A Look Ahead at Early 2022 Dynamics

MARKET UPDATE

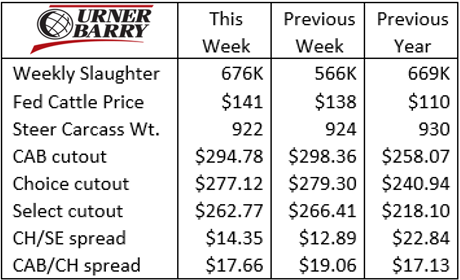

The fed cattle market rally continued in full force through last week with the five-area weighted steer average up to $140.67/cwt. The trading range was $140 to $142/cwt. in the north and mostly $142/cwt. in the south.

The past six weeks have brought about an $18/cwt. increase in values, a 15% increase for the period, a welcome change from the 20-week period where prices remained stagnant between $120 and $125/cwt.

Supply and demand fundamentals are driving the current market. The noted cash prices are premium to the December Live Cattle contract, at $137.90/cwt. as of this writing.

Last week’s huge slaughter total of 676K head is reflective of the catch-up slaughter schedule that packers ran following the prior holiday-shortened week. This remains the case to start this week, as Monday’s steer and heifer slaughter total was 96K head, a respectable sum in today’s packing environment.

Looking through the end of December, we might venture to guess that there’s not a lot more upside in fed cattle prices, given that end product prices continue to pull back in typical fashion as we get closer to the Christmas holiday. With cash premium to futures, the scenario suggests feeders become a little more willing to sell cattle at current prices rather than wait a week or two.

Looking at high-quality beef in the market, the price spreads between grades, including the Certified Angus Beef ® brand premium to low Choice, are very much aligned with where they’ve been in the past two years during December. With holiday wholesale buying demand dropping off within reasonable seasonal fashion, the spreads tend to narrow through year’s end.

A LOOK AHEAD AT EARLY 2022 DYNAMICS

December has started off on a high note in the fed cattle sector and all of us on the cattle side of the supply chain should be made well aware of what’s ahead in 2022. We’ve recently discussed feed and weather-related pressures shrinking the beef cow inventory. Industry analysts predict further contraction of the herd in 2022, pulling feeder calf supplies lower for the next two years.

As the cattle markets look more optimistic in the near term, it becomes easy to take an eye off of the goal for a minute. As prices rise, the bottom half of the cattle supply becomes more valuable, in step with the top half. Yet, the need to differentiate the best cattle from the average never fades. With corn costs projected for the next year to average in the high $5/bushel range, the cattle with the ability to gain quickly and convert feed to pounds of beef efficiently will be vastly more valuable to the cattle feeder.

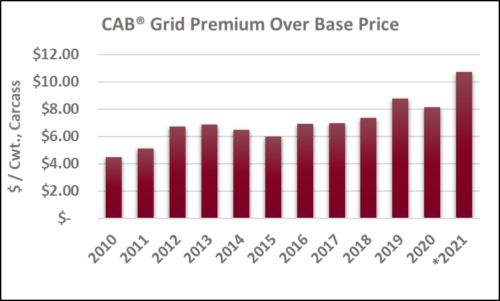

On the output side of the ledger, let’s take a look at what will be required to compete from a carcass quality perspective. Returning leverage to the cattle sector means that some will become complacent regarding carcass quality targets. Yet packers, regardless of their margin position, are serving a customer base – the end users that have become accustomed to higher quality beef in the modern era.

With more and more firms featuring premium Choice and Prime, such as the Certified Angus Beef ® brand, there is no going back to commodity beef. We’ve featured many examples in the CAB Insider regarding the widening price spreads supporting that very concept. We know that we have a lot of customers to fulfill with a “best in class” eating experience, and a lot of competition in the market to purchase the product.

