MARKET UPDATE

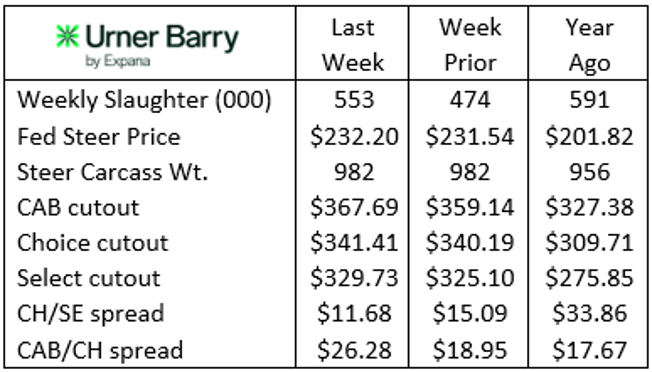

As we wrapped up 2025 and the calendar turned to 2026, two holiday-shortened weeks of federally inspected cattle harvest pulled head counts down to 425,000 head and 474,000 head. Last week’s 553,000 head was not a decisive return to pre-holiday volume as the week’s total was the second smallest since mid-October. Fed steer and heifer volume was 445,000 head, compared to 4th quarter non-holiday weekly averages of 464,000 head and all 4th quarter weeks at 436,000 head. Looking to the first quarter, feedlot turnover rates should continue on a slow pace with added days on feed remaining a theme, and the expectation is for smaller weekly totals. Assuming the U.S. border reopens, CattleFax is projecting a 600,000 head decline in fed cattle harvest for the year. That eventuality is not a given, while a change to the current policy would not increase fed cattle supply until the second half of the year.

Adding disincentive to increase production volume, packer margins are estimated to be at more than $200 per head in the red, according to latest reports.

The comprehensive carcass cutout value began the year with the first week’s average at $353/cwt., 8% higher than the January 2025 average. The first three full weeks of 2025 featured fed cattle harvest volume of 485,000 head. Continuation of smaller weekly head counts is likely to hold wholesale boxed beef prices on a higher plane.

Mid-way into January, seasonal focus has shifted from middle meats toward the more favored winter end-meat roasting cuts. Wholesale cut prices are reflecting major downward corrections with ribeyes and tenderloins dipping below spot prices of the last two years. It’s yet to be seen if retailers will take advantage of the opportunity to buy a volume in the spot market to entice consumers to the meat case.

Price Speaks Volumes

Whether it’s calves, fed cattle or boxed beef, staying current with relevant price information has been an everyday task in the beef sector. Volatility is a tired term in the modern era, even with the exclusion of major industry news.

Running headlong into 2026, the cattle market is ablaze with feeder cattle generating a highlight reel of prices in the first two weeks of January. It’s as if the industry awoke on January 1 to realize that projected declines in feeder calf supplies were suddenly truthful.

On the the end-product side of the equation, there have been recent seasonal undulations as new record carcass weights were charted—accompanied by a record share of 87% Choice and Prime carcasses for the past four weeks. Certified Angus Beef® brand certification has been steady for the period, near 37% of Angus-type carcasses qualifying. As carcass weights touched new records in the fourth quarter, a disproportional number of those were excluded from the brand as they exceeded 1,100 lb. weight limit specification.

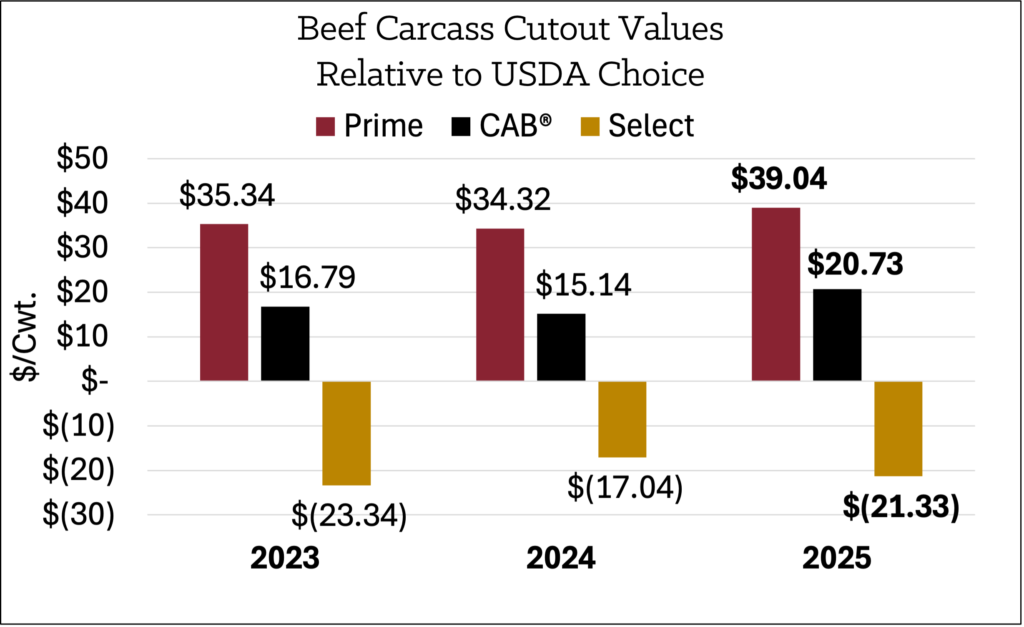

With USDA Prime carcass tonnage (including CAB® Prime) record-large again in 2025 we revisit price spreads up and down the quality grade and branded product offering. Even as Prime carcass supply increased 11% on the year, the annual average Prime premium increased to $39.04/cwt.above commodity Choice, up $4.72/cwt. for the year. The record $56.21/cwt. annual Prime premium, set in 2022, is unlikely to be tested again anytime soon.

CAB carcass counts were the fifth largest in brand history for the fiscal 2025 and just 3% fewer than a year ago on the calendar year. Yet the year’s advance of $5.59/cwt. in the cutout premium for traditional CAB carcasses was up 36% over 2024 to average $20.73/cwt. according to Urner Barry.

Calculated Select carcass tonnage slipped 9% on the year while the discount deepened from $17.04/cwt. to average $21.33/cwt. Recent seasonality has brought focus to the Choice/Select spread dipping briefly below $1/cwt. in early January. However, the year-long trend brings to light the big picture of further demand destruction for Select carcasses even as they are less prevalent in the supply chain.

The strong price spread trend is a clear indicator for the industry in 2026. While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality. Importantly, more and more retail and foodservice firms are grasping that a satisfied beef customer is a loyal customer. That starts with a marbling-rich carcass meeting specifications.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Big Shifts in Quality Grades

The 2025 quality grade trend tracked the USDA Prime grade a full percentage point higher than the prior year through August, averaging 11.5%. Since then, the Prime grade trend has defied seasonal expectations, normally setting a course toward a fall low in both Choice and Prime grade percentages.