850,000 Records say: Marbling Still Matters

by Miranda Reiman

Just missed it. Just missing a flight, a deadline for a major rebate, or watching your child’s winning shot at a ball game. The feeling is much the same.

What if you knew you “just missed it” when it comes to cattle qualifying for the Certified Angus Beef ® (CAB®) brand?

For many cattle across the United States that’s the difference in a marbling score of 492 versus 500. Those commodity Choice carcasses are just a few fat flecks away from upper two-thirds Choice and their share of the $50 million that packers pay each year for cattle earning that high-quality designation.

“I don’t think many producers know just how close they are to being ‘in the money’ so to speak,” says Justin Sexten, CAB director of supply development. “So many cattle sit right on that line and shifting that line ever so slightly is a big deal.”

Take selecting for Angus bulls with breed average marbling expected progeny differences (EPDs), for example. At 0.56, just moving that up to 0.81 would suggest a 25-point improvement of marbling score, or a quarter of a score. That would move them from “just missed it” to “made it.”

“That’s a potential 21% increase in supply to the CAB brand,” Sexten says. “For producers, that means thousands more cattle that could earn the average $40/head bonus.”

That’s just one take-away from the brand’s 2016 study that looked at data on nearly 40% of the Angus-influenced, or “A-stamped,” carcasses in three, two-week periods.

“It allows us to measure and monitor average characteristics on CAB-certified carcasses over time,” says Clint Walenciak, CAB packing director.

The analysis contains 850,000 records that include four of the brand’s 10 carcass measurements: ribeye area, hot carcass weight, fat thickness and marbling. The team also uses that data to look at what keeps cattle from making CAB.

“This information can then be passed along to producers as validation that they are still focusing in the right areas to produce CAB-qualifying cattle, or redirect if need be,” he says.

In each of five studies from 2008 to 2016, marbling easily rises to the top as the No. 1 reason cattle fail to qualify. In 2016, 92.6% of the A-stamped cattle that were kicked out had insufficient marbling. That’s compared to a high of 95% in 2012.

