CAB Tonnage up, premium spike emerges

MARKET UPDATE

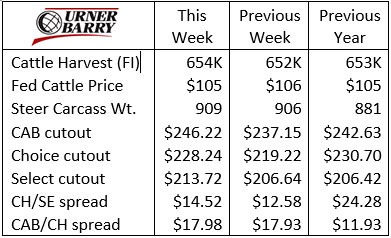

Seven weeks of slight improvements in fed cattle pricing came to a halt as packers paid $1 to $2/cwt. less for fed cattle last week. The USDA Cattle on Feed Report, published the Friday before, had some influence, with the August 1 on-feed number posting a record high for the date. Larger than anticipated July placements brought further pressure to the market, in a run where traders were looking for a bearish turn.

The tone this week leans toward price weakness again as packers buy for the holiday-shortened Labor Day week ahead.

Any comparison of current cattle and boxed beef prices to a year ago needs an asterisk for the near term. The week of September 9, 2019, brought on the fall low in live fed cattle values at $100/cwt., in the aftermath of Tyson’s Finney County plant fire. In each of the 2017 and 2018 markets, a natural seasonal low came at the beginning of September as well. However, the added pressure in September 2019 pulled prices perhaps another $5/cwt. lower than if the Tyson plant had not been temporarily closed.

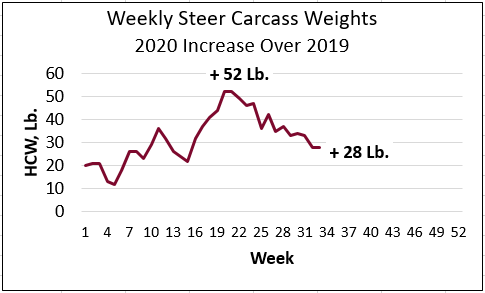

On the boxed beef side of the market, last week’s report on total carcass cutout values spiked much higher than a year ago. The CAB cutout price at $246.22/cwt. was a whopping $9.07/cwt. higher on the week prior and $3.59/cwt. higher than a year ago.

The spot trade (delivery within 10 days) in the boxed beef market can be similar to that of the fed cattle complex. It’s much smaller than the forward contract and formula volume. Taken for what it’s worth, last week proved more bullish for product values than expected, even with Labor Day demand. The recent spike on the graph only looks the same as a year ago due to those abnormal conditions in 2019. Of the two prior years 2018 showed a smaller late-August increase.

PREMIUM BEEF WINS AGAIN

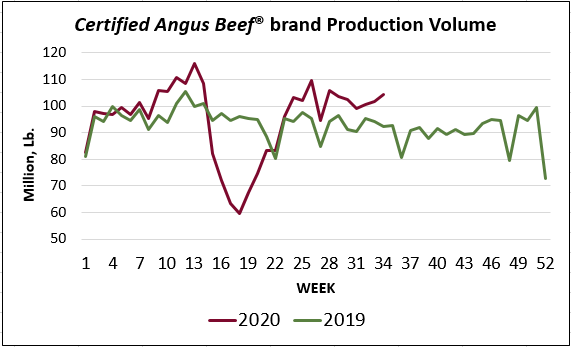

The production side of our business keys on the inventory of cattle on feed, especially the head count for more than 120 and 150 days. In tandem we look at the daily fed steer and heifer harvests. The latter has been averaging near 99% of a year ago on confirmed numbers from early July to mid-August. Robust Saturday harvest schedules at packing plants have made a difference.

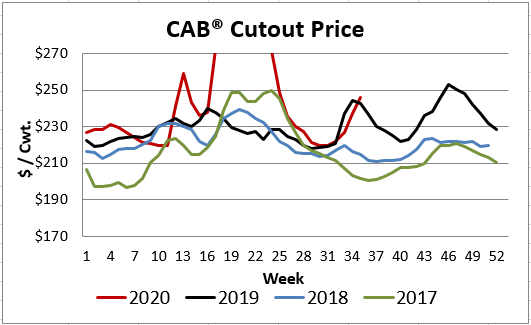

Feedlot show lists decline weekly, albeit at a frustratingly slow pace. Carcass weights are showing the improvement in fed supply currentness with the year-over-year gain trimmed almost in half from the largest annual increase of 52 lb. in May.

While this good news needs to see more progress to reach a healthy level, there are more positives to share on the end product side. It’s intuitive that heavier, longer-fed cattle yield carcasses with more external fat than ideal. But the side benefit is that carcass marbling achievement was abnormally high through the summer.

The combined Choice and Prime quality grade average in the latest USDA report stands at 83% of the total fed cattle supply, compared to 77% a year ago. CAB-qualified carcasses are running at 35.5% of the eligible supply versus 32.5% a year ago.

Even as total harvested head counts are slightly lower than a year ago, added carcass weight per head has pushed the latest 12-week CAB tonnage total 9% higher than last year.

An increase to that degree brings to mind a probable erosion in the CAB carcass cutout premium compared to Choice. But demand for CAB product has held up very well, despite the disappearance of a significant portion of foodservice business this summer.

The CAB cutout premium normally ranges very close to $9/cwt. over Choice during July and August, but recent pricing has seen that elevated to $15/cwt. and more. Bear in mind that spot market quotes are representative of only the short-term deliveries. Larger volumes moved on forward purchases are often at smaller premiums. We don’t interpret the spot market as comprehensive pricing information across the entire trade, yet it does provide a window into short-term demand and the immediate interest of end users to purchase product.

Of specific priority to cattlemen is how larger cutout premiums have translated to grid pricing values for finished cattle. The “normal” seasonality of the Choice/Select spread suggests that early September should present a small Choice premium in the $5 to $7/cwt. range, a seasonal low. However, the current Choice premium is nearly $15/cwt., surprisingly large for this time of year. Moreover, the CAB premium is spiking upwards of $5/cwt. (on top of the Choice price) in the weighted average report.

The combination of the beef supply, suddenly awash in high-quality carcasses, and unseasonally high premiums for quality suggests more solid demand for higher-quality beef than some may have realized.

The take-home message: While beef and cattle markets have been tumultuous this year, consumer demand continues to ask the supply chain to deliver quality.

VIRTUAL FEEDING QUALITY FORUM FOLLOW UP

If you missed out on the virtual Feeding Quality Forum last week, have no fear. Visit feedingqualityforum.com, where you will find our speakers’ presentations as well as the Industry Achievement Award winner information on Dr. John Matsushima. The date is set for next year’s Feeding Quality Forum for August 24-25, 2021 in Fort Collins, Colorado.

DON’T MISS THE LATEST HEADLINES!

Bridging the gap

Senses and sense

Rookies, quick studies and jumping in

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.