Will the Prime Market Heat Up

MARKET UPDATE

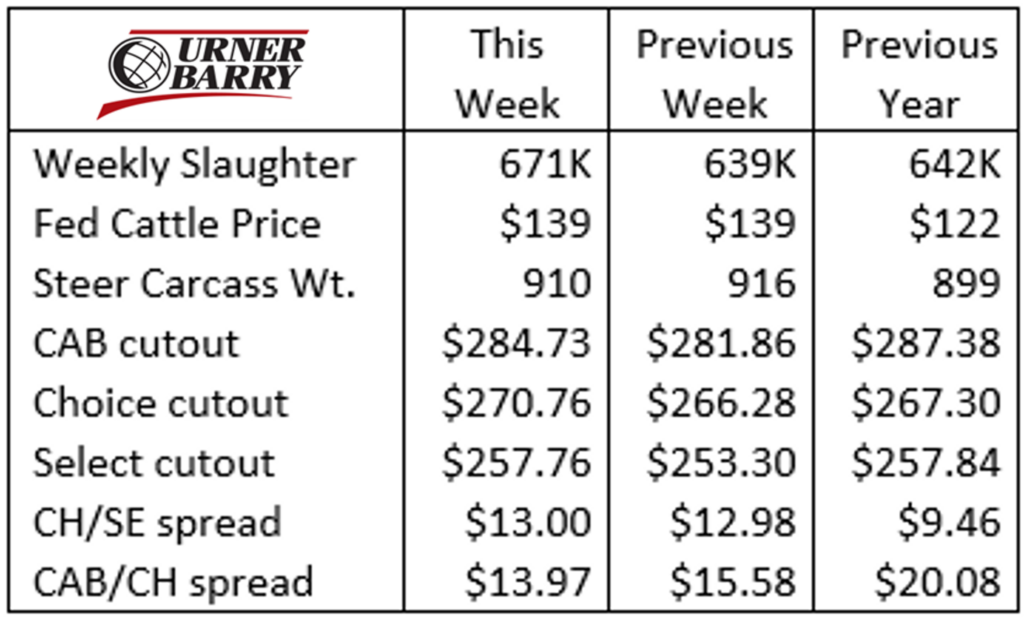

Another sideways price pattern developed last week in the cash fed cattle trade as the market average came in again near $139/cwt. That marked five weeks with an average between $138 and $139/cwt. following a downward adjustment from $143/cwt. for the week of February 28. Looking at the current week, packer bids on Tuesday were consistent with last week’s average.

As we near the middle of April, cattle feeders feel a spike in fed cattle prices is due immediately – if it’s to happen at all. This comes as feedyards are transitioning from long yearling finished cattle to spring-born calf-feds.

This period is typified by a brief supply gap incentivizing a price spike as packers compete for fewer pens that have seen enough days on feed to hit premium quality grade targets. The USDA data indicates that larger than normal feedlot placements in the fourth quarter, forced by dry conditions, will push more finished cattle toward feedlot show lists beginning in May. Should that condition develop, then feedlot pricing leverage will weaken.

