MARKET UPDATE

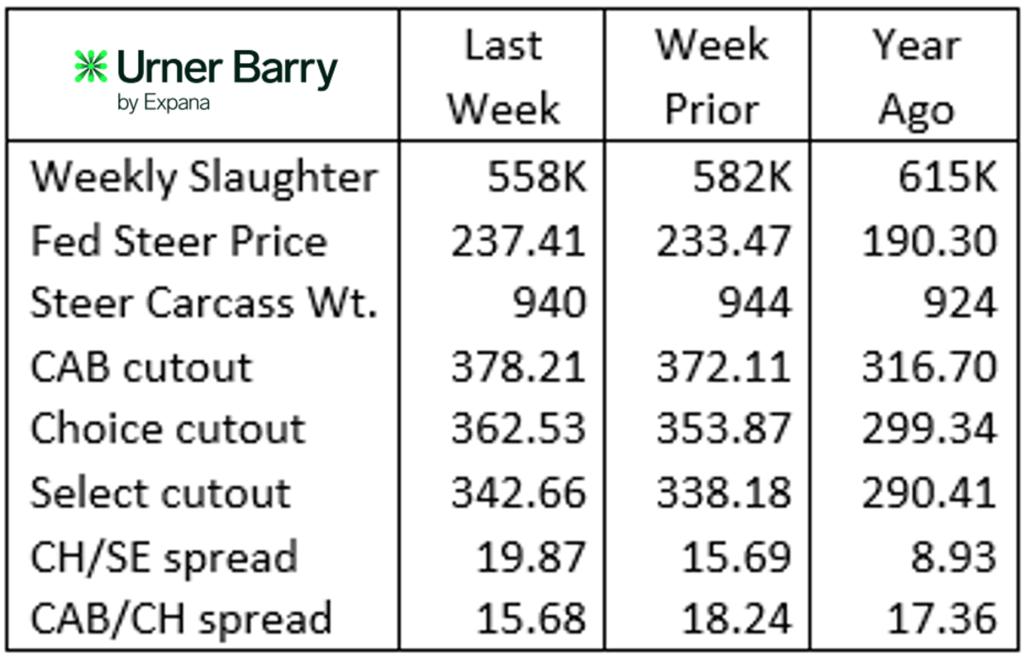

Perpetually higher fed cattle prices have persisted over the last several weeks, with the latest market average dollars higher than the prior week. The Nebraska and Iowa/Minnesota reporting regions continue to lead the way with a trading range from $239 to $244/cwt.

Last week, a light volume of negotiated trade in Kansas and Texas was conducted at generally $235/cwt., with the Texas market showing the largest advancement from the prior week’s $229/cwt. on a live basis. The Texas discount to Nebraska prices was essentially cut in half last week, leaving the gap at $6.35/cwt.

Harvested head counts continue to reflect significantly negative packer margins even as boxed beef values continued to advance to new record wholesale levels, excluding the May 2020 pandemic-induced spike. Despite reported employee absenteeism at some plants last week, packer red ink and reduced cattle supply remain the main factors keeping a lid on harvest throughput.

A closer look at the Certified Angus Beef (CAB) carcass cutout report shows 52-week price highs on 17 cuts with all-time wholesale prices on four items. Three of the four record-setting cuts originate from the loin primal, including strip loins, top sirloins and tri-tips with inside skirts rounding out the list. Most impressive of these is the tri-tip, pricing at roughly $1/cwt. (+14%) higher than the previous record set in June 2021.

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite. Hamburger prices are simultaneously set to rise on the spot market as both, the required 50% lean trim from fed cattle and 90% lean from domestic cull cow sources, are seeing price inflation on tighter supplies and rising overall carcass values.

Cutout and Quality Strong

June typically brings on the largest fed cattle harvest volume of the year as both market-ready cattle supplies and consumer demand combine to move the increased volume. At the midway point, this June promises to underperform in harvested head count numbers, with the first two weeks already smaller than four of the five weeks beginning March 3.

Beef demand in May continued to impress as retail performance indicates fresh beef sales volume was up 4.7% while total dollars in sales were up 11.8%. Each of these increases were greater than those measured in fresh chicken and pork (Anne-Marie Roerink, 210 Analytics). The all-fresh beef retail price was down from April’s $8.50/lb. to $8.41/lb. in May, indicating consumers are shifting to lower priced beef offerings.