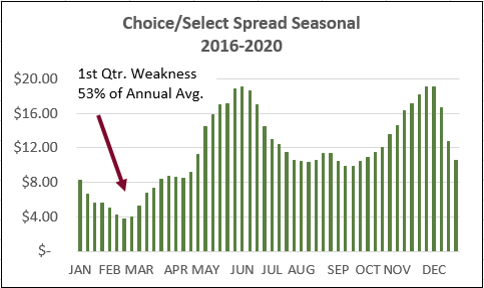

As we move forward into the first quarter of 2022, we will most likely see the seasonal decline in carcass quality price spreads. That’s to be expected, but make no mistake, the fireworks will return, likely in the middle of the second quarter. The spreads will widen when supplies of richly marbled carcasses tighten and consumer grilling demand rears its head again.

Despite the struggles that are never too far removed in production agriculture, it makes sense to seek out the high-return areas of the market. It’s an exciting time as we take a look at the near-term future of the beef cattle business. Positioning one’s self to not only be successful, but highly successful, when the slack is pulled tight in the supply chain is a wise philosophy for those that have toiled through darker times.

RIB DEMAND DROP HITS CUTOUT VALUES

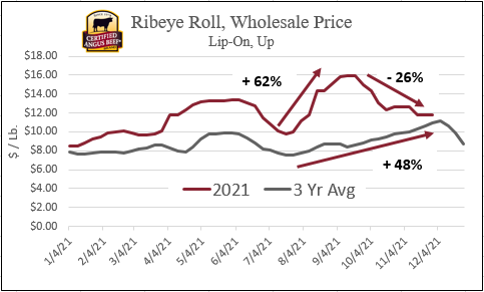

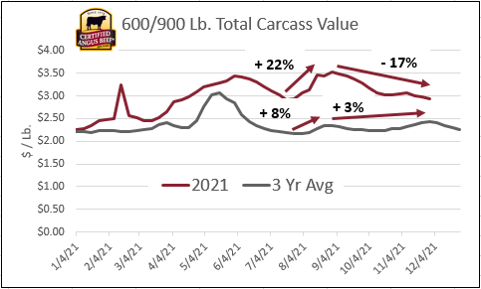

In mid-September we highlighted the dramatic upward move in carcass rib primal values. The 2021 rib marketing year presented an anomaly as CAB®, lip-on ribeyes saw an amazing 62% price increase from the middle of July through mid-September. The previous five-year average for the same period spawned a much softer 15% increase.

In the September Insider we also reviewed the Suspended Fresh (trade name) technology, whereby beef product can be procured at what would normally be a seasonal low price and taken to an almost frozen, technically still fresh, temperature. Product is then marketed at a later date and higher price point just in time for heightened consumer demand, such as the period just before Christmas.

This new-era phenomenon appears to have taken hold in 2021 to an exaggerated degree. So much so that the “opportunity buy” on ribeyes during the late summer period, when prices are typically low, had wholesale buying ramped up to the point that record high ribeye prices were realized in September. It’s reminiscent of piranhas in a feeding frenzy.

Moving now into the present time we’re seeing significant price pressure for ribeyes, translating to a contra-seasonal decline in ribeye values and smaller buyer interest. Undoubtedly, ribs have been pre-purchased in the scenario outlined above, as well as the pre-booked business removing spot market activity from the market at present.

This abnormal market activity has ribeye prices currently dipping to fourth-quarter lows in the spot market, rather than realizing seasonal high prices in late November or early December, as is the historic trend. Since the rib primal carries significant weight relative to total carcass value, it’s no stretch to blame the rib buying phenomenon for what we’re now seeing as an unseasonal total carcass cutout decline in the fourth quarter.

Read More CAB Insider

Onward with Quality

It’s been a quality-rich season in the fed cattle business with added days on feed and heavier weights continue to push quality grades higher.

It’s Beef Month

Wholesale and retail beef buyers have been preparing for weeks ahead of the spike in consumer beef buying associated with warmer weather and holiday grilling demand.

USDA Prime Eclipses Select

In a twist unthinkable just two decades ago, USDA data reveals that the current percentage of Prime carcasses has averaged 11.9%, surpassing Select carcasses that are averaging 11.1%, in each of the last five weeks.