only fractional piece-count advantages with added cut weight.

Strip loin prices tend to peak in June and reach annual lows in September. Fourth quarter roast demand traditionally has little impact beyond a 10% lift into December. Yet last week’s wholesale strip prices made a sharp 6% upward departure while an equally sharp decline into early September is historically the norm. No doubt, limited piece count is a factor with strip loins this season, accompanied by the substitution factor of this quality steak/roast cut selling several dollars below it’s middle meat contemporaries.

With middle meats a key seasonal transition at this time, we’d be remiss not to note the heaviest primal, the chuck, and it’s exceptional pricing trajectory of late. The entire CAB chuck value has increased 19% since late July with the chuck roll up a whopping 70% in August. The round has benefitted greatly as well, following ground beef supply/demand factors, with a 15% uptick for the period. Odds are that round prices will relax with expected slowing ground beef demand.

It remains to be seen if current price levels are just the beginning of a continued trend of increasing prices as retail meat buyers get ahead of a shortfall in fourth quarter spot market supplies. Alternatively, these factors are simply pricing into the market earlier and to sharper extremes than we’d typically expect, leaving smaller increases to follow into the fourth quarter.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.