Seasonal carcass trends intact

MARKET UPDATE

Fed cattle prices have seen little change since the last edition of the CAB Insider, with the most recent two weeks averaging $119/cwt. With no tie to cutout values, the spot market for fed cattle lies in wait for more equilibrium of cattle supply relative to packer processing capacity.

The latest 638K federally inspected slaughter total remains well below what the demand indicators suggest the trade could absorb. We’ll not dwell on what cannot be changed, but also look with great anticipation to a much larger slaughter total this week.

Regional prices show Texas and Kansas fed cattle prices declining less last week than prices paid in Nebraska. This suggests finished cattle supplies in Nebraska/Iowa have become a bit more plentiful compared to recent weeks. The quality grade trend in the north indicates the same, with an increasing Nebraska Choice and Prime grade.

The frighteningly steep rise in corn prices finally took a step back this Monday as widespread rain in the corn belt generated the expected lowering in CME Corn futures prices.. Even so, current feedyard cost of gain calculations create heart-stopping reactions for feedyards looking at values well above live cattle prices in a pound-for-pound comparison.

The spot boxed beef market has continued on a blistering pace with the Choice cutout over $3.00/lb. and the CAB cutout averaging near $3.20/lb. With the exception of May 2020, current price levels are historically high. Records high prices were set last week for ribeyes, briskets, tenderloins, sirloin flap, tri tips, outside skirts and flanks. Teres majors and chuck flaps also hit 52-week highs.

Loins accounted for a huge portion of cutout gains last week accounting for40% of the total, with ribs accounting for 14%. Foodservice and retail demand have both been very strong across the board. May is “Beef Month” for good reason, with Memorial Day and Father’s Day just ahead on the calendar. Consumers are itching to get outside to do some grilling and demand will be spurred on these factors.

Analysts and beef buyers had predicted that record high prices would tumble on resistance through sticker shock. This has yet to happen, and logic says that larger supllies will be necessary to loosen up spot market boxed beef availability. The trade is looking for a 660K+ harvest total this week with hopes of many more weeks at that level through June.

SEASONAL CARCASS TRENDS INTACT

Cattle and beef markets the past two years have conditioned us to expect the unexpected. Several fundamentals are “upside down” in the total beef complex, but a few are behaving in relatively seasonal fashion.

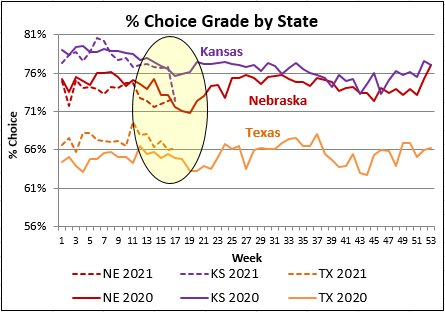

Of course, we frequently review carcass grading trends and have watched with interest as the March quality grade records turned slowly lower from 86% Choice and Prime. The normal downturn has been a bit slower to develop as year-to-date carcass weights have averaged 8 lb. heavier than the once record-high 2020 weights. Lack of currentness in the feedyard sector receives most of the credit surrounding the topic. It’s true, the grade would not be as rich with fewer feeding days and lighter weights. But let’s not rob ourselves of the credit due to the quality of genetics the production sector has propagated.

The downtrend in carcass grades has hit the charts with full force in the latest USDA report. Kansas packers lost 4.35 percentage points in the Choice category to average 72.4% Choice across their plants in the last week of April. The Prime grade didn’t soak up the difference this time, as Kansas Prime carcasses were fractionally fewer. They had been 11.6% of the total for four weeks.

As we move swiftly into the youngest of the spring-born calf-fed cattle, quality grades decline like clockwork. This was even true of this period a year ago, before cattle were backed up in the harvest schedule.

The demand side of the market is hungry for Choice and higher boxed product as we eye grilling season. This marks the spring antagonistic market when quality demand spikes and the carcass quality mix dips. We’ve yet to see it in the CAB carcass counts, but smart money favors some decline.

