MARKET UPDATE

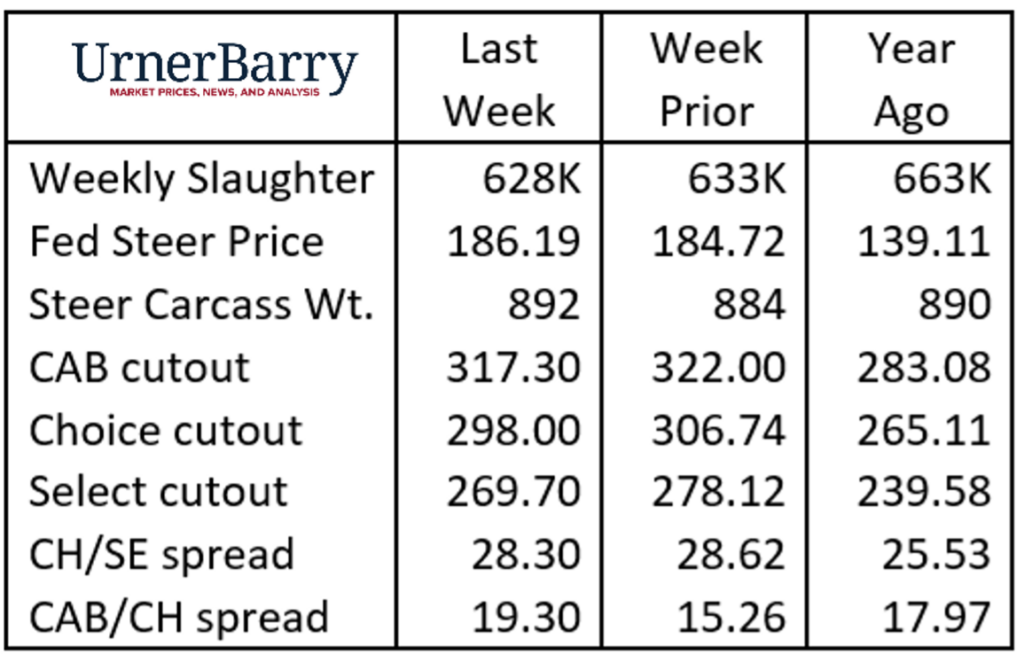

The fed cattle market was strong again last week with northern feedlots receiving $188/cwt. on live sales, about $2/cwt. higher on the week. Texas and Kansas feedlots also enjoyed a $2/cwt. increase as their average improved about $2/cwt. on the week to $180/cwt.

Federally inspected slaughter was lower by 5,000 head last week, totaling 628,000 head. The smaller head count doesn’t help packer margins much since their overhead costs stay the same on smaller throughput. Estimates will vary, but packer margins are slightly negative as cattle prices have held up and boxed beef cutout prices were firmly lower again last week.

As far as the cutout values are concerned, the July price and demand slump is upon us. We can readily see that with slaughter volume relatively small and prices still lower. The beef industry typically categorizes the July beef market as a period of lower demand as families embark on summer travel and trade steak consumption for hamburgers. With intense heat in many parts of the country this month, consumers are opting for lighter meals, sans grilling out.

With that said, the seasonal tendency is for cutout values to bottom any time now. This week cutout values have firmed and shown variable increases daily. Prices have come down on some middle meats which has been the primary adjustment to total carcass value. Beef prices will stabilize near term and packers will need to see their margins turn positive before they’re incentivized to increase the slaughter pace. This isn’t expected to be an immediate turnaround since fed cattle values are firm and feedyards are intent on holding the position.

CAB Supplies Hold Up Despite Smaller Slaughter

In the second quarter, national average carcass quality grades held up especially well considering that carcass weights were 15 to 20 lb. lighter than a year ago in the first quarter. Weights aligned more closely with a year ago, beginning in May, before bottoming at 853 lb. in the late June confirmed data.

The Prime grade category shone brighter in Q2 with a one-half percentage point improvement over 2022, averaging 9.4% of fed cattle carcasses. However, with fed cattle slaughter averaging 4.3% smaller, carcass supplies remained tight. This held the Prime cutout just under $30/cwt. in the second quarter. The Q2 Prime premium was $2/cwt. cheaper this year but the Prime cutout was simultaneously 12% higher than in 2022. Higher overall beef prices likely held the Prime premium lower as buyers pushed back at the top end of the price range.

The Choice grade held quite close to last year in the second quarter at 72.5% of the total. Once again, lower total supplies in the Choice category—coupled with little demand for Select product—drove the Choice/Select spread to $30/cwt. Despite the smaller slaughter totals, CAB carcasses were up by more than 2,000 head per week from April through June. This was assisted by the share of brand eligible, Angus-type cattle increasing 1-2 percentage points year over year, averaging 73% of fed cattle evaluated.

With fed cattle carcass weights now set to steadily increase into at least October, carcass quality grades typically decline beginning in early August. Lighter placements and continued smaller slaughter totals will keep product supplies in check. Labor Day demand is just weeks away and with that uptick, the quality-based price spreads are likely to perform quite well.

Read More CAB Insider

Utilization Key to Prime Success

More demand for individual Prime grade cuts is being discovered on the part of packers and wholesalers as they educate downstream users about the opportunities to capitalize on growing Prime demand.

Seasonal Demand Shifts Carcass Values

January often presents the lowest beef demand, while February likely vies second. Also, we see a shift in consumer preference away from holiday middle meat roasts toward end cuts for “comfort food” meals.

Price Speaks Volumes

While the tightest fed cattle supplies in the cycle are projected this year, consumer demand has issued directional support that tight supplies do not necessitate narrowing of price differentiation for quality.