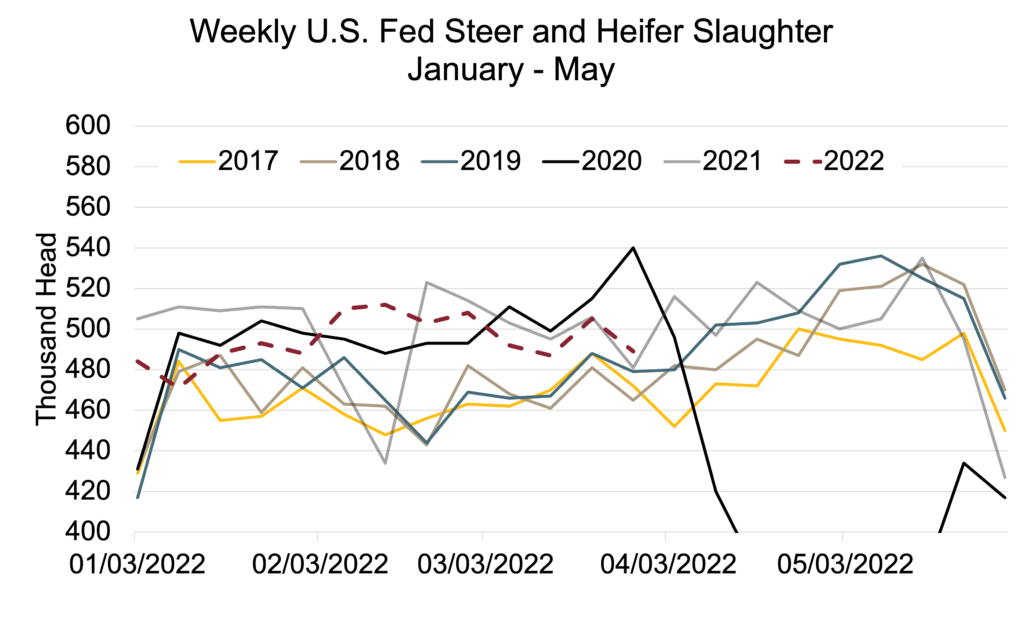

Last week’s federally inspected cattle slaughter was adjusted down from 679,000 to 671,000 after revising the Saturday headcount estimate. Regardless, the revised number is very respectable, matching the total from the week of February 12, the only other week with such a large sum this year.

It’s important to note that cull cow slaughter continues to run much higher than last year. A closer look shows cull cows were up an enormous 16.7% over a year ago in last week’s total, whereas fed steers and heifers were just 1.3% higher. Weekday fed cattle headcounts ranged from 94,000 to 97,000 last week except for Friday’s 91,000 total.

Carcass cutout values are performing within the seasonal trend with the spring buying upswing pushing prices higher. Comparisons to the 2020 and 2021 markets require caution when it comes to beef cuts since beef price increases jumped well beyond trends in the years immediately preceding. However, year to date 2022 comprehensive beef cutout values have outpaced the same period in 2021 by 19%. As a result, a significant seasonal demand factor points toward cutout values continuing to perform at a higher level into May. The confounding factor continues to be U.S. economic inflation and the consumer response in terms of volume that the market can absorb domestically.

Will the Prime Market Heat Up?

We focus a lot on carcass pricing here and it’s only fitting. Individual carcass values chart the industry’s course toward fulfilling consumer demand. That being said, the weeks immediately ahead should fuel interest in high-quality beef cuts for grilling. As the share of harvest-ready calf-feds grows in the fed cattle supply, we anticipate seasonally lower quality grade trends.

The Prime quality grade is not as rich as last year, beginning April at 9.9% of all fed cattle carcasses versus 12.5% a year ago. Focusing further on not only the percentage share but more specifically on total Prime carcass tonnage reveals an estimated 8% smaller Prime production for the most recent four-week period compared to a year ago.

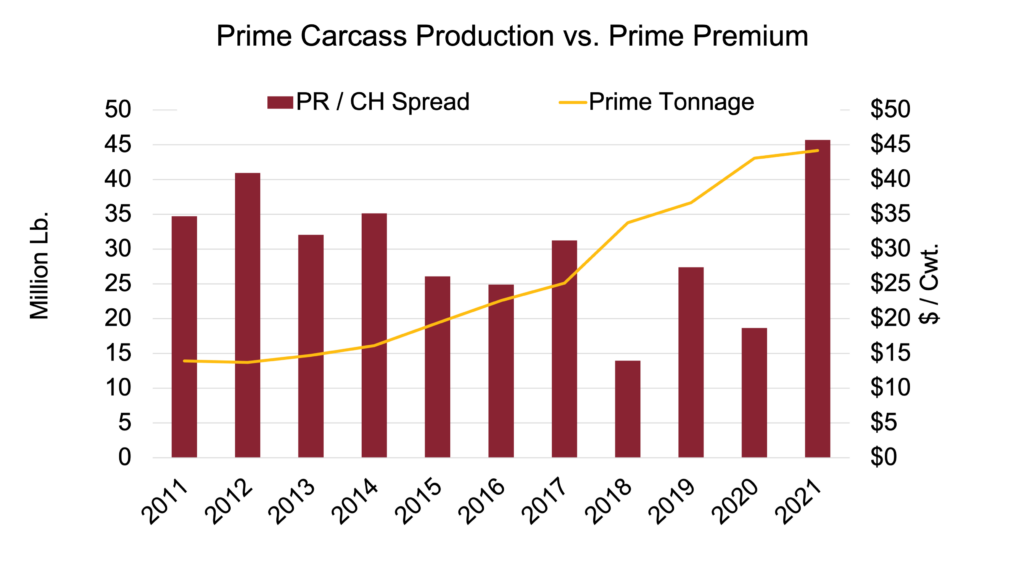

The chart illustrates a steady increase in Prime production beginning in 2013 with a more earnest increase noted in 2015 and beyond. The yellow line depicts a breakout departure from the multi-year rut of 2-3% annual Prime grading trends toward the modern 10% range. The increase in net estimated tonnage is a result of fluctuations in fed cattle slaughter and generally higher carcass weight averages.