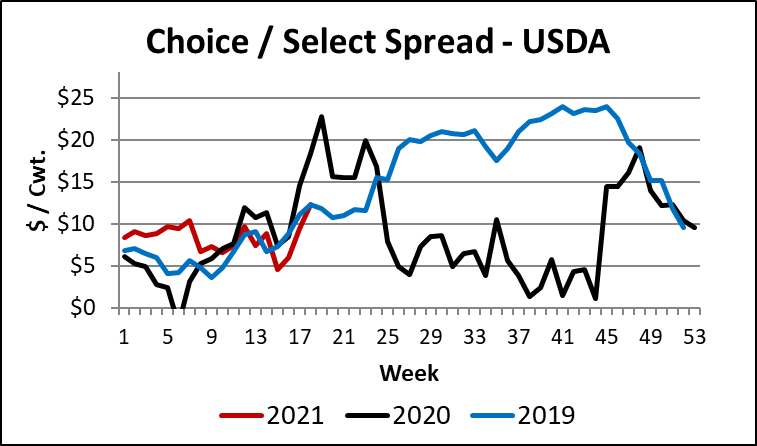

We acknowledge that the base price is the most significant price for cattle feeders, and lately quite a disappointment. Yet if there’s a bright side in the month of May it’s that the quality price spreads are beginning to take shape in response to demand. Latest figures peg the daily Choice/Select spread just over $15/cwt. That’s $3/cwt. narrower than a year ago, but the 2020 data is inconsequential for this period.

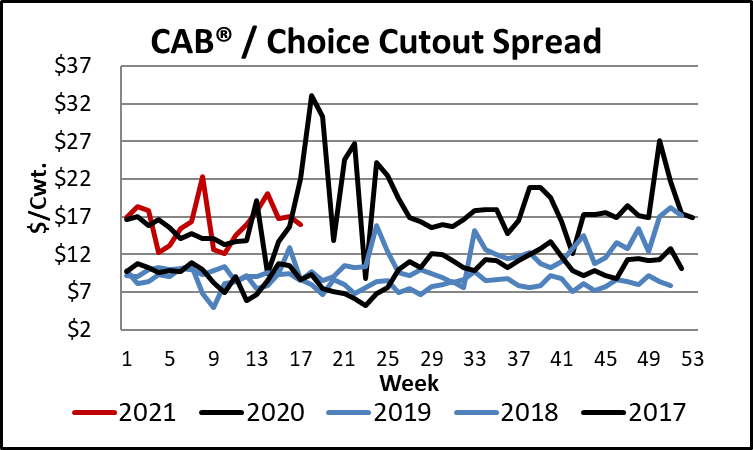

CAB product supplies are tight on the spot market, even as we log the largest certified head counts in history. The CAB/Choice cutout spread in last week’s data at $15.92/cwt. was $1.08/cwt. lower than the week prior. Yet the trend is decidedly higher than in recent normal years, ranging from $6 to $8/cwt. higher than the same week in 2017-2019. Average CAB grid premiums bumped up to $5.78/cwt. That’s a respectable average considering the latest weekly supply is roughly 12,000 head larger than the previous record for that week in 2018.

LABOR ISSUES ABUNDANT

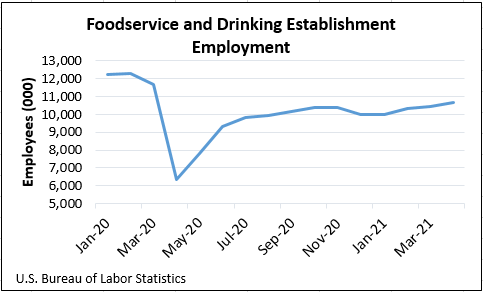

The agricultural industry is familiar with labor issues as a perennial topic, rather than a post-pandemic problem. However, labor shortages in today’s restaurant trade are entirely consequential of the pandemic. The U.S. Bureau of Labor Statistics pegs employment growth in the restaurant and drinking establishment sector at 30% from 2011 through January 2020.

As restaurants continue to see restrictions lifted, there are plenty of businesses eager to answer consumer demand for normalcy, including dining out. Federal unemployment benefits have partially undermined the restaurant sector’s demand for workers. Another large portion of the trade’s personnel found other employment months ago, when they were laid off indefinitely.

Restaurants are struggling to fill positions as capacity restrictions are expanded and lifted. Many establishments have resigned to fewer hours of operation or cutting a day of operation from their work week in order to give their weary staff time off. Examples of signing bonuses and 90-day continuous work bonuses are plentiful.

Current beef commerce is focused on the labor shortage in the packing sector, but end users are facing many of the same problems. We know that foodservice activity has been a big factor in current beef demand fundamentals. But those firms’ ability to move the product hinges on having staff members to prepare and serve it to the public.

Read More CAB Insider

Progress, Not Complacency

Beef demand has been exceptional because of dramatic increases in consumer satisfaction for a few decades. Since taste ranks at the top of the list when it comes to what drives consumers to choose beef, we know where our figurative “bread is buttered.”

Cutout and Quality Strong

Summer weather has begun to set in with more regions of the country set to experience hotter temperatures. This means the traditional turning of consumer focus toward hamburgers and hot dogs rather than steaks, the spring favorite.

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.