Quality grades lower, production factors shift

MARKET UPDATE

The fed cattle market continues to trade in a fairly wide range from the northern feeding region to the south. Texas continued the July trend holding the bottom of last week’s range at $118/cwt. to $120/cwt. while Iowa and Nebraska picked up the top of the range from $120 /cwt. to $125/cwt.

The wide trading range throughout July has been constant, due to more market-ready cattle on feedyard showlists in Texas than normal. July CattleFax data reported the Texas showlists 23% smaller, on average, than a year ago, but 140% of the average from 2015 to 2019.

In contrast, the Colorado and Nebraska showlists have averaged just 102% of the 2015 to 2019 average. The comparatively smaller inventory of market-ready cattle in the north has driven more bidding competition.

The Choice/Select spread has remained unseasonally wide after marking a record of $35.68/cwt. in mid-June. Urner Barry data shows a 47% reduction in the spread, up through last week’s average of $18.83/cwt., However, this is still the second highest Choice premium since the $21.29/cwt. premium seen the same week in 2019.

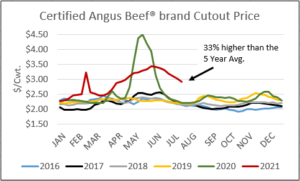

Carcass cutout prices through July have dropped in very seasonal fashion with the CAB cutout down $53/cwt. from the June high of $343.10/cwt. Last week’s price at $290.91/cwt. is still 23.8% higher than a year ago. Beef buyers continue to look for more price deflation, but may find that competition will pick up again. Buying for Labor Day holiday needs will likely see cutout values finding traction near term. Beef prices typically catch an uptick from now through mid- to-late August, before heading lower again in September.

Beef demand remains the bright spot on the horizon for the production sector. The promise of demand trickling back through the supply chain to product origin is impossible to take to the bank. We’ve seen great demand in 2021 despite inflated retail prices. We’ve reported that demand for high quality beef has long been on the rise, but to observe the quality premiums noted above in a period where retail prices are second only to pandemic-induced packing slowdowns is quite an amazing thing to witness.

The unfortunate reality of the western U.S. drought this year is accelerating cow herd reduction and will continue to do so into the fall. It’s disingenuous to suggest that fewer cows are better for the industry when it comes at a cost to thousands of ranchers by way of forced culling. The impact of this culling will be rapidly felt as the cattle supply becomes aligned with slaughter capacity.

QUALITY GRADES LOWER, PRODUCTION FACTORS SHIFT

This summer many of us have had our eyes on carcass weights, grading trends and days on feed as they relate to the fed cattle sector. These factors have been set on abnormal paths since the onset of the pandemic and accompanying backlog over a year ago.

Carcass weights and days on feed directly affect carcass marbling and quality grade achievement. Weighted average steer and heifer carcass weights topped out at the 900 lb. record last October. A correction in carcass weights has been much slower than many had anticipated. Burdensome fed cattle supplies have remained a factor under smaller weekly slaughter head counts. Latest carcass weights are just 17 lb. lighter than a year ago, but 23 lb. heavier than the same week in 2019.

Added days on feed have been another well-publicized feature of the pandemic casting an extended shadow well into 2021. The number of cattle on feed for 150-plus days in 2021 had come close to the 2019 total by April this year, but the June report pegged the number at still 12% excess of the June 2019 number.

Throughput has not yet been rapid enough to return feedyard currentness to pre-pandemic levels. This is slated to be achieved more readily in the 3rd and 4th quarters.

Carcass quality grade trends have held Choice, CAB and Prime percentages similarly at record highs under abnormally high carcass weights and days on feed. However, seasonal grade patterns have not been lost, as the trend lines have simply marked new highs through the seasonal ebb and flow.

The combined share of Choice and Prime carcasses in 2021 ran at record highs through the 1st quarter and a portion of the 2nd. It wasn’t until early May that the spring carcass weight decline, acting more normally this year than last, pulled the Choice and Prime carcass total below 2020.

This June and July, quality grades lowered more rapidly than anticipated. The arrival of the spring low in carcass weights came two to three weeks later than normal, providing a possible clue to the faster grade decline.

The Prime grade has declined from its May high of 12.6% to the mid-July 8.4%, the lowest so far in 2021. With fewer Prime carcasses, the Choice grade captured a few more carcasses, holding the Choice percentage just fractions of a percentage below the prior year for the same period.

Carcasses certified for the CAB brand are also holding fairly steady as the proportion meeting brand carcass specifications has run either side of a year ago for weeks in the 37% of all eligible cattle. This is down from the 42% record highs seen this spring, but still in record territory for June/July.

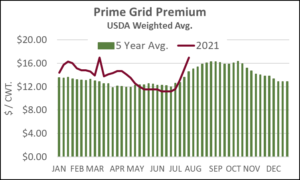

The CAB Insider has thoroughly covered the record Choice/Select spread and continued premium in the quality market so far this summer. Noteworthy on the pricing front most recently is the reaction of the Prime grid premiums being paid by packers in reaction to the dip in Prime carcasses. The increase falls in line with the seasonal tendency for increasing Prime premiums beginning in August. The current Prime premium jump from $11/cwt. to $17/cwt. in a matter of three to four weeks is a stronger increase than that seen in the five-year average.

CAUTIOUS OPTIMISM

The Market Update calls out strong 2021 beef demand as an optimistic driver for the beef complex. The opinion isn’t unique to the Certified Angus Beef ® brand, as CattleFax and other analysts have drawn strong attention to it. With that said, it’s wise to consider risks that can threaten beef’s position in the market.

July boxed beef prices have followed the seasonal “rule” for the dog days of summer with relaxed values on many beef subprimal cuts. A lower short term trend has not, however, brought prices near the more traditional price ranges seen in most recent “normal” market years of 2015-2019. Inflation is everywhere and logically beef should not be exempt. However, beef and other food items have not enjoyed the same inflation as other goods, historically.

With this said, the looming question is whether consumers will continue to demand beef in similar quantities as they have in recent years. The current CAB cutout value is 33% higher than the previous five year average. The price also varied no more than 3.6 percent in any of the years from 2016 to 2020 for the most recent week of July 19. The future may be brighter with more consumer dollars spent on beef. That chapter is yet to be written.

Read More CAB Insider

It’s Beef Month

Wholesale and retail beef buyers have been preparing for weeks ahead of the spike in consumer beef buying associated with warmer weather and holiday grilling demand.

USDA Prime Eclipses Select

In a twist unthinkable just two decades ago, USDA data reveals that the current percentage of Prime carcasses has averaged 11.9%, surpassing Select carcasses that are averaging 11.1%, in each of the last five weeks.

Carcass Quality Spreads Pop

High quality steak and roast items such as ribeyes, strip loins, tenderloins and sirloins carry an outsized share of the load when it comes to generating pricing separation up and down the carcass quality spectrum.