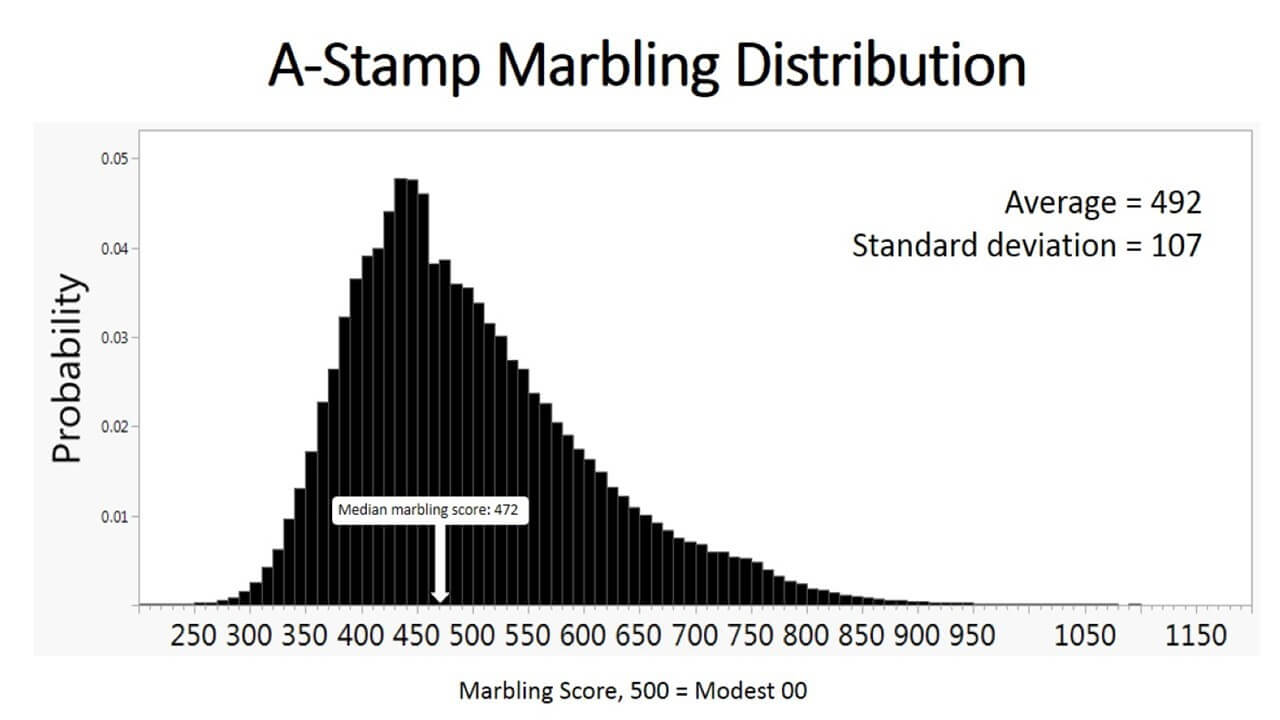

“It’s improving,” Sexten says. That 492 average marbling score, or low Choice, was 472 nearly a decade ago on the 1,000-point scale. “But that’s the barrier to entry here.”

Even though the average is very close to CAB’s marbling requirement of 500, the median is 20 points lower.

“Producers hear us talking about 75% of the cattle grading Choice and Prime and they might think, ‘Mission accomplished,’ and move on to another trait. But more than half of the Angus cattle fall short of the brand’s marbling requirement,” he says.

That’s why the focus continues on improvement through genetic selection and management. Some suggest the drive for quality has spurred the upward trend in hot carcass weight (HCW), Sexten says.

“They’ll say, ‘If you make them big enough, they’re going to meet your specs,’” the animal scientist repeats. The data show even at a relatively light 650 lb. HCW “there are a whole pile of cattle that marble.”

At the same time, there are a great many Select grade carcasses with heavyweight discounts. “Carcass weight is certainly an indicator,” Sexten says, “but it’s not a perfect relationship.”

In 2014, CAB moved to include up to 1,050-lb. carcasses, a 50-lb. increase from its prior specification, but Sexten says that was just to “to keep the brand relevant to all stakeholders.” Indeed, 9.1% of Angus-type animals now fail to qualify because of carcasses too heavy (though some would also fail to make CAB for lack of marbling). That’s compared to just 2.6% of them in 2008, when the brand’s limit was 1,000 lb.

“As cattle have gotten bigger, so have ribeyes,” he notes. CAB requires a 10- to 16-square-inch ribeye, and very few (.4%) fall short of the threshold, but more than a tenth (11.2%) of those cattle have ribeyes greater than the 16-inch cap.

“That’s really a concern for our foodservice partners, when it comes to portion control and plating, so we try to address variability with that specification,” Sexten says.

Only 3.5% of the records. were above the 1-inch back fat limit.

“Even during these times of record high grading, the fact is lack of marbling is still by far the leading obstacle that keeps cattle from our brand,” Walenciak says. “That’s been true historically and it is today.”

You may also like

An Ambassador for All

Joanie, with daughter Lindsey and her husband, Adam Hall, raise registered Angus cattle with two primary goals: producing high-quality seedstock that perform well in a wide variety of environments and ensuring end-user satisfaction. Those goals tie everything together, from promoting Angus to other producers to sharing their story with CAB partners and beef consumers.

An Unforgiving Land

What makes a ranch sustainable? To Jon, it’s simple: the same family, ranching on the same land, for the last 140 years. The Means family never could have done that without sustainability. Responsible usage of water, caring for the land and its wildlife, and destocking their herd while the land recovers from drought.

System Over Scale

For Dallas Knobloch, it’s not about being the biggest feedyard—it’s about building a high-quality system that works. Today, with Tory’s wife Sadie and daughter Ivy, the Knobloch family owns and operates 4K Cattle. They feed 2,500 cattle at eight locations within 10 miles of home, manage 1,000 acres of crops and run a 125-head cow herd, all near Hills, Minn.