Strong CAB growth in retail

MARKET UPDATE

The disparity in fed cattle values between North and South has favored a premium for Nebraska and Iowa cattle since the spring. The weather-induced imbalance had only revealed itself to the degree of $1 to $2/cwt. until last week’s trade, when it widened. Southern feeders, under the pressure of ample market-ready supplies, traded early last week in a range of $107 to $109/cwt. while Northern feeders held firm until late-week when prices increased to the $111 to $113/cwt. range. The week’s average regional basis difference was $4.50/cwt., favoring Nebraska vs. Texas/Oklahoma fed cattle.

The federally inspected harvest was strong again despite the holiday-shortened week, with an estimated 573,000 head, compared to a year ago at 569,000 head. As had been predicted, June came to a close with a very large total harvest and what could be the largest monthly sum for the year.

Two weeks ago we discussed a price spike for Prime carcasses as supplies dipped to the spring low. That scenario has since become further pronounced, with the latest weekly information pegging the Prime cutout at +7% over a year ago. The commodity Choice cutout value is -1.5% under a year ago, bringing the spread between the two grades to $29.35/cwt.

The boxed beef trade saw a relatively subdued week because of the holiday interruption. The CAB carcass cutout value was fairly resilient in June even as the expected seasonal decline brings us most recently to a three-week lower trend. The total magnitude was just $5.52/cwt. lower, with Choice in the same pattern on a four-week decline of $4.72/cwt. Select product fell precipitously out of favor as demand for the lesser-marbled product waned. That pulled Select cutout down $13.74/cwt. over five weeks as the supply of premium-marbling beef just now starts to come off of the spring low.

While middle meat discounting has been a theme for weeks now, the CAB lip-on ribeye held fairly firm last week as 0x1 strip loins continued to falter. As far as primals are concerned, briskets are losing the most value recently but that’s predictable at this point in the season, as smoking demand tails off into mid-July.

Few robustly higher price quotes are noted. Items that did see positive territory include loin ball-tips, flap meat, flank steaks and CAB whole-muscle grinds across the chuck, round and sirloin.

SALES GROWTH STRONGEST AT RETAIL

Increases in CAB carcass supplies are essential for the brand to expand its reach with larger annual sales totals. Continuation of beef cow herd expansion so far in 2019 has added 1.2% overall fed cattle to the supply. Since the start of the brand’s fiscal year in October, the supply of Angus-type (CAB eligible) cattle has increased by 2.6% through May.

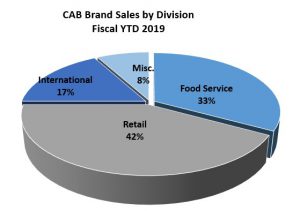

While recognizing the importance of supply, we actually track the success of CAB through sales tonnage, not through production volume of carcasses meeting the brand’s specifications. It’s sales of CAB branded product going out the packer’s door to a licensed end-user that factor in measurable results.

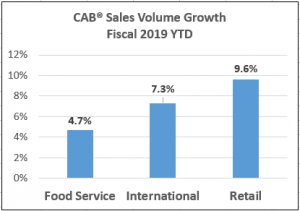

Fiscal 2019 has so far brought on sales tonnage volume increasing almost 6% with the June data not yet final. While many on the production side of our business quickly associate the CAB brand with fine to upper-end restaurant dining, the retail sector has been the growth leader so far with a hefty year to date increase of 9.6%.

It’s likely less surprising that 60% of those retail CAB sales came from end meats while just 21% were from middle meats. CAB Prime sales in the retail division have doubled in the year-over-year comparison, with over 9 million pounds being sold in the fiscal year so far.

What many may not recognize is the opportunity that CAB whole muscle grinds bring to the forefront in adding value to the CAB carcass at retail. The old mantra that “ground beef is ground beef” doesn’t hold up as consumers do recognize a difference in eating quality and texture from the 100% “A-maturity” product from the chuck, round or sirloin. Grinds have accounted for 19% of CAB retail sales so far this year and offer an opportunity for the meat department to add a premium beef item to their case that virtually every consumer can prepare easily.

TEXAS QUALITY GRADES DISSOLVE

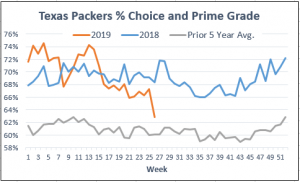

As noted in opening Market Update comments, the imbalance in market-ready fed steers and heifers is showing up in regional prices. Latest USDA grading data is playing out in quite the opposite fashion than one would expect, given that southern feedyards are weighted with more of the market-ready supply in contrast to the North.

The graph depicts a counterintuitive Choice and Prime quality grade decline with a one-week drop from 67% to 63% in the Choice and higher grading. This occurs as Nebraska and Kansas grades remain fairly stable, albeit fractionally lower than a year ago.

Assuming that the data is correct, the rational explanation is that packers are shifting the plant destination for some of their Texas purchases to their plants to the north to fulfill their head count needs in those facilities. This potentially leaves a weaker grading set of cattle to be harvested in the Texas plants, thus, the impact of lower quality grade shows up in the south where it would be otherwise unexpected.

Not only does this balance out supplies to the North, it also lowers overall packer input cost given the basis difference, freight withstanding.

DON’T MISS THE LATEST HEADLINES!

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.