At the same time, the red bars generally display a downward trending Prime cutout premium over Choice from 2012 to 2018. Around that time the end-user market began to adjust to more Prime product availability, including grocery stores having access to a sizable volume for the first time. Skipping past the COVID restaurant lockdowns defining 2020, the 2021 market surged again with Prime demand, setting a record-high Prime premium in the presence of more Prime carcasses than the industry had ever recorded.

The above factors point to a positive outlook for Prime demand in 2022. While the current deficit in Prime is a small step backward in a historical context, it is notable in a marketplace that has been fueling the customer base with Prime product availability not previously available.

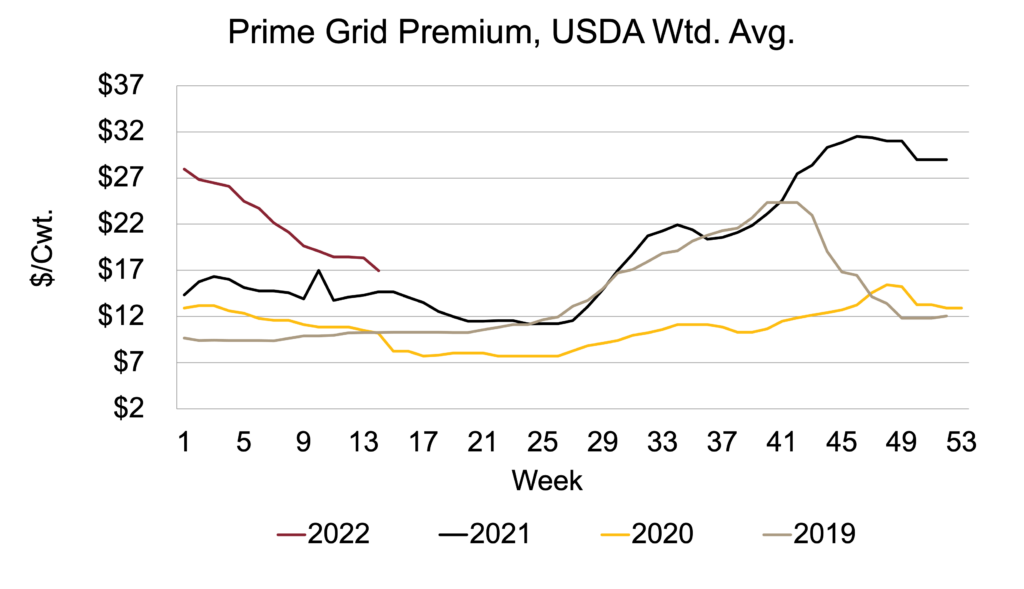

This scenario brings to light the question: How will market prices incentivize Prime production in the weeks ahead? The Prime cutout last week was $26/cwt. premium to Choice, 38% higher than the same week a year ago. The weighted average packer grid premium for Prime carcasses last week was $16.98/cwt., 16% higher than a year ago.

Will the smaller supply and ripe demand drive the Prime premium higher? The historic grid pricing data doesn’t portray any significant spring Prime premium increases in recent history, even though the Choice and CAB premiums have proven to be quite reactive to spring supply/demand imbalances.

The Prime grid premium has fallen to half its record high of $32/cwt. last November. Its latest value is the highest for that week since the cattle cycle low in 2014. The trends continue to chart new territory for the most premium quality grade and current conditions show reason for incentive. A potential directional shift up and to the right on the premium chart is not out of the question.

Read More CAB Insider

Feedyard Insights Bring Focus to Profitability

The recently published “Industry Insights” report conducted by CattleFax analysts in partnership with Angus Media revealed several interesting trends and attitudes from the feedyard and cow-calf sectors. Focusing on feedyard factors most relevant to the CAB brand and end-product merit shows attitudes and behavior aligned with the market’s pull-through demand signals

Carcass Weights Surge

Heavier carcasses typically coincide with richer marbling and higher quality grades. But seasonal grade trends simply push quality lower this time of year as USDA’s grading report for the September 11 week shows an abrupt leg down in percent USDA Choice

Competition Increases for Shrinking Pool of Cull Cows

Total carcass cutout prices have tended to increase during August in most recent years, but round cuts are holding the stronger price spike this season longer into September due to the substitution effect noted in this update.