MARKET UPDATE

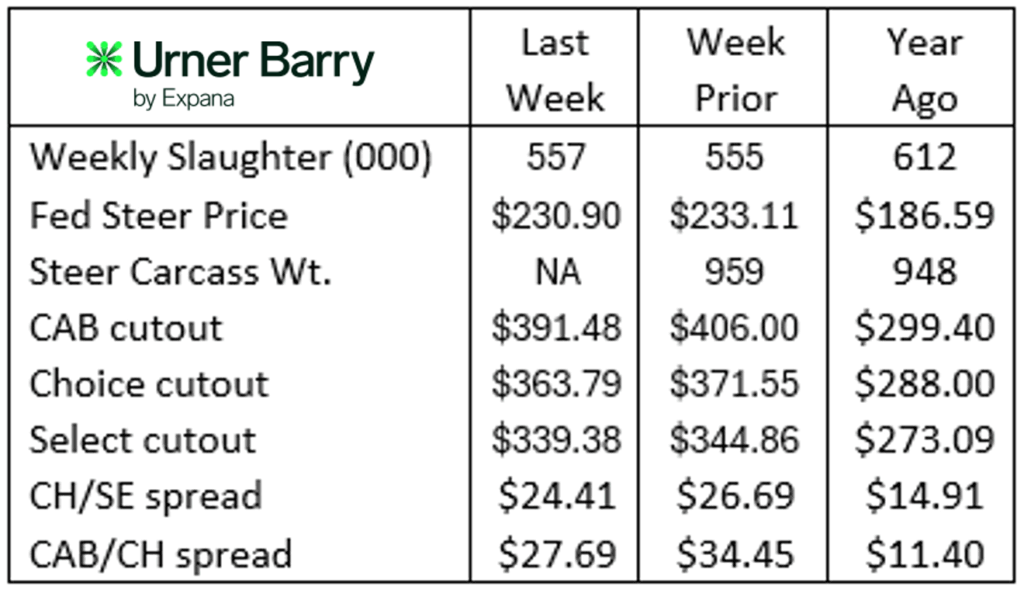

The weakening fed cattle price trend, in place throughout September, showed no directional change last week as the market traded $2 to $3/cwt. lower.

A significant trend shift, first reported here two weeks ago, focuses on the tremendous change from the northern feeding region’s $10/cwt. premium over the southern region. This has inverted to give southern feedlots a $3/cwt. premium over the north in last week’s ending values. There is a degree of seasonality attributed to a fall turnaround in this regional price structure, coupled with more adequate fed cattle supplies currently in the north.

Downward price pressure to fed cattle values can largely be attributed to carcass cutout values that have rapidly eroded since the beginning of September. It is seasonally appropriate for boxed beef prices to cheapen during September although fed cattle prices have increased an average of 6% during the month in the past three years. In latest estimates, the relationship between fed cattle and wholesale cutout values has pushed spot market packer margins near losses of $200 per head.

Just as live cattle prices have drifted lower, feeder cattle prices have catapulted higher. CME Feeder Cattle contracts are revisiting their late-August highs with October and November contracts touching $368/cwt. Cash prices are setting new records across the country this week as fall feeder calf sales hit their stride in what promises to be a highlight season in the auction barns. Feedlot breakevens are leaving broken pencils in their wake as managers try to gain traction in an extremely competitive market.

Continual Improvement Drives CAB Acceptance Rates

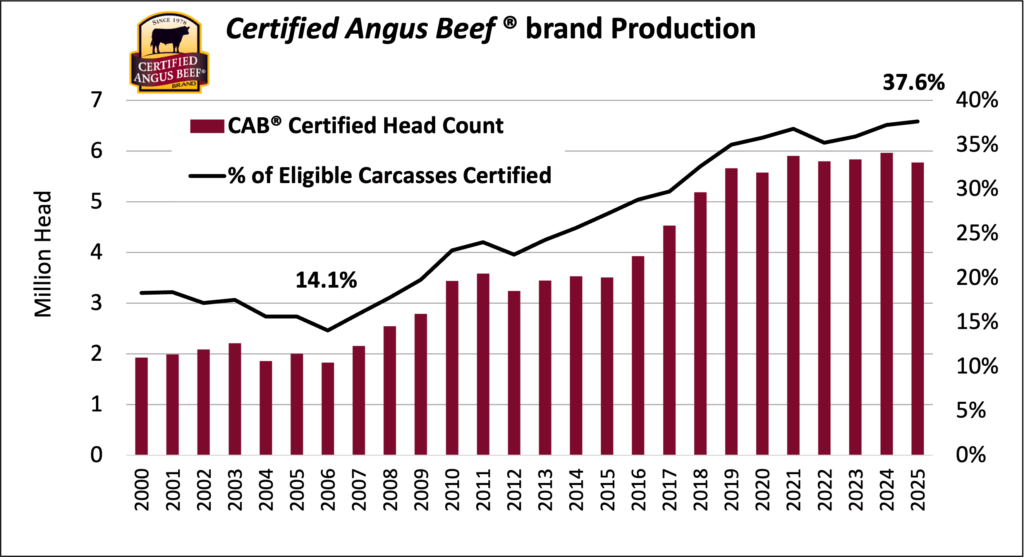

The Certified Angus Beef fiscal year wrapped up in September, offering the chance to measure successes and challenges for hundreds of the brand’s partners. Cattlemen who supply the brand are similarly afforded a chance to review years of quality improvements in cattle and carcasses.

The total pounds of Certified Angus Beef ® brand product sold is the downstream measure that keeps revenue flowing for all parties. Rather than reverting to a “commodity in volume” mentality, think of it as “pounds of premium product” sales. The past year marked the tenth consecutive year that brand sales have topped one billion pounds. This is impressive for the brand, given the year was constrained by significantly fewer fed cattle harvested. In fact, the 5.77 million certified carcasses represent a 2.9% decline in carcass supplies for the brand than last year.

Slight year-over-year improvement in the brand’s carcass acceptance rate drove brand suppliers to achieve a new record of 37.6% of eligible carcasses meeting the 10 required carcass specifications. Those close to the feedlot sector understand that escalating days on feed and finishing weights have added to average carcass marbling achievement this year. While impactful in the short term, the long term trend is nearly linear, tracking the brand’s acceptance rate from just 14% in 2006, the lowest in modern history, to increase 170% in 20 years.

Just as we detailed in the last Insider, carcass weights have increased mightily in the past few years. The brand’s average carcass weight for the fiscal year was 921 lb., a 22 lb. increase over last year and 38 lb. over two years. This shored up a portion of the decline in carcass production volume brought down by idled processing speeds. It appears that heavy weights are a fixture of the current market environment with end-users begrudgingly accepting this reality a few years ago.

Finally, Certified Angus Beef ® brand Prime sales were a highlight of the year as the trends we’ve reported on in the Insider played out in annual sales reports. It’s no surprise given that “taste” is the most important driver in consumer decisions when purchasing protein. This, plus the fact that a record 13.6% of all CAB carcasses were CAB Prime last year, a 3.6% increase in a year when total certified head counts were lower. Elevated CAB Prime carcass supplies opened the door to record sales volumes. While not without challenges, the past year has been very successful for CAB. It can’t be overstated how important growing consumer demand for our product has been in the past few years. It’s due in no small part to the concerted effort and pressure cattlemen have placed on carcass quality for two decades.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.