Fall Factors to Test CAB Acceptance

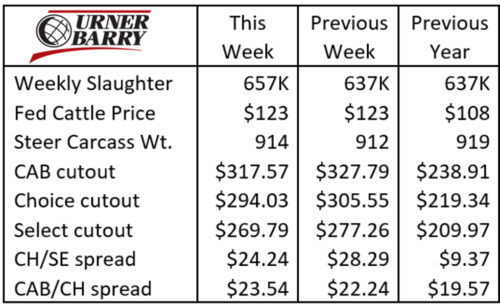

MARKET UPDATE

The federally inspected cattle harvest was boosted by 20,000 head last week over the prior week. This was within the trade expectation, albeit a little weak, given that the 637K total two weeks ago was a function of one packing plant’s brief closure for cooler cleaning. Daily head counts for the steer and heifer harvest topped out last Wednesday at 97K head.

The biggest market adjustment on the production side of the business recently has been the string of summarily positive days in Live Cattle futures last week. The October 2021 contract moved $4.68/cwt higher from Monday’s open through Friday’s close. Monday and Tuesday of this week were a bit softer at the conclusion of the optimism.

Futures are still leading the cash market a bit as the short-lived October contract closed this Tuesday at $125.02/cwt, while packer bids early this week were locked in the same range seen a week ago between $122 and $124/cwt.

Looking much further ahead, deferred futures are adding value to calves sold straight off the cow in the current spot market.

Turning to the boxed beef trade, cutout values continue to fall rapidly in a fall pattern that’s grossly overdue. Much remains in flux in the 2021 market, with record-high seasonal beef values inflated alongside so many other commodities and hard goods. Mid-October pricing should be moving upward at this time, but last week’s average Choice cutout was $11.52/cwt cheaper than the week prior. As of Thursday, the Certified Angus Beef ® (CAB®) brand cutout price was slightly more resilient, down $10.22/cwt. We suspect, that as of Friday, the decline would have been in line with the Choice decline.

The Select cutout lost the least, down $7.47/cwt. This is logical in that when beef buyers begin to push back on price, the demand frenzy for quality sees some slack as well. Even so, the quality price spreads have been historically wide this year.

Unsurprisingly, the rib primal has seen the most weakening price in recent reports. Last week’s negative $30/cwt rib slide for the CAB cutout was overdue based on the now longstanding imbalance in ribeyes versus the remainder of the carcass.

This fourth quarter begins with unseasonal market signals regarding wholesale prices. Consumers are seeing inflation across so many products, especially staples such as food and gasoline. Anecdotally, grocery stores are wary of sticker shock to the consumer at the same time that labor shortages are commonplace in every sector, driving wages higher as stores try to secure new employees. Much remains in question regarding retail beef demand this season.

FALL FACTORS TO TEST CAB ACCEPTANCE

At the Feeding Quality Forum in August, the brand’s Meat Scientist Daniel Clark, Ph.D., and Director of Product Solutions Clint Walenciak pulled back the curtain on factors that limit eligible steers and heifers from qualifying for CAB. A large study across the brand’s licensed packers covered 8 million head of Angus-type cattle across seasons of the year.

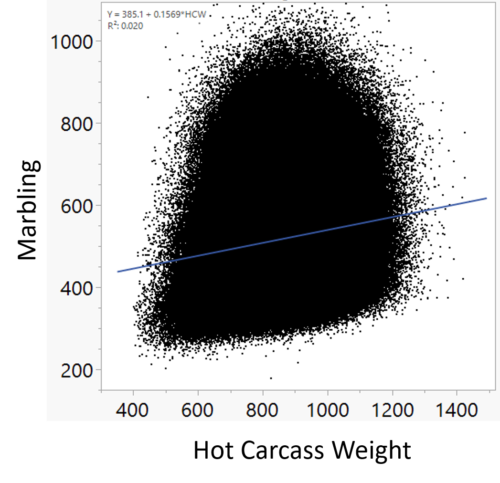

Possibly surprising to some readers is the fact that carcasses both up and down the weight spectrum posted high and low marbling scores. Carcasses as light as 600 lb., while fewer in number, achieved well into premium Choice and even Prime grades. In contrast, carcasses weighing 1,000 lb. and heavier typically achieved higher marbling levels, but many did not achieve low Choice.

It’s important to note that the trend line moves in favor of higher marbling as carcass weights increased. Intuition about added days on feed and heavier finished weights aligns with the latter point. Genetics, nutrition and growth technologies all contribute to differing marbling outcomes up and down the carcass weight distribution.

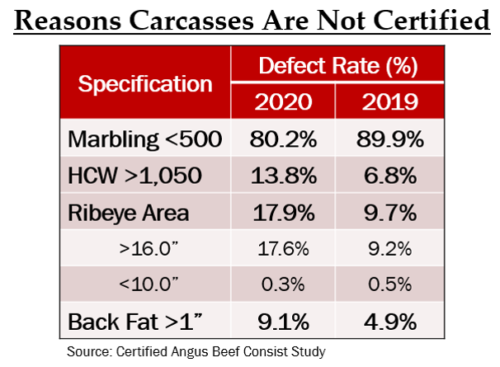

The fed cattle backlog changed the composition of U.S. fed cattle carcasses beginning in the spring of 2020. The table shows that about 90% of Angus-type cattle failing to meet the standards for the Certified Angus Beef ® brand fell short of the marbling specification. Marbling has always been the most common reason carcasses fall short. However, in 2020 marbling moved down to 80% of the cause for “defects”, as it relates to carcasses not qualifying for CAB. The sustained industry-wide delays in harvesting fed cattle generated extended days on feed across the board, elevating both external waste fat and marbling.

Added marbling is always a valuable goal but it needs to exist within the limitations that other factors remain within optimal constraints. The table further displays increased nonconformance issues that cropped up with respect to the brand’s specifications. Added days on feed understandably pushed carcass weights frequently above the maximum 1,050 lb. threshold. Accompanying this, ribeye area measurements exceeded 16 sq. inches 17.6% of the time, versus just 9.2% in 2019. Backfat measurements also surpassed 1-inch more often, falling outside of CAB compliance 9% of the time, versus 5% in the prior year. Before one draws too many conclusions from this data, there’s more to the story to share and consider. We’ll take another look at this topic in the next edition of the CAB Insider.

Read More CAB Insider

Credit End Meats With CAB Value-Add

We focused on fourth-quarter middle meat demand as a beef price driver in the last edition of the Insider. This is certainly the case in the current data as rib and tenderloins are pricing near their annual highs. However, a look at annual price trends across the beef carcass shows increasing contributions to CAB premiums from both ends of the carcass.

Middle Meats and Supply Driving Fourth Quarter Spreads

At the retail level, November brings a brief shift in focus, away from beef to turkey and ham, for Thanksgiving meals. Turkeys are the classic “loss leader” item in grocery stores during November as retailers practically give them away to lure a volume of shoppers to spend on the high-margin center of the store goods.

CAB Brand Sales Third Best in 45-Year History

In this CAB Insider,shifting market dynamics have already marked trend changes in the 2023 cattle and beef markets. These shifts are most succinctly summarized through two factors, fewer cattle and higher prices, that will further entrench themselves in near term trends.