Continued growth and demand

MARKET UPDATE

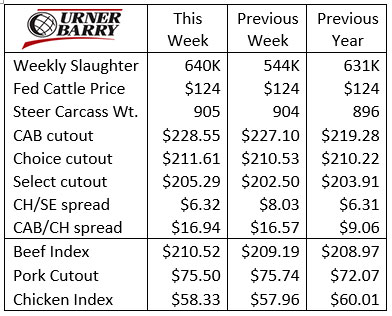

The fed cattle market continued on the same track last week remaining at $124/cwt. Fed cattle prices have now increased for 18 straight weeks basis the USDA 5-area Weighted Average Direct Slaughter Cattle report. The run has seen prices improve by 25% since the annual low of $99.92/cwt. reached the week ending September 13th.

CAB carcass supplies in the last two weeks of December were a bit stronger as the percentage of eligible carcasses meeting all 10 specifications rose to 36.3%, about 1.5 percentage points higher than a year earlier. That amounted to 1,122 more carcasses for those two weeks in the year-on-year comparison.

Packing firms are seeing seasonal tightening of their operating margins caused by the aforementioned higher cattle costs aligning with lower boxed beef values.

The comprehensive carcass cutout price has declined 10% from the $234/cwt. fourth quarter high achieved in early November. Many of us are quick to point to fourth quarter demand drivers in the super-inflationary pricing of ribeyes and tenderloins for the December holidays.

Those cuts are definitely seasonal favorites but as we look at the cheapening of the total carcass cutout value from the November high through December, the lower trend is shared across many subprimal cuts. For instance, the chuck and round primals underwent 11% and 8% price declines from early November to year’s end. In comparison, rib and loin primal price drops were 16% and 13%, respectively. This doesn’t negate the positive impact that marbling-rich middle meats have on the market during this time period.

Seasonal supply/demand shifts emerge

A new calendar above the desk means more to the beef business than it may to other enterprises. The passing of December holidays signals the end of late-year market popping demand for marbling-rich middle meats. To say that demand has fallen off is untrue, but carcass cutout values for those items shift back towards normalized levels with notable seasonal changes.

This demand shift has a big impact on dollars returned to the cattle feeder during the first quarter. The accompanying chart displays the relationship of the Certified Angus Beef ® brand (CAB) carcass price to Select carcass price on a quarterly basis for the past four years (blue bars). Also illustrated is the quarterly supply of CAB carcasses as compared to the annual total.

In each of the past four years CAB carcass supplies in the first quarter of the year averaged 96% of the weekly average for the year. This stands to reason given that total weekly fed cattle harvest is lower in the first quarter on smaller total supplies. However, Choice and Prime quality grades during this period run near their annual highs as a portion of the whole. CAB carcass certification rates are often at their highest in the first quarter as well, but the net volume based on improving marbling rates can’t overcome the smaller processed head counts.

All of this sets up the observation that seasonality of demand plays a particularly important role in the first quarter of the year. While CAB carcass production (supply) is lowest during the first quarter, the premium for CAB carcasses on the end-user side is also lowest (demand) in the first quarter in the most recent four years.

The CAB cutout above Choice last week was above $16/cwt., a lagging effect of smaller December supply, potentially. How this plays out in the next few weeks will be interesting as the Choice/Select spread has behaved much differently with that price gap at a very narrow $2.46/cwt. just yesterday. These are two different trends within the graduated scale of Select on up through Certified Angus Beef ® brand product.

This being the case, feedlot operators and those retaining ownership should simply recognize the seasonal decline in quality premiums which tend to rapidly widen again in the spring.

2019 yearbook, continued growth and demand

As we charge headlong into 2020 it’s instructive to take a quick look at the numbers that we’ll mark in the annual yearbook.

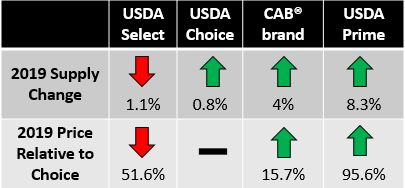

From a production and sales volume perspective we’ve built a story for 2019 indicating larger USDA Prime supplies as the Prime grade trend held stronger for the year, even as Choice volume was challenged in the second half of the year. Certified Angus Beef ® brand Prime supply was likewise higher with category growth of 36% on the year with most of that growth at retail. Just as some might have thought that demand for premium quality beef was maturing, paradigms have had to shift.

This leads us to address short versus long-term thinking. Some may look at the rapidly narrowing Choice/Select price spread in the commodity market and formulate a theory that quality is important only part of the time. Considering that alternatives in marketing a pen of finished cattle today is certainly impacted by this fact. However, let’s not cloud the issue with short-term seasonal tendencies.

Building a story of trends across years, however, shows that we’ve produced more high quality beef again in 2019 than ever before. Simultaneously, the price spreads between the grades and for the CAB brand also widened.

DON’T MISS THE LATEST HEADLINES!

Read More CAB Insider

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.

Big Shifts in Quality Grades

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages.