MARKET UPDATE

Regardless of which market we might discuss, “uncertainty” is an accurate descriptive term. U.S. equities are unsettled with interest rate hikes currently delayed but promised in March, according to the Federal Reserve.

This background has done little to settle the equity markets, and this spills over to cattle and beef. A couple of strong days headlined cattle futures this week, following up a very choppy futures trade a week ago.

Cash cattle trade this Tuesday found feedyards fairly bullish and packers equally responsive in the range of $140/cwt. Trade was regional at this price, but the $3/cwt. increase over last week’s average found feedyards willing to sell their better cattle.

A broader view of fed cattle prices for January reveals a sideways price trend, with very little tie from boxed beef values to fed cattle prices.

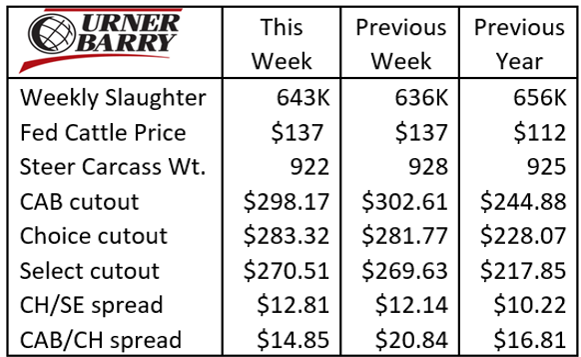

Packer efficiency improved last week, with an incremental uptick in the slaughter pace to 643K head, a 1.1% increase over the prior week. As we’ve reiterated many times before, larger slaughter rates are key to the success of every supply chain sector. There is no downside to larger head counts at this time.

The historical bias for beef demand for the month of February is lower. As a matter of fact, Feb. tends to be the low-demand month of the year. We can practically throw this aside in 2022 because of the smaller harvest pace.

Beef inflation is a two-pronged anomaly today. Of course, the broader economy is reflecting the inflationary conditions across all consumer goods. Yet retail beef prices continue to bear the added burden of the imbalance in supply and demand.

Boxed beef values last week were mixed, with the CAB cutout reported slightly lower but Choice and Select values a bit firmer. Early this week, the daily pricing shows a softer pricing trend across the board. Two primary factors are continued concerns of COVID and the fact that current retail beef price levels are record high for this time of the year, 20% higher than the same period last year. Regarding COVID concerns, end users are likely debating that normal Valentine’s Day beef demand will be lessened.

COW HERD IMPLICATIONS

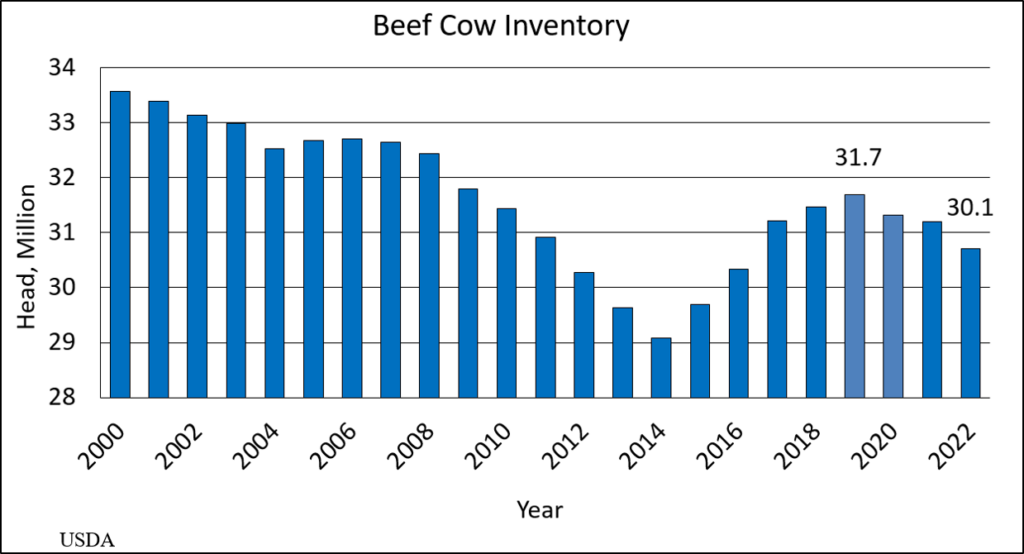

The USDA January 1 cow herd inventory, published this Monday, confirmed a 2% decline in the beef cow herd, along with a 1% decline in feeder cattle supplies. This is relatively in line with earlier estimates, although some had projected the beef cow decline fractionally smaller than the USDA number.

Implications moving forward for cattle markets remain unchanged due to this report, as these facts were already priced in to the market. Good news for cattlemen from a price perspective, as the outlook is quite bullish with smaller supplies expected to heat competition for feeder cattle. As we’ve noted, feeder and fed cattle futures contracts in the deferred months have priced this in for some time now.

In the near term, placements of feeder cattle have been robust in the fourth quarter and January is likely to show another strong month of placements. For the 2022 marketing year, this has front-loaded the calendar year with cattle directed more heavily toward feedlots. Fewer are going out to graze on small grain pastures due to dry conditions.

The second half of the year has risk toward fewer fed cattle supplies in terms of the typical seasonal balance. Of course, this has opposing implications for buyers and sellers of fed cattle during that period.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.