MARKET UPDATE

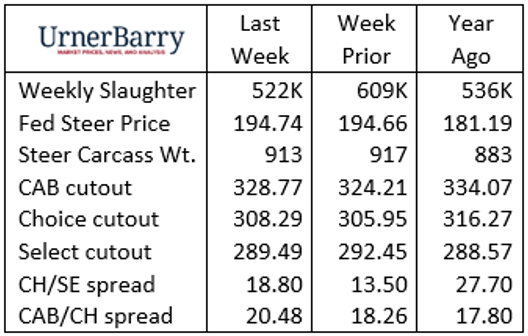

Last week’s Independence Day break created a smaller slaughter total at 522,000 head. This followed an upward adjustment to Saturday’s estimate, taking the day’s total to 47,000 head. Heavy rains caused Cargill’s Dodge City, Kan., plant to cease operations for a period of time last week, generating understandable concern. Yet beef industry packing capacity has not been fully utilized for many months and shifting the lost productivity to other facilities was quite feasible to support supply throughput.

Fed cattle have traded in a relatively stable price range for the past two weeks with continued strength and price leadership in the North at primarily $198/cwt. live and $312-$315/cwt. dressed. Texas cash trade continued at the bottom of the range last week at $190/cwt. while some Kansas cattle were sold to northern plants for $193/cwt. (after freight was factored).

Early this week, August Live Cattle futures traded at a deep discount to latest cash prices with a lower trend this Monday and Tuesday, creating a widening disconnect between the two.

Carcass cutout values are hitting their stride with a seasonal price peak emerging late, compared to a year ago. Last week’s comprehensive cutout was $6.03/cwt. higher than the prior week’s average, posting a 2024 high of $324.27/cwt. Historical patterns suggest a near-term decline through the summer slump as middle meat prices cool down.

The charts show continued, yet mixed, price support from untraditional beef cuts this summer as lean grinding material remains a demand driver.

Impressive carcass quality performance at Texas packing plants has pulled the state’s combined Choice and Prime production 2.8 percentage points above a year ago to 72.4% of the carcass mix. Breaking that down further shows the Texas Prime percentage at 6.3% following a steady build-up from 4% to start the year. While this is just over half of Nebraska’s Prime percentage, it’s not an insignificant contribution from the second-largest packing state in the country.

Weight Drop Arrives

Easily one of the top themes for the first half of 2024, carcass weights have averaged a 21 lb. surplus above the same time a year ago. In the past seven weeks, the weight increase bulged to average 32 lb. heavier than a year ago.

Latest confirmed data for the week of June 17 shows a carcass weight decline of 10 lb. over three weeks, pulling average steer and heifer weights down from the abnormally high 892 lb. position in early June. This is the first substantial weight decline since February, in a year featuring a steadily sideways weight trend throughout the spring. This stands in contrast to the classic industry pattern tracking carcass weights steadily lighter from November to the annual low in June.

This recent downturn has yet to fully culminate in an expected 2024 bottom, but the shift shows development of a seasonal trough.

Reports from several feeders indicate that the 2023 spring-born calves, now being harvested, spent more days in the feedyard this year than in more typical recent years. We know that days on feed, on average, have been building to longer durations for several years but 2024 will see the jump exacerbated. As well, weather through June in much of the larger feeding regions promoted efficient weight gains with temperatures uneven, yet generally cooler, than average.

Adoption of the feed additive Experior™ in steer rations has allowed feedyards to enhance lean muscle growth at the end of the feeding phase. Feedyards using the technology have acknowledged the benefit of extending feeding duration for cattle while keeping external fat accumulation in check, effectively increasing target finishing weights for steers.

One can easily surmise that this had measurable effects in keeping calf-fed steers in the feedyard longer this season than would have been practical without feeding Experior™.

As well, packers are pursuing more pounds of carcass per shackle while fed cattle counts are lower due to national cow herd contraction. These factors play together to promote the heavy carcass weights we’re currently observing and will certainly continue to see for many months to come.

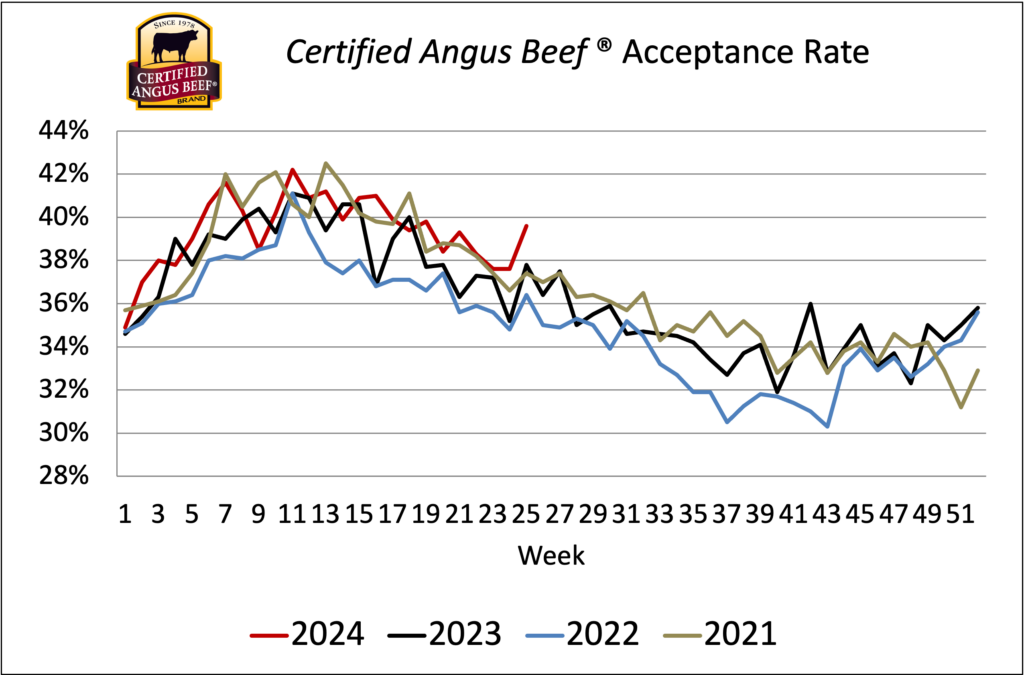

Tracking carcass quality alongside this atypical carcass weight scenario has shown that, on average, carcass marbling achievement has behaved in a seasonal pattern. Yet in the past two months, Prime quality grades have increased to challenge the record-high rates charted in 2020. Added days on feed and heavier weights have had the expected effect, increasing quality grades and Certified Angus Beef ® brand acceptance rates. Over the past six weeks, CAB acceptance rates have averaged 38.5% of eligible carcasses, 1.7 percentage points higher than a year ago for the period.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.