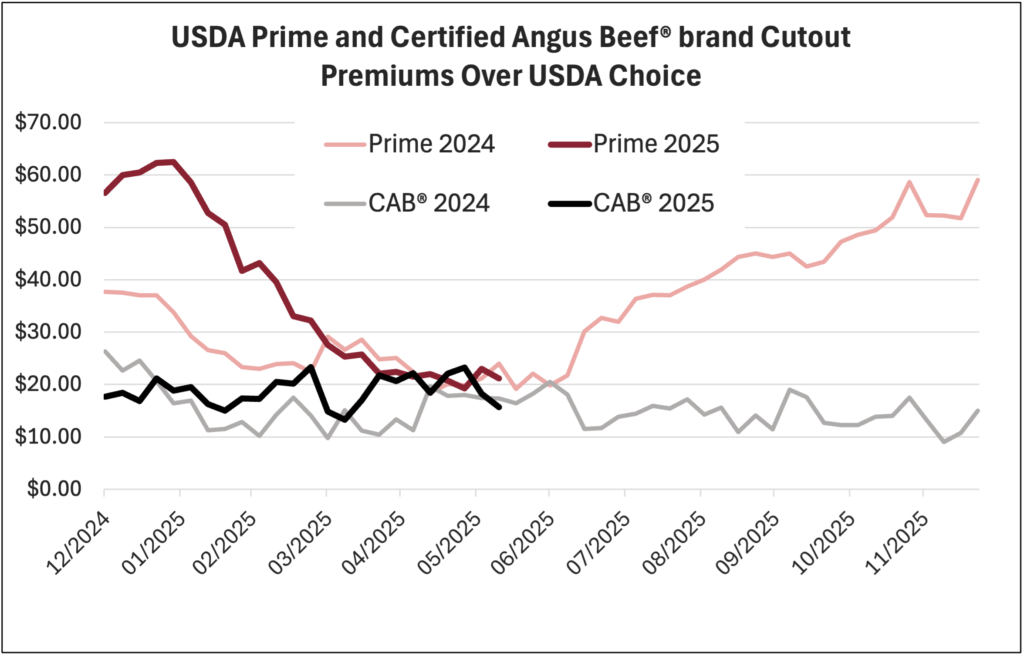

As great as May demand was, current beef cutout values are increasing at a pace sure to test consumer resolve. Last week’s Comprehensive Cutout value of $3.67/cwt. was the culmination of a 10.5% increase since the market made a momentary price dip in late April. More recently, the daily Choice cutout value has shot up 19-cents per lb. in the last 10 days to yesterday’s quoted $3.86/lb. The CAB cutout premium to Choice was $0.15/lb. ($15/cwt.) in last week’s report while Prime carcass commanded $22/cwt. over Choice.

The Prime premium is well below the $62/cwt. year-to-date high recorded in January. This is seasonally within expectation as the April-June time period has marked annual lows in the Prime-Choice spread in recent years. With Prime carcass production at 9% greater tonnage so far this year over last, the premium level exceeded that of 2024 by $20/cwt. on average, then matching last year’s pattern from April forward. Weighted average packer premiums for Prime carcasses have averaged $12.59/cwt. in the last two weekly reports, down from this year’s high of $23/cwt. in February.

The traditional Certified Angus Beef ® brand premium above USDA Choice dipped to $13/cwt. in early April, following the brand’s record-large monthly sales volume in March. Angus-type carcasses qualified for CAB brand standards at the rate of 42% for the period, topping out at the new record of 44.3% the second week in April. Traditional CAB cutout premiums returned to just over $20/cwt. in May but retreated to $15/cwt. in last week’s report as all carcass values soared higher.

Exceptionally small June harvest head counts have, so far, pressured prices to unprecedented levels. Quality-based premiums remain in the market and consumer beef demand has run unexpectedly high. Seasonal price weakness is historically appropriate from mid-June into July as temperatures heat up and consumers shift away from the pricier middle meats. Yet, if packer throughput remains low there would logically be a higher limit to the downside price trend this summer

Read More CAB Insider

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.

Big Shifts in Quality Grades

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages.

Tracking Premiums to the Source

Certified Angus Beef faced the same challenges in the formative years, as the first branded beef label set out to garner specification-based premiums in a market where none existed. Now in its 47th year, the brand has successfully carved out premiums over commodity USDA Choice from end to end of the carcass.