Grid values improve, grade runs high

Market Update

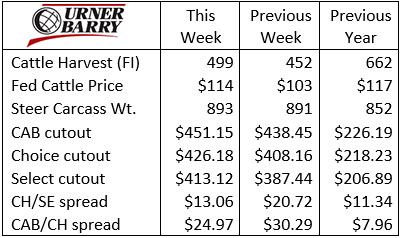

Last week’s federally inspected cattle harvest brought a much brighter outlook to the supply chain, as it marked a two-week continuance of increased head counts in the country’s packing facilities. A one-week increase of 47K head brought the weekly total to 499K head. That’s just over 1,300 semi-loads of cattle, and a great jump in the right direction.

Of course, packers have a long road ahead to get throughput within a reasonable proportion of normal capacity. Regardless, we’ve already moved from 60% to 75% of the volume seen a year ago in the latest report.

This Monday brought on an overall 9% increase in the cattle harvest and 14% larger steer/heifer counts compared to the prior Monday.

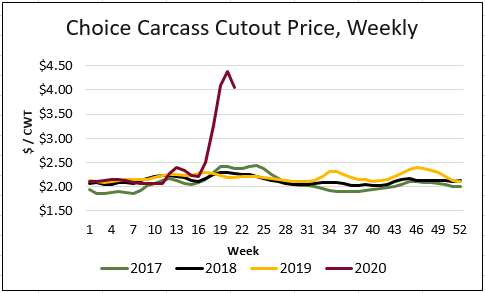

Carcass cutout values reached all-time highs last week, with the weekly average CAB cutout value touching $451/cwt.

Last Wednesday appears to have been the peak as the Choice cutout value hit $478/cwt. in that morning’s report. The descent began quickly as that metric had fallen to $434/cwt. by Friday afternoon.

Questions about beef pricing abound, as consumers join retail and restaurant protein buyers navigating these daunting prices. With record prices hitting right in the middle of Beef Month it’s definitely not a healthy environment for beef demand.

Ground beef may be the most obvious pain point for consumers as retail meat case prices in the range of $6 to $7/lb. are abundant. While it’s difficult to identify the extreme topside of the price range, examples have shown some grinds up to $10/lb. That pricing does not even describe the grass-fed or other niche label product.

Boxed beef cutout prices have fallen 14% since last Wednesday, with this Tuesday afternoon’s Choice quote down to $397/cwt. for product shipping within 10 days. This is a needed trend and a further reduction in cutout values is to be expected as long as harvest levels continue to ramp up.

GRID VALUES IMPROVE, GRADE RUNS HIGH

The slowdown in the packing sector is having a notable impact on beef carcass outcomes. The latest USDA confirmed data pegged steer carcass weights at 893 lb, 41 lb. heavier than a year ago. The added carcass weight and days on feed are generating the expected increase in end-product marbling scores and resulting quality grades.

The 82.8% combined Choice and Prime quality grades easily set an all-time grading record for the week of May 4th. This specific period in May normally sees marbling in beef cattle reach annual lows as the youngest of the spring-born calf-feds are harvested. We’re currently seeing a dramatic departure from this seasonal norm as the backlog of finished cattle are held on feed longer than normal.

From a beef demand perspective, nothing is normal as we are just a week removed now from all-time cutout highs. However, end-users are still buying what beef they can and consumers are generally clearing meat case inventories. Possibly the millions of Americans stuck at home under the orders of their respective states are more motivated to get outside and grill a steak for Memorial Day than ever before.

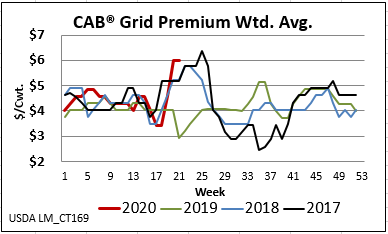

Pricing on the boxed beef and retail side has been unprecedented, but the quality grade spreads and CAB product price differentiation remain mostly intact. This is a reasonable market reaction when all beef products are in short supply and consumers still prefer quality.

USDA data shows that packers have adjusted grid premiums higher for CAB carcasses as well. Whether lasting or not, the market has abruptly changed in this regard. Just a month ago we commented on the narrower grid premiums for higher marbling product, particularly due to the dropoff in middle meat demand at that time. Fed cattle harvest dipping to 60% of normal, coupled with the resumption of higher levels of restaurant trade, has generated some higher prices for premium beef.

We should continue to draw reader attention to the Prime grade while we’re focusing on premium beef pricing. The proportion of carcasses grading prime continues to outperform history for the same reasons stated above. In fact, the U.S. average Prime percentage has grown unseasonably high to 11.6% in the latest data, whereas the Choice grade share is roughly similar to a year ago. Again, total Prime tonnage remains hampered by the smaller harvest levels, so there is no abundance of Prime supply. However, restaurant trade is certainly not at pre-COVID-19 levels and the comprehensive beef price reaching record highs has generated buyer pushback.

The Prime boxed beef price is within expectation at $15/cwt. higher than Choice in the latest report. However, the Prime over “branded” beef price spread is just $1.43/cwt. This suggests that buyers are currently willing to pay a significant premium for branded product (most of which is the CAB brand) but not much more than that for Prime. Packers are currently paying an $8/cwt. premium for Prime carcasses in relation to Choice, just $2/cwt. higher than a Premium Choice, CAB carcass.

Restaurant reluctance

The dine-in foodservice industry continues to be positioned very poorly in many states, depending on COVID-19 regulations. As if temporary closure to dine-in business weren’t problematic enough, many have been surprised with states relaxing that policy faster than anticipated. Restaurants were unprepared for a return to a larger business volume and had largely cancelled beef orders or drastically reduced them. Record beef prices have just added insult to injury for these firms as they’ll now have to creatively price their menus or offer a limited selection of beef dishes, based on price.

In the wake of their many challenges, many restaurateurs have gone to their landlords to renegotiate their rents. This is a necessity as their business plans and revenues will need to factor smaller hourly customer flow. The loss of lucrative crowded bar environments is no small factor as margins on alcohol and beverages are normally better than food items. With no known ending date to the 25% or 50% occupancy restrictions, adjustments need to be made to make the new business model work financially.

Some restaurateurs have noted that they’re not interested in reopening for full dine-in business at anything less than 75% occupancy. The costs associated with returning to a fully-staffed front and back of the house labor force will outweigh their income on fewer meals sold per hour. Not to mention, some of the potential foodservice labor pool has reportedly been difficult to incentivize to work due to bolstered unemployment benefits.

DON’T MISS THE LATEST HEADLINES!

Fine tuning your herd

Forward motion

Faith and flexibility

Committed students earn Colvin Scholarship

Read More CAB Insider

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.

Big Shifts in Quality Grades

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages.

Tracking Premiums to the Source

Certified Angus Beef faced the same challenges in the formative years, as the first branded beef label set out to garner specification-based premiums in a market where none existed. Now in its 47th year, the brand has successfully carved out premiums over commodity USDA Choice from end to end of the